Big Yellow Group And Two More Leading Dividend Stocks To Consider

The United Kingdom stock market has shown resilience with a steady performance over the last week and a notable 7.4% rise over the past year, coupled with an expectation of earnings growth at an annual rate of 13% in the coming years. In this context, selecting dividend stocks like Big Yellow Group that potentially offer both stability and growth could be particularly compelling for investors looking to capitalize on current market conditions.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.95% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.69% | ★★★★★☆ |

Impax Asset Management Group (AIM:IPX) | 7.17% | ★★★★★☆ |

DCC (LSE:DCC) | 3.54% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.94% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.34% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.88% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.80% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.39% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.79% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

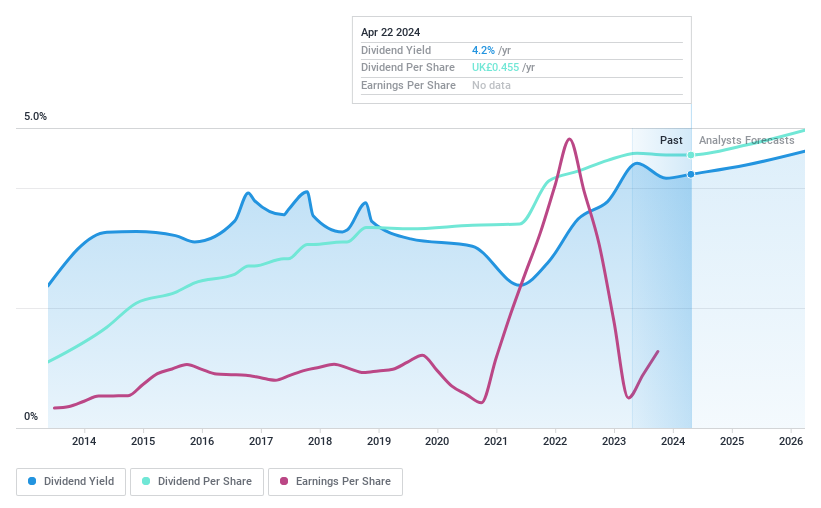

Big Yellow Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Big Yellow Group, recognized as the UK's brand leader in self-storage, operates with a market capitalization of approximately £2.27 billion.

Operations: Big Yellow Group generates £199.62 million from its provision of self-storage and related services.

Dividend Yield: 3.9%

Big Yellow Group's dividend yield stands at 3.88%, which is modest compared to the UK market's top quartile. Despite this, dividends have shown stability and growth over the past decade. The company's recent financial performance highlights significant earnings growth with net income rising to GBP 239.83 million from GBP 73.33 million year-over-year, supporting a sustainable payout ratio of 81.4% covered by earnings and 84.2% by cash flows, although revenue is only expected to grow by 5.58% annually. However, shareholder dilution occurred last year and insider selling has been noted recently, posing potential concerns for long-term value retention.

Click to explore a detailed breakdown of our findings in Big Yellow Group's dividend report.

Our valuation report unveils the possibility Big Yellow Group's shares may be trading at a discount.

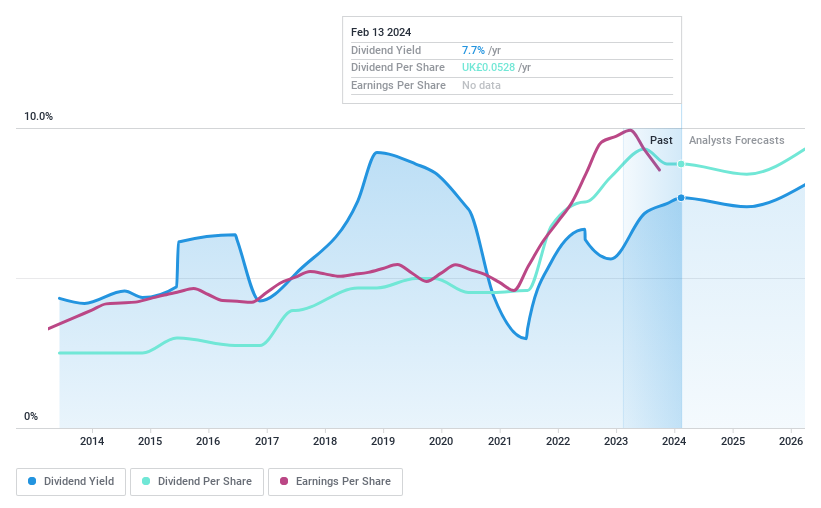

Record

Simply Wall St Dividend Rating: ★★★★★★

Overview: Record plc operates globally, offering currency and derivative management services across regions including the UK, North America, Continental Europe, and Australia, with a market capitalization of approximately £127.42 million.

Operations: Record plc generates revenue primarily from the provision of currency and derivatives management services, totaling £44.10 million.

Dividend Yield: 8%

Record plc maintains a robust dividend yield of 7.95%, placing it in the top 25% of UK dividend payers. The dividends are well-supported with an earnings coverage at 89.1% and cash flow coverage at 88.2%. Despite recent board changes, which introduced new expertise, the company's financial reports are outdated by over six months, raising concerns about current financial health visibility. However, dividends have been consistently reliable over the past decade with a forecasted earnings growth of 9.38% per year.

Get an in-depth perspective on Record's performance by reading our dividend report here.

The valuation report we've compiled suggests that Record's current price could be quite moderate.

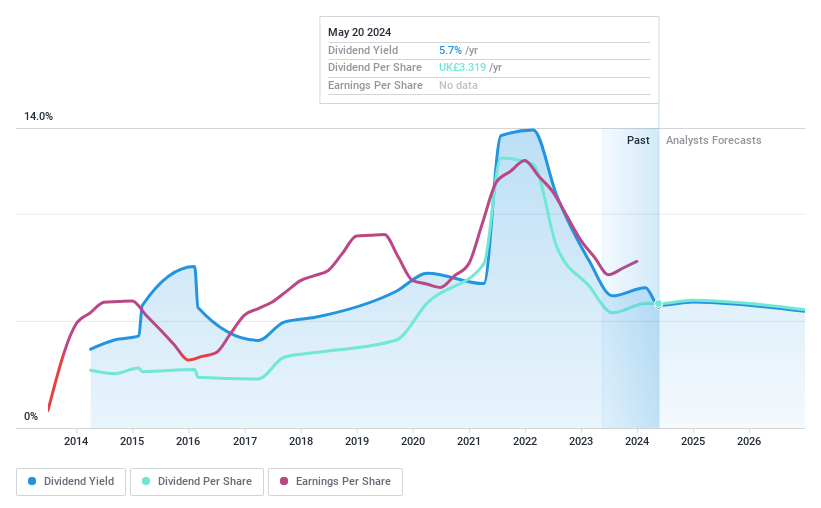

Rio Tinto Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rio Tinto Group is a global mining company involved in the exploration, mining, and processing of mineral resources, with a market capitalization of approximately £89.56 billion.

Operations: Rio Tinto Group generates its revenue primarily from four segments: Iron Ore at $32.25 billion, Aluminium at $12.29 billion, Copper at $6.68 billion, and Minerals at $5.93 billion.

Dividend Yield: 6.3%

Rio Tinto Group, trading 38.6% below its estimated fair value, offers a dividend yield of 6.34%, ranking in the top quartile of UK dividend payers. Despite a volatile dividend history over the last decade, recent increases suggest growth. Dividends are supported by earnings and cash flows with payout ratios at 70.1% and 84.8%, respectively. However, significant insider selling in the past three months could raise concerns about its future stability and growth prospects.

Delve into the full analysis dividend report here for a deeper understanding of Rio Tinto Group.

Our valuation report here indicates Rio Tinto Group may be undervalued.

Summing It All Up

Explore the 59 names from our Top Dividend Stocks screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BYG LSE:REC and LSE:RIO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance