Bionano (BNGO) to Report Q2 Earnings: What's in the Cards?

Bionano Genomics, Inc. BNGO is scheduled to report second-quarter results on Aug 4.

The company’s earnings surprise record has been stable so far, with the bottom line matching estimates in three of the trailing four quarters while missing on another occasion, with the average negative surprise being 8.3%. In the last reported quarter, Bionano’s earnings were in line with estimates.

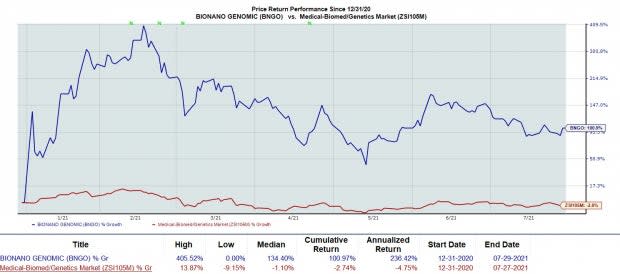

Shares of Bionano have rallied 100.9% so far this year against the industry's 2.8% decline.

Image Source: Zacks Investment Research

Factors to Note

Bionano generates product revenues from the sale of instruments and consumables. Consumable revenues consist of sales of complete assays, which are developed internally, along with sales of kits that contain all elements necessary to run tests. It currently sells its products for research-use-only applications. The company also generates service revenues from the sale of diagnostic testing services for those affected with autism spectrum disorder and other neuro developmental disabilities through wholly-owned subsidiary, Lineagen.

The company develops and markets the Saphyr system – a platform for ultra-sensitive and ultra-specific structural variation detection that enables researchers and clinicians to accelerate the search for new diagnostics and therapeutic targets, and streamlines the study of changes in chromosomes, which is known as cytogenetics.

Total revenues for first-quarter 2021 were up 179% year over year. This increase in revenues was attributed to the company’s expansion into new geographical areas including South Africa, Russia, South Korea, China and United Kingdom as well as into new applications such as prenatal analysis, cancer research and drug development. This trend of revenue increase is most likely to have continued in the to-be-reported quarter.

Operating expenses also grew year over year in the last reported quarter due to an increase in headcount and material and supply expenses, offset by a $1-million decrease in bad debt expense. Expenses are most likely to have been higher in the quarter under review. We inform investors that gross margins of the company have improved during the first quarter to 33%, up 8% from the previous quarter due to a shift in the product mix toward higher margin consumables and services.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Bionano this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Its Earnings ESP is 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of 5 cents per share.

Zacks Rank: Bionano currently carries a Zacks Rank #3.

Bionano Genomics, Inc. Price

Bionano Genomics, Inc. price | Bionano Genomics, Inc. Quote

Stocks to Consider

Here are a few stocks you may want to consider, as our model shows that these have the right combination to deliver an earnings beat in the to-be-reported quarter.

Adverum Biotechnologies ADVM has an Earnings ESP of +19.46% and a Zacks Rank #2.

Corvus Pharmaceuticals CRVS has an Earnings ESP of +14.29% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dynavax Technologies Corporation DVAX has an Earnings ESP of +318.18% and a Zacks Rank #3. The company is scheduled to report quarterly earnings on Aug 4.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Adverum Biotechnologies, Inc. (ADVM) : Free Stock Analysis Report

Corvus Pharmaceuticals, Inc. (CRVS) : Free Stock Analysis Report

Bionano Genomics, Inc. (BNGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance