BOK Financial (BOKF) Lags Q1 Earnings Estimates, Stock Rises

BOK Financial BOKF reported net income per share of 88 cents lagged the Zacks Consensus Estimate of $1.29 for the first quarter of 2020. Further, the bottom line compared unfavorably with the prior-year quarter’s earnings per share of $1.54.

Contracting margin and deteriorating credit quality were concerning. Nonetheless, top-line growth, lower expenses and rise in deposits were driving factors. These factors likely drove BOK Financial’s stock 3.1% up, following its first-quarter 2020 earnings release.

Net income was $62.1million compared with $110.6 million recorded in the year-ago quarter.

Revenues Climb, Costs & Loans Decline

Adjusted revenues in the first quarter were $441.7 million, up 3.7% year over year. The revenue figure, however, missed the Zacks Consensus Estimate of $448.2 million.

Net interest revenues totaled $261.4 million, down 6% year over year. Further, net interest margin (NIM) shrunk 50 basis points year over year to 2.80%.

BOK Financial’s fees and commission revenues amounted to $192.7 million, up 20% on a year-over-year basis. Higher fiduciary and asset management revenues, brokerage and trading revenues, transaction card revenues, and elevated mortgage banking revenues primarily led to the upswing. This was partly offset by lower deposit service charges and fees along with reduced other revenues.

Total other operating expenses were $268.6 million, down 6.5% year over year. This mainly stemmed from lower personnel expenses.

Efficiency ratio increased to 58.62% from the prior years’ 64.80%. Generally, a lower ratio indicates improving profitability.

Total loans as of Mar 31, 2020, were $22.5 billion, down 3.2% sequentially. As of the same date, total deposits amounted to $29.2 billion, up 15.4% sequentially.

Credit Quality Deteriorates

During the March-end quarter, provisions for credit losses of $93.8 million compared with $8 million in the prior-year quarter. The combined allowance for loan losses was 1.40% of outstanding loans as of Mar 31, 2019, up from 0.94% in the year-ago period.

Additionally, non-performing assets totaled $292 million or 1.30% of outstanding loans and repossessed assets as of Mar 31, 2020, up from $261.5 million or 1.20% in the prior-year period. Net charge-offs were $17.2 million, up 7.1% year over year.

Capital Position

Armed with healthy capital ratios, BOK Financial and its subsidiary banks exceeded the regulatory well-capitalized level. As of Mar 31, 2020, the common equity Tier 1 capital ratio was 10.98% as compared with 10.71% as of Mar 31, 2019.

Tier 1 and total capital ratios on Mar 31, 2020, were 10.98% and 12.58%, respectively, compared with 10.71% and 12.24% as of Mar 31, 2019. Leverage ratio was 8.16% compared with 8.76% as of Mar 31, 2019.

Share Repurchase Update

During the January-March period, the company repurchased 442,000 million common shares at an average price of $75.52 per share.

Our Viewpoint

Fee income growth and favorable efficiency ratios for first-quarter 2020 are encouraging for BOK Financial. Furthermore, growth in deposit balances indicates an efficient organic-growth strategy. However,rising provision for credit losses is concerning.

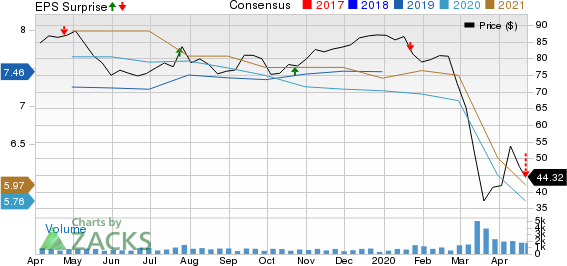

BOK Financial Corporation Price, Consensus and EPS Surprise

BOK Financial Corporation price-consensus-eps-surprise-chart | BOK Financial Corporation Quote

BOK Financial currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

M&T Bank Corporation MTB has pulled off first-quarter 2020 positive earnings surprise of 26% on higher mortgage banking revenues. Net operating earnings per share of $1.95 surpassed the Zacks Consensus Estimate of $1.55. However, the bottom line compares unfavorably with $3.35 per share reported in the year-ago quarter.

Truist Financial’s TFC first-quarter 2020 adjusted earnings of 87 cents per share surpassed the Zacks Consensus Estimate of 54 cents. However, the bottom line declined 22.3% from the prior quarter.

Regions Financial Corporation RF reported first-quarter 2020 adjusted earnings of 15 cents per share, missing the Zacks Consensus Estimate of 19 cents. The figure plummeted 59.5% year over year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regions Financial Corporation (RF) : Free Stock Analysis Report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

BOK Financial Corporation (BOKF) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance