Bitcoin crashes to three-month low after China clampdown sparks sell-off

The combined might of Chinese state control and Elon Musk’s wandering ego today sent Bitcoin spinning on its biggest intra-day rollercoaster since its seismic 2017 crash.

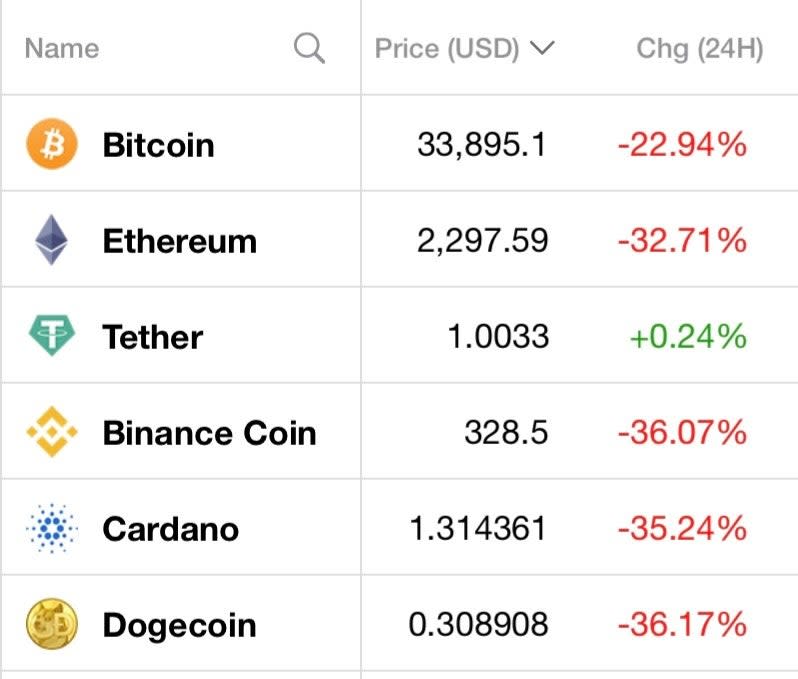

Beijing’s ruling that financial institutions must no longer accept cryptocurrency as payment sent the world’s biggest digital currency crashing 22% to hit a three-month low of $32,129 and wiped $500 billion from its peak market value.

It was the most severe one day fall since the crash of December 2017, which saw 45% lopped off its value - from $20,000 to $12,000 - and from which it took almost three years to recover.

The ruling also sent a global shockwave through the rest of the crypto market with other major tokens including ethereum (down by 50% in a week) and ‘joke crypto’ dogecoin (down 45%) joining the pity party.

A late rally saw bitcoin, at least, recover a chunk of its value as institutional investors - including influential stockpicker Cathie Wood’s Ark fund took - the opportunity to buy the dip lifting the token back to around $40,000, still down 12%.

Wood told Bloomberg she still expects the cryptocurrency to reach a price of $500,000, saying: “This is a really great time to buy.”

Ark's Cathie Wood is sticking with her $500,000 target for Bitcoin #TheBusinessweek https://t.co/9eBp5M39Zi pic.twitter.com/VeSRF5fplm

— Businessweek (@BW) May 19, 2021

Inbuilt volatility

Just four weeks ago, bitcoin hit a record high of $64,870.

That came at the climax of a two-month rally triggered by an announcement from Elon Musk that Tesla would accept it as payment for its e-vehicles.

This was hailed as a watershed moment for the token, burnishing its growing reputation as a 21st century “digital gold” safe haven from inflation fears, which has seen major US banking institutions begin to take it seriously.

It’s not the first time Elon Musk’s tweets have been erratic and, frankly, wrong.

But Musk’s subsequent recent social-media utterances - closely watched by his legion of cultist admirers - have conspired to wipe out all of those gains.

Last week he criticised the “insane” amount of energy used to ‘mine’ the tokens from the digital ether (roughly equivalent to the annual electricity consumption of Sweden) and said Tesla would suspend car purchases using the token.

Over the weekend, he hinted his EV company might have sold its Bitcoin holdings, said to stand at around $1.5billion. Then said it hadn’t.

Amidst all this, during a guest slot on US satirical show Saturday Night Live, he branded Dogecoin - a crypto rival started as a joke which has seen a 21,000% increase in price this year - “a hustle.”

All of which left ‘holders’ confused. Meanwhile, Tesla shares have plunged 35% since January.

As the rally gathered pace, Musk returned to Twitter to tell his millions of followers Bitcoin has ‘diamond hands’ - a slang term used by Reddit’s army of day traders meaning to hold on tight to a position despite a price collapse.

Tesla has 💎 🙌

— Elon Musk (@elonmusk) May 19, 2021

China ‘not a fan’

Today’s rollercoaster ride began after three Chinese industry bodies said cryptos are “seriously infringing on the safety of people’s property and disrupting the normal economic and financial order” in a joint statement on the People’s Republic’s WeChat account.

Beijing has been putting pressure on the crypto space for some months, but this marks an intensification and is anticipated to come ahead of an expected ‘digital Reminbi’ giving the ruling party control over cryptocurrencies.

Ulrik Lykke, executive director at crypto hedge fund ARK36, said: “It is not the first time Elon Musk’s tweets have been erratic and, frankly, wrong. The crypto markets are extremely emotionally driven and their participants are prone to overreacting to events they perceive as negative.”

Following today’s crash, traders are bracing for more pain with analysts warning of danger ahead.

“From a technical standpoint, the indicators are flashing red,” said Ipek Ozkardeskaya, senior analyst at Swissquote told Bloomberg.

“The next important support level stands near $37,000, then the $30,000 mark. There is a chance that we see a pullback to these levels and even below, at least in the short run.”

Cathie Wood’s Ark Investment Management is buying the dip in Tesla, sticking with high-conviction names and setting aside a big disagreement with Elon Musk over Bitcoin https://t.co/loKj2hpwtV

— Bloomberg (@business) May 19, 2021

Adding to the growing doubts, a note from JP Morgan suggested that institutional investors are dumping bitcoin in favour of gold.

“The bitcoin flow picture continues to deteriorate and is pointing to continued retrenchment by institutional investors,” JPMorgan wrote in a note to clients.

“Over the past month, bitcoin futures markets experienced their steepest and more sustained liquidation since the bitcoin ascent started last October.”

Laith Khalaf, financial analyst at AJ Bell, said: “Some rough and tumble is to be expected when holding something as volatile as cryptocurrency, but in recent weeks there have been significant developments which undermine Bitcoin’s long term prospects.

“Bitcoin mining uses up a phenomenal amount of energy, and unlike traditional metal mining, doesn’t actually produce anything which is useful in the economy.

“Even celebrity endorsements may dry up as public figures become wary of being associated with an environmentally unfriendly product.

“Meanwhile the Chinese central bank has issued a warning that cryptocurrencies shouldn’t be accepted as payment for products or services.

“This is a manifestation of the regulatory risk surrounding cryptocurrencies. Central banks aren’t simply going to roll over and let systemic risks build up on the back of Bitcoin trading, particularly when cryptocurrencies are looking to usurp their position as arbiters of monetary value.”

Another respected commentator said: “Given that it has no apparent fundamental metrics of value, you may as well bet on raindrops racing down a window.”

Read More

Elon Musk impersonated by crypto-scammers in multi-million bitcoin fraud

Tesla will no longer accept bitcoin due to environmental impact, says Elon Musk

Yahoo Finance

Yahoo Finance