Bookies brace for more than £200m profit hit as Government caps 'crack cocaine' betting machine stakes at £2

UK bookmakers could suffer a hit of more than £200m to annual profits after the Government confirmed it would slash the maximum stakes on ‘crack cocaine’ betting machines to £2 from £100 now.

Culture Secretary Matt Hancock said the Government had chosen to “take a stand” against fixed odds betting terminals (FOBT), which he accused of causing a “social blight” due to the potential for gamblers to suffer huge losses.

William Hill, which makes roughly a fifth of its sales from FOBTs, said the move would make about 900 of its shops lossmaking and that some of these could subsequently be closed.

The bookmaker expects an annual profit hit of between £70m to £100m as a result of the Government’s decision but suggested it might be able to mitigate some of this prior to the cut being implemented.

GVC is expected to suffer a £120m profit hit once cost-saving initiatives had been implemented while Paddy Power Betfair, the least exposed of the major high street bookmakers, is predicted to suffer a £22m profit hit.

William Hill chief executive Philip Bowcock said the Government had “handed us a tough challenge”.

“It will take some time for the full impact to be understood for our business, the wider high street and key partners like horse racing,” he said.

GVC welcomed the certainty after months of speculation about what the Government would decide but expressed frustration at the decision.

Kenny Alexander, GVC boss, said:“We are disappointed with the outcome, particularly given the previous independent evidence on stake cuts published by both the Gambling Commission and the Responsible Gambling Strategy Board.”

“It is now important that the industry is given an adequate implementation period to help prepare and plan for the shop closures that will arise, including attempting to mitigate the impact of resultant job losses.

“Significant re-engineering of the machines and gaming software will also be required to effect these changes.”

Investec’s Alistair Ross said GVC was “over-hedged” against the impact and that his valuation of the company could actually rise despite the outcome.

This was partly because of the way GVC structured its takeover of Ladbrokes Coral, which dictated it would pay no extra money beyond its base £3.2bn offer if FOBT stakes were cut to £2.

Paddy Power Betfair’s Peter Jackson said his company had “consistently called for a significant stake cut” and so was “pleased [Mr Hancock] had acted so decisively”.

“Today’s move will have a short-term impact on our business, but we think it’s a really important step towards building a sustainable industry,” he added.

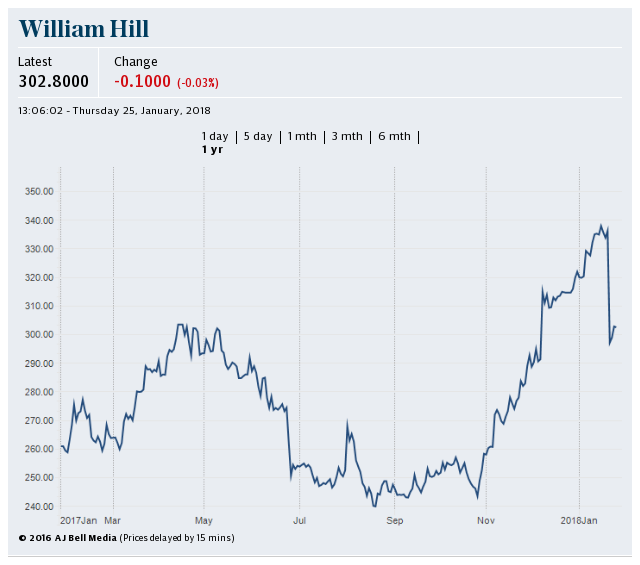

Shares in the companies initially fell but William Hill regained the loss to return to 316p while GVC was marginally up after an early dip to 924p.

No firm date has been given for when the £2 stake will be enacted but commentators expected it to be sometime in 2020.

To make up for the estimated £1bn loss to the Treasury, ministers said they would raise the 15pc tax on online gambling to a level yet to be decided by ministers. This tax does not cover sports betting, the levy on which will remain at 15pc to stay in line with the charge on bets made over the counter in shops.

Online gambling companies cried foul of the move, claiming they had been stung by the fallout from FOBTs in spite of not owning any of the machines.

Richard Flint, the boss of Sky Bet, said his company had no FOBTs but that it - and the Yorkshire economy where it is based - “risk being punished because of them”.

“Any increase in remote gaming duty is a tax on hi-tech Yorkshire jobs,” Mr Flint said.

“Our company is based in Leeds and has created nearly 1,000 roles in the past three years - with another 120 jobs to fill," he said. "Increasing an already heavy tax burden will clearly have an impact on our plans to create new jobs in the North of England in the years to come.”

Analysts at Barclays said in spite of the £2 stake being the most severe option the Government could have chosen, the implementation period would provide some grace for bookmakers.

“Whilst a £2 maximum stake is a negative for the sector, if the implementation date is pushed back past 2020, online taxes come in later and the impact to profits is less bad than feared, then there may be a sense of relief today,” the bank said.

There was also a fear for the horse racing industry, which predicted a maximum annual loss of £60 million.

There are two main ways in which racing is likely to lose income if, as bookmakers predict, they have to close 500 shops that will become unprofitable. The new levy replacement scheme, which captures bets made on British horse racing from any operator onshore and offshore, is predicted to yield £95m, but what effect the loss of shops has on this is unknown as FOBT players tend not to spend on racing. Fewer shops, however, may force punters on-line.

The second income stream to take a hit is media rights, which is worth approximately £30,000 a shop. Close 100 shops and income for media rights drop £3m, 500 shops, which is the bookmakers' assessment, and that leaps to a £15m pound hit that will be felt at smaller racetracks.

The British Horseracing Authority, criticised in some quarters for lobbying at all and others for not lobbying enough, broadly welcomed the announcement and has sought to help reduce the impact such inevitable legislation will have through its contact with government.

Elsewhere, John White, who heads up Bacta, a gambling trade body which represents amusement arcades, said he "warmly welcomed this announcement".

"A stake reduction to £2 has long been needed to protect consumers from the harm caused by FOBTs," he said.

"This is a decision that puts player protection first, and will allow the gambling industry as a whole to move forwards and create a safer, more socially responsible environment for consumers."

The Government said it would also be toughening up protections around online gambling and launching a multi-million pound advertising campaign to promote responsible behaviour.

Yahoo Finance

Yahoo Finance