Big 4 supermarkets face rising threat from discounters as Christmas lunch eats into extra spending

Tesco won the battle for Christmas food shoppers – but is facing an increasing threat from bargain chains Aldi and Lidl.

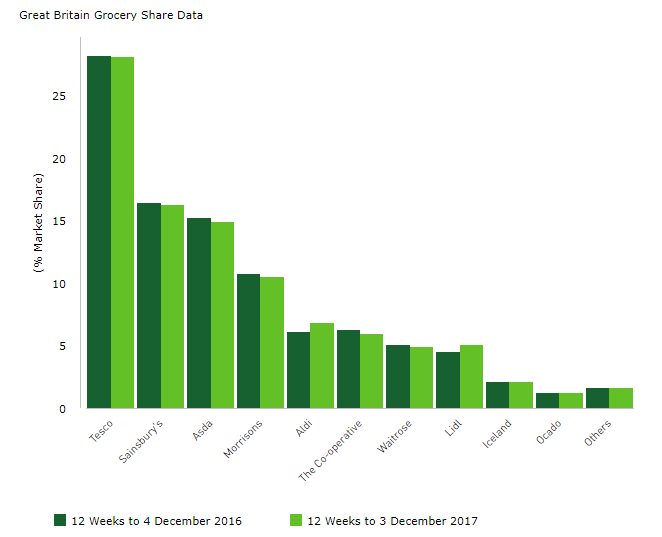

The nation’s biggest supermarket chain saw sales rise 3.1% in the three months to the end of December, cementing its 28% share of the UK grocery market.

But, it was Aldi and Lidl who were the real star performers, according to analysts Kantar Worldpanel, as both saw sales soar by 16.8%.

MORE: ‘Volatile’ Christmas sales sees Debenhams issue profits warning

The other members of the Big 4 – Sainsbury’s, Asda and Morrisons – all saw gains of about 2% as overall sales for the sector rose 3.8% to £28.9bn compared to last year.

Tesco – due to report its own figures on Thursday – was boosted by the performance of its own label products as well as last-minute Sunday purchases at its convenience store network on Christmas Eve.

Kantar said that, across the grocery retailers, households spent an average £1,054 over the period.

However, the rising price of mince pies, turkey, cranberry sauce and all the trimmings of Christmas food left little room for shoppers to splurge elsewhere.

According to figures from the British Retail Consortium, food sales for the three months to December rose 4.2%, their biggest rise in six months.

MORE: 44 shops closing every week as retailers struggle with rising business rates

But sales of non-food items, such as clothing, fell 3.7% – marking their steepest drop in five years. The BRC said shoppers’ spending power “had been absorbed by essential items”.

Helen Dickinson, chief executive of the BRC, said: “There was both light and dark in this year’s Christmas trading period.

“Growth in spending was in line with the, albeit modest, average for the year.

“However, the divergence between growth in sales of food and non-food has never been so stark.”

MORE: Mothercare profits warning after dire Christmas sees sales slump

She said the fact most households focused on putting the traditional spread on the table, left this year’s festive period “all the more nail-biting” for non-food retailers which were forced to slash prices heavily and early.

“Those who could offer and deliver on last minute delivery options did better, boosting online non-food sales more than 15% in the seven days before Christmas, a week when, until now, shoppers would have had to turn to stores to ensure gifts made it under the tree in time,” Dickinson said.

The reports come during a big week for retail results. Debenhams and Mothercare have already warned profits will be down after a dire Christmas period, and House of Fraser has sought rent reductions as it struggles to maintain margins.

However, Next did better than expected, as did supermarket Morrisons.

Yahoo Finance

Yahoo Finance