Bed Bath & Beyond (BBBY) Posts Dull Preliminary Results for Q3

Shares of Bed Bath & Beyond Inc. BBBY plunged 30% during the close of the trading session on Jan 5, following its revelation of drab preliminary results for third-quarter fiscal 2022.

In the quarter, the company leveraged the liquidity gained from the holiday season to pursue higher in-stock levels. Meanwhile, it collaborated with suppliers, and undertook productive merchandise plans and store fleet optimization plans. However, these efforts failed to bear fruits.

The fiscal third-quarter results were impacted by inventory constraints and reduced credit limits, which led to lower levels of in-stock presentation within the assortments.

Based on lower customer traffic and reduced levels of inventory availability, management anticipates net sales of $1.26 billion, whereas it reported $1.88 billion in the year-ago period. The company also envisions a net loss of $385.8 million, including impairment charges of $100 million, whereas the company reported a loss of $276.4 million in the year-ago quarter. SG&A expenses are expected to be $583.6 million, whereas it reported $698.0 million in the year-ago period, driven by cost-optimization initiatives.

Bed Bath & Beyond also highlighted that it is on track with turnaround plans, with an increased focus on merchandising and inventory, enhancing digital and omni-capabilities, and strengthening its financial position. It is also making efforts to improve its cash position and mitigate any potential liquidity shortfall.

But the turnaround plans do not seem to work much for the retailer. According to sources, the company’s dismal outlook has led to suppliers halting shipments. This is likely to further affect its financial situation.

That said, BBBY raised concerns about its ability to continue based on recurring losses and negative cash flow from operations for the nine months ended Nov 26, 2022. Consequently, BBBY is currently exploring all alternatives, including restructuring debt, seeking additional debt or equity capital, reducing or delaying the company's business activities and strategic initiatives, selling assets, and filing for bankruptcy.

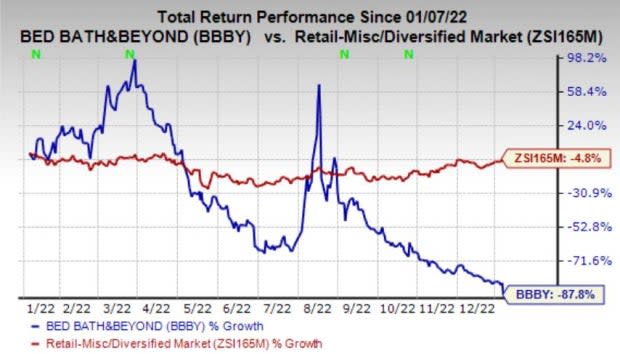

Image Source: Zacks Investment Research

In the past year, shares of this Zacks Rank #4 (Sell) company have plunged 87.8% compared with the industry’s decline of 4.8%.

Conclusion

BBBY has been on a downhill ride for nearly a decade, as evident from its sluggish sales and inability to compete with other retail giants and a shift to private brands. This drove away many loyal customers, who were looking for their favorite brands. However, the company has started to bring back some of the well-known national brands, such as Oxo, Ninja and SodaStream, as part of its turnaround efforts.

All said, we hope that Bed Bath & Beyond will be able to come out of the woods soon.

Stocks to Consider

Here are three better-ranked stocks to consider, namely Wingstop WING, Ross Stores ROST and Technoglass TGLS.

Ross Stores, an off-price retailer of apparel and home accessories in the United States, currently sports a Zacks Rank #1 (Strong Buy). ROST has an expected EPS growth rate of 10.5% for three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ross Stores’ current-year sales and EPS suggests declines of 1.6% and 11.7%, respectively, from the year-ago period’s reported figures. ROST has a trailing four-quarter earnings surprise of 10.5%, on average.

Tecnoglass, the manufacturer and seller of architectural glass and windows, and aluminum products for the residential and commercial construction industries, currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for TGLS’ 2023 sales and EPS suggests growth of 11.2% and 9%, respectively, from the year-ago period’s reported levels. TGLS has a trailing four-quarter earnings surprise of 26.9%, on average.

Wingstop, the operator of franchises and restaurants, currently carries a Zacks Rank #2 (Buy). WING has a long-term earnings growth rate of 11%.

The Zacks Consensus Estimate for Wingstop’s 2023 sales and EPS suggests growth of 18.1% and 16.4%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Bed Bath & Beyond Inc. (BBBY) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance