As a bidding war for Evri heats up, there are signs the brand is delivering

Yougov’s chief executive Steve Hatch takes a closer look at the data behind the biggest stories in business.

Recent reports have shown that multiple buyers are interested in buying Evri – with

Sky News putting the firm’s value at £2bn. If you’ve followed some of the headlines

around the brand, you might find this valuation surprising (especially when you

consider the troubles of competitors such as Yodel). In fact, late last year, the

company went as far as to say that it had “earned” its poor reputation. So is this a

brand that consumers value?

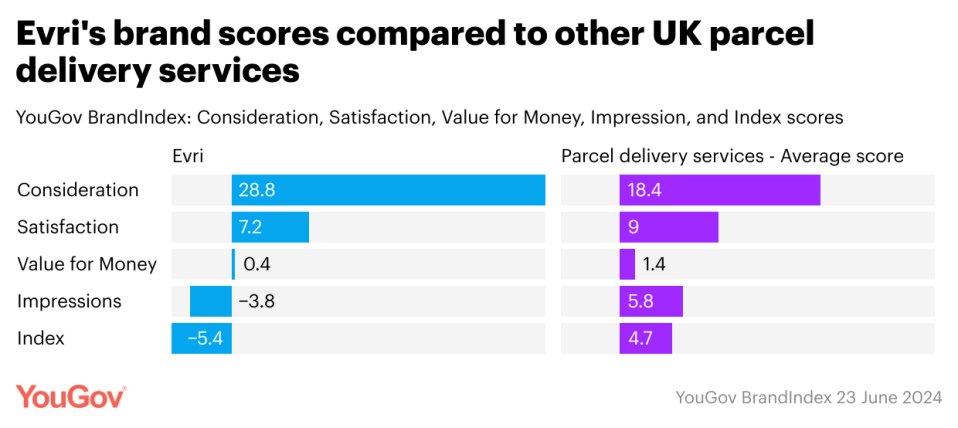

YouGov BrandIndex data reflects some of the negative perceptions – while painting

a more complex picture. It’s true that Evri is more disliked than not: Impression

scores, which measure general sentiment towards a brand, are at -3.8 compared to

scores of 5.8 for parcel delivery firms on average. But our data also shows signs of

improvement: compared to Evri’s scores for this metric a year ago (-10.2) this score

represents a rise of 6.4 points.

It’s a similar story across other metrics. Evri’s Satisfaction scores (7.2) trail those of

parcel delivery firms on average (9.0) – but the sector as a whole has seen an

increase of +0.3 points from last year (8.7), while Evri has jumped by +4.3 points

compared to its score of 2.9 from June 2023.

The brand’s Value for Money also lags behind – with scores of 0.4 compared to 1.4

across parcel delivery firms – but again, it has improved 2.6 points compared to a

year ago (when scores for this measure were -2.2).

One area of unqualified positivity is customer Consideration scores, which ask which

brands consumers would think about using next time they need a parcel delivered.

At 28.8, Evri’s scores outperform the average (18.4) by more than 10 points – as

they did a year ago, when scores were 24.4 (compared to 17.8 for competitor

brands).

Improving in Evri way? It may be too early to tell. But as maligned as the brand once

was, it also appears to be moving in the right direction in terms of public opinion. Will

Evri’s new owners – if the company is indeed sold – be able to build on these

improvements?

Yahoo Finance

Yahoo Finance