Beijing Enterprises Water Group Ltd's Dividend Analysis

Exploring the Dividend Performance and Sustainability of Beijing Enterprises Water Group Ltd (BJWTF)

Beijing Enterprises Water Group Ltd (BJWTF) has recently declared a dividend of $0.09 per share, scheduled to be paid on 2024-07-29, with the ex-dividend date on 2024-06-11. As investors anticipate this forthcoming distribution, it is crucial to delve into the company's dividend history, yield, and growth rates. This analysis, supported by data from GuruFocus, will provide insights into the sustainability and performance of Beijing Enterprises Water Group Ltd's dividends.

Company Overview

Warning! GuruFocus has detected 10 Warning Signs with BJWTF.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

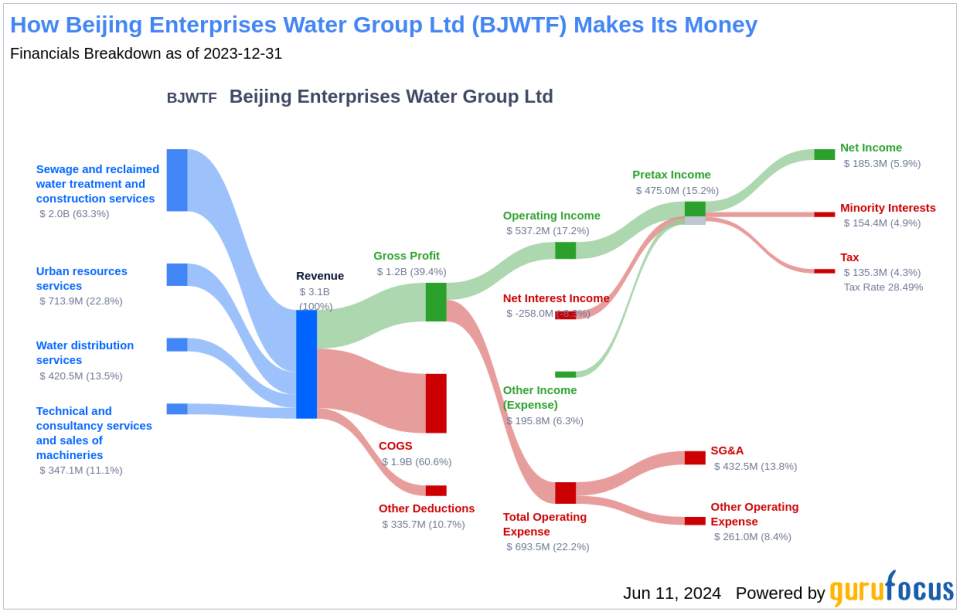

Beijing Enterprises Water Group Ltd is a prominent provider of waste treatment services in China, focusing primarily on sewage and reclaimed water treatment and construction services. This segment is the major revenue generator for the company, which also operates in water distribution, and technical and consultancy services, including machinery sales, and urban resources services.

Dividend History and Payment Frequency

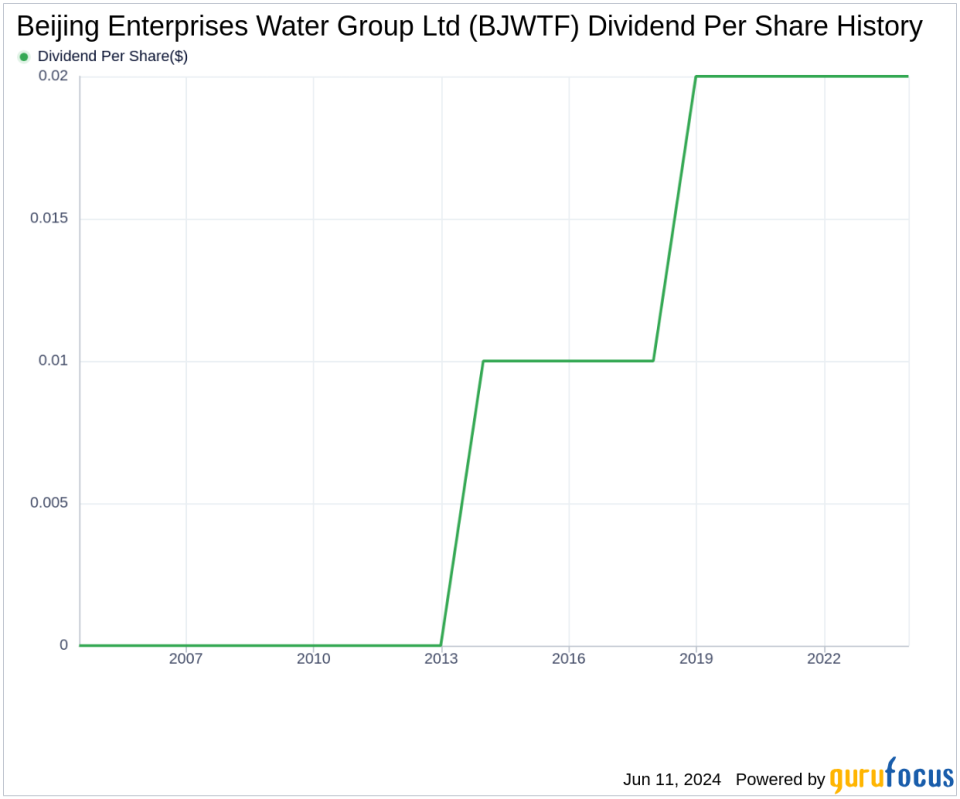

Since 2012, Beijing Enterprises Water Group Ltd has consistently paid dividends, adopting a bi-annual distribution schedule. This consistent payment history highlights the company's commitment to returning value to its shareholders.

Analysis of Dividend Yield and Growth

Currently, Beijing Enterprises Water Group Ltd boasts a trailing dividend yield of 5.94% and a forward dividend yield of 6.59%, indicating an anticipated increase in dividend payments over the next 12 months. Despite a three-year annual dividend growth rate of -1.00% and a five-year rate of -3.80%, the company has achieved an impressive 13.10% growth rate over the past decade. The 5-year yield on cost for Beijing Enterprises Water Group Ltd's stock is approximately 4.89%.

Evaluating Dividend Sustainability

The sustainability of a dividend is crucial and can be assessed by examining the dividend payout ratio, which for Beijing Enterprises Water Group Ltd stands at 0.77 as of the end of 2023. This ratio suggests that the company retains a substantial portion of its earnings, which supports both sustainability and potential growth. Additionally, the company's profitability rank of 7 out of 10 indicates robust earnings potential, supported by consistent positive net income over the past decade.

Future Growth Prospects

For dividends to be sustainable, underlying company growth is essential. Beijing Enterprises Water Group Ltd's growth rank of 7 suggests a strong competitive position. However, its revenue growth and earnings performance have been underwhelming relative to global peers, with a 3-year revenue growth rate of 2.40% and a 3-year EPS decline rate of -21.20%. These metrics, alongside a 5-year EBITDA growth rate of -21.40%, indicate areas where the company may need to improve to sustain its dividends.

Conclusion

While Beijing Enterprises Water Group Ltd offers an attractive dividend yield and has a commendable history of dividend payments, its recent growth metrics and earnings performance suggest potential challenges ahead. Investors should consider both the yield and the company's ability to sustain its dividend payments in the context of its overall financial health and market position. For those looking to explore further, GuruFocus Premium provides tools such as the High Dividend Yield Screener to discover high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance