Belvoir Group PLC's (LON:BLV) CEO Will Probably Have Their Compensation Approved By Shareholders

We have been pretty impressed with the performance at Belvoir Group PLC (LON:BLV) recently and CEO Dorian Gonsalves deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 27 May 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

View our latest analysis for Belvoir Group

How Does Total Compensation For Dorian Gonsalves Compare With Other Companies In The Industry?

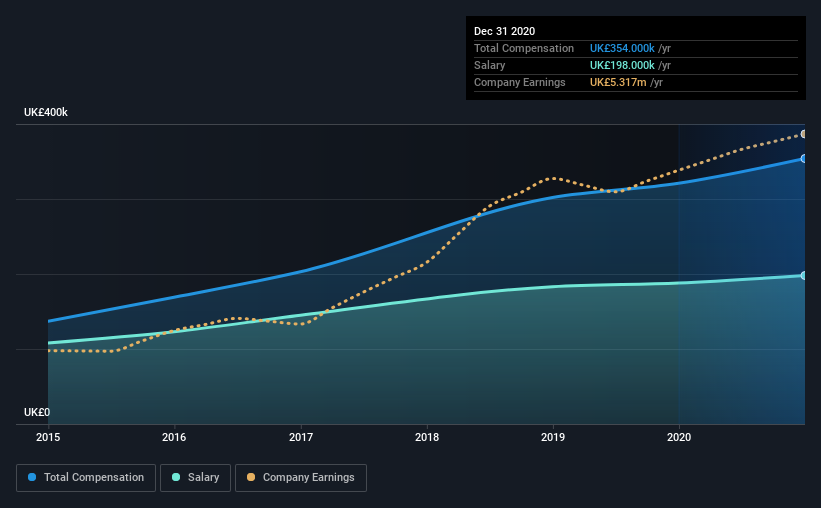

Our data indicates that Belvoir Group PLC has a market capitalization of UK£80m, and total annual CEO compensation was reported as UK£354k for the year to December 2020. That's a notable increase of 10% on last year. In particular, the salary of UK£198.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below UK£141m, we found that the median total CEO compensation was UK£283k. This suggests that Belvoir Group remunerates its CEO largely in line with the industry average. Furthermore, Dorian Gonsalves directly owns UK£1.1m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£198k | UK£188k | 56% |

Other | UK£156k | UK£133k | 44% |

Total Compensation | UK£354k | UK£321k | 100% |

Speaking on an industry level, nearly 54% of total compensation represents salary, while the remainder of 46% is other remuneration. Although there is a difference in how total compensation is set, Belvoir Group more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Belvoir Group PLC's Growth

Belvoir Group PLC's earnings per share (EPS) grew 21% per year over the last three years. Its revenue is up 13% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Belvoir Group PLC Been A Good Investment?

Most shareholders would probably be pleased with Belvoir Group PLC for providing a total return of 155% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Belvoir Group that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance