Billionaire Kretinsky Eyes Atos Unit in Latest French Deal

(Bloomberg) -- Atos SE has begun exclusive discussions to sell a legacy division to a private equity firm run by Czech billionaire Daniel Kretinsky, taking another step toward an overhaul that will split the European software firm.

Most Read from Bloomberg

Trump Cites Self Incrimination Concern in Lawsuit Against Cohen

S&P 500 Wipes Out Almost 1% Gain; Bond Yields Drop: Markets Wrap

QQQ Churns in Late Hours on Apple, Amazon Earnings: Markets Wrap

Atos is in talks to offload the Tech Foundations business to Kretinsky’s EP Equity Investment, the company said in a statement on Tuesday. As part of a deal under negotiation, Atos will get €100 million ($110 million) in cash and transfer €1.9 billion in debt to the buyer, it said.

The proposed deal follows months of struggle for the French company after its IT outsourcing business was slow to adapt to the cloud. A series of setbacks and profit warnings has sent Atos’s market value plunging to about €1.1 billion at Monday’s close from €8.2 billion at the end of 2020.

Shares of Atos gained as much as 14.3% in Paris and were up 6.5% at 12:20 p.m. Bonds issued by the company also rose on the news.

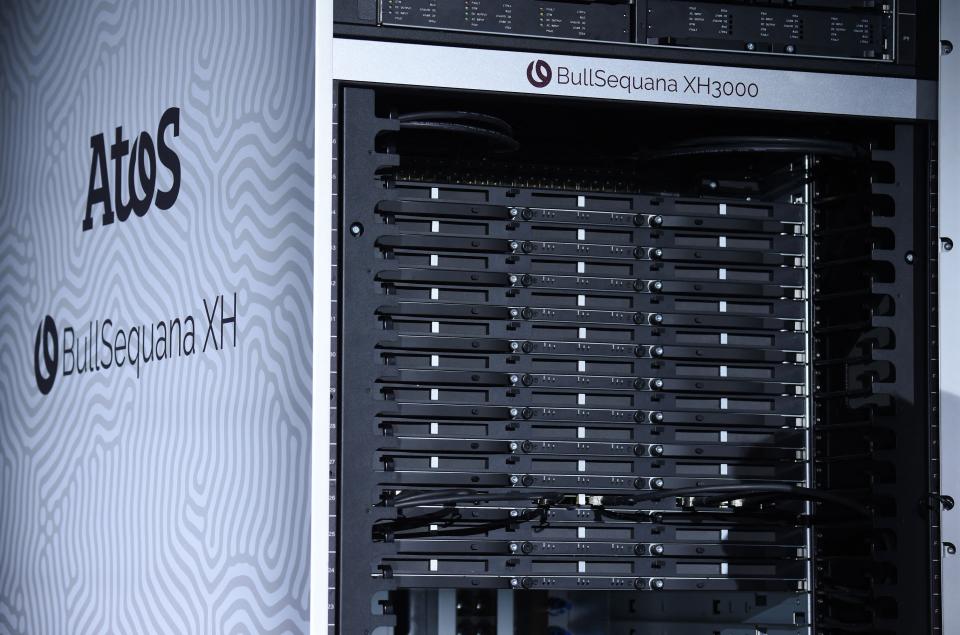

The company announced plans a year ago to split into a legacy IT services unit that will keep the company’s name and Eviden, which is made up of its cybersecurity, cloud and supercomputing businesses. It said the two are now fully operational as separate entities within the Atos Group, ahead of the listing of Eviden planned later this year.

“Post this transaction, Eviden should be free of the drag (top line, margin and FCF) from Tech Foundations, which should be a relief for investors,” wrote Stifel analyst Chandramouli Sriraman.

As part of the proposed deal with EPEI, the company said it plans to raise €900 million, including €217.5 million from Kretinsky’s group. Kretinsky’s investment, which includes a reserved capital increase at €20 per share, will give him a 7.5% stake in Eviden.

EPEI said it had “confidence” in Chief Executive Officer Nourdine Bihmane and the current management of Tech Foundations. It added that Fimalac, the holding company owned by French billionaire Marc Ladreit de Lacharriere, could take a minority participation in the acquisition and Eviden capital increase.

BNP Paribas SA and JPMorgan Chase & Co. have agreed to provide standby underwriting for the rights issue, excluding the amount that EPEI has committed, and Atos said it is “very confident” that its bank syndicate will grant the necessary loan waivers. The Eviden business will also seek to extend its loan maturities to reduce its debt load, the company said.

Kretinsky made his fortune buying power plants with his group EPH, and is on an investment spree to diversify his assets. The planned acquisition is the third major deal for the Czech billionaire this year in France. With other investors, he is set to take control of the debt-laden French supermarket operator Casino Guichard Perrachon SA, and also agreed to buy publisher Editis from Vivendi SE.

“We are confident in the value and prospects that Tech Foundations and Eviden bring to the market,” Kretinsky said in a separate statement. “We will continue to develop the Atos brand, which ranks among the strongest in the market.”

The deal is expected to be completed by the first quarter of next year, the company said. The proposed sale has the unanimous approval of Atos’s board.

(Updates with additional details throughout)

Most Read from Bloomberg Businessweek

Influencers Built Up This Wellness Startup—Until They Started Getting Sick

AI in Hollywood Has Gone From Contract Sticking Point to Existential Crisis

With AI Booming, Gary Gensler Wants to Keep Finance Safe for Humans

Amazon Unveils Biggest Grocery Overhaul Since Buying Whole Foods

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance