Best-In-Class NasdaqCM Undervalued Stocks

Companies, such as TSR, are deemed to be undervalued because their shares are currently trading below their true values. There’s a few ways you can measure the value of a company – you can forecast how much money it will make in the future and base your valuation off of this, or you can look around at its peers of similar size and industry to roughly estimate what it should be worth. Below, I’ve created a list of companies that compare favourably in all criteria based on their most recent financial data, making them potentially good investments.

TSR, Inc. (NASDAQ:TSRI)

TSR, Inc. provides contract computer programming services in the New York metropolitan area, New England, and the Mid-Atlantic region. Formed in 1969, and now led by CEO Christopher Hughes, the company provides employment to 428 people and with the company’s market capitalisation at USD $8.73M, we can put it in the small-cap stocks category.

TSRI’s stock is currently floating at around -40% below its value of $7.75, at a price tag of US$4.65, based on my discounted cash flow model. The difference between value and price signals a potential opportunity to buy TSRI shares at a discount. Additionally, TSRI’s PE ratio is trading at 22.15x while its IT peer level trades at, 24.81x implying that relative to other stocks in the industry, we can purchase TSRI’s shares for cheaper. TSRI is also robust in terms of financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. TSRI also has no debt on its balance sheet, which gives it headroom to grow and financial flexibility. Continue research on TSR here.

American Outdoor Brands Corporation (NASDAQ:AOBC)

American Outdoor Brands Corporation designs, manufactures, and sells firearms worldwide. Established in 1852, and headed by CEO P. Debney, the company employs 2,192 people and with the market cap of USD $691.78M, it falls under the small-cap category.

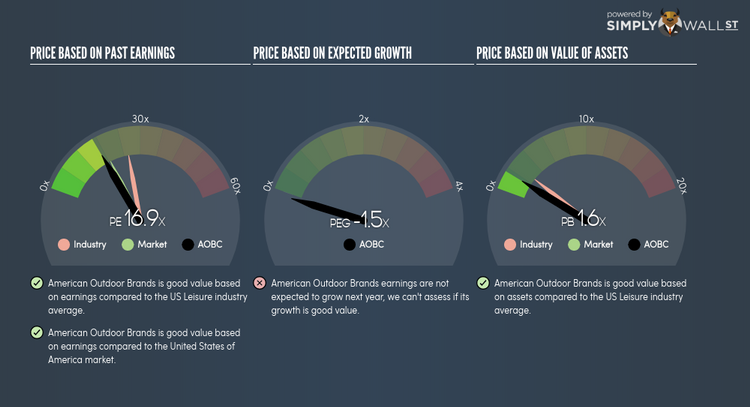

AOBC’s shares are currently floating at around -33% less than its true value of $18.67, at the market price of US$12.52, according to my discounted cash flow model. signalling an opportunity to buy the stock at a low price. Furthermore, AOBC’s PE ratio stands at 16.93x relative to its Leisure peer level of, 25.63x indicating that relative to its peers, AOBC can be bought at a cheaper price right now. AOBC is also in good financial health, as current assets can cover liabilities in the near term and over the long run.

Dig deeper into American Outdoor Brands here.

China HGS Real Estate Inc. (NASDAQ:HGSH)

China HGS Real Estate Inc., through its subsidiaries, develops real estate properties in the People’s Republic of China. Founded in 1995, and currently run by Xiaojun Zhu, the company size now stands at 142 people and with the market cap of USD $94.60M, it falls under the small-cap stocks category.

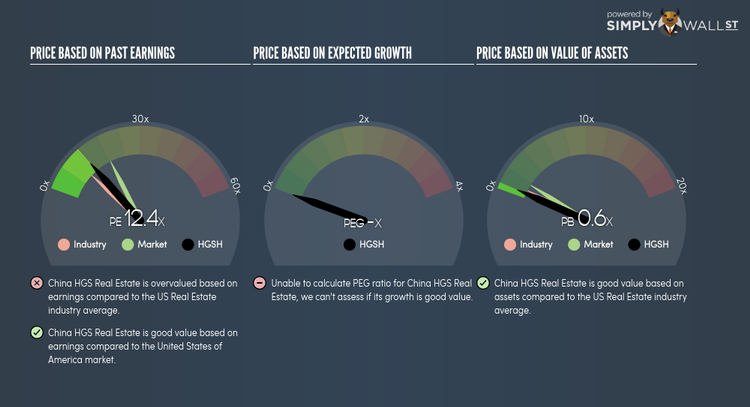

HGSH’s shares are now floating at around -70% below its actual level of $7.36, at the market price of US$2.20, based on its expected future cash flows. This discrepancy gives us a chance to invest in HGSH at a discount. In addition to this, HGSH’s PE ratio is trading at 12.41x while its index peer level trades at, 18.56x implying that relative to its comparable company group, HGSH can be bought at a cheaper price right now. HGSH is also strong financially, as current assets can cover liabilities in the near term and over the long run.

Continue research on China HGS Real Estate here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance