Berkeley at 'peak profits' as it warns on London housing market

Berkeley Group’s finance boss insisted the company was still committed to focusing on London after worries about the capital’s slowing housing market and a second warning that profits had peaked spoiled a strong set of annual results.

The FTSE 100 housebuilder posted a 15.1pc rise in pre-tax profits for the year to April 30 and upgraded its short-term financial forecasts.

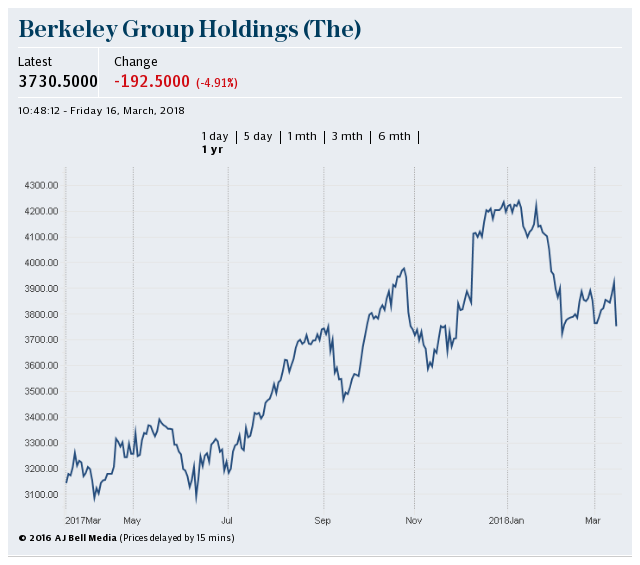

But it reiterated a prior warning that profits would typically be around 30pc lower in future years as the benefit of a glut of sites acquired cheaply in the wake of the financial crisis begins to wear off, sending its shares down more than 5pc to £39.20 by mid-afternoon.

Richard Stearn, chief financial officer, said London’s housing market had suffered from changes to the stamp duty regime, tighter mortgage lending rules and uncertainty around Brexit.

Berkeley started work on its first development outside of the south-east in Birmingham recently and of the 12 sites it acquired last year, 11 were outside the capital.

But Mr Stearn said the company remained “committed to London”, adding: “London is under-supplied, it is a fantastic city and those attributes will last long beyond Brexit or short-term volatility.”

Berkeley’s average selling price was £715,000 last year, up from £675,000 the past year, but it sold 3,536 homes, down from 3,905, meaning revenues held steady at £2.7bn.

The company upgraded its financial forecasts, saying it expected to make £1.58bn in profits over the next two years, up from previous estimates of £1.5bn, and £3.38bn in the next five years, up from £3.3bn.

Berkeley ended the year with £687m in net cash, almost £400m more than in 2017, but said it would hang on to the funds instead of investing in new sites or paying out bigger dividends.

Mr Stearn said: “Ideally one would have invested that, but it reflects the uncertainty we see in the current market environment.”

The Government’s Help to Buy scheme, which makes it easier for first-time buyers to afford a new-build home, has boosted some developers but Mr Stearn said Berkeley had not benefited as much as others because so many of its homes were above the £600,000 maximum price threshold.

Yahoo Finance

Yahoo Finance