BP Inks 2M Metric Ton LNG Purchase Deal With Venture Global

BP plc BP has inked a 20-year agreement with Venture Global to purchase liquefied natural gas (LNG) for finalizing commitments for the Calcasieu Pass export facility based in Louisiana. Notably, Venture Global is a U.S. LNG group.

Upon completion of construction of the facility, expected to come online in 2022, BP will buy 2 million metric tons per year of LNG. Per the terms, BP will buy LNG on a free-on-board basis for 20 years, which will enable the company to sell the fuel in the market.

The Calcasieu Pass facility will have a capacity of 10 million tons per year. Venture Global is also undertaking developmental operations at the Plaquemines LNG facility. The unit is located on the Mississippi River south of New Orleans and will have a capacity of the 20 million metric tons per year.

To date, Venture Global has raised $525 million for the development of the Calcasieu Pass and the Plaquemines LNG facilities.

The confirmation of the deal takes the total purchase commitment to 6 million tons at the Louisiana facility. Venture Global has also signed agreements with Royal Dutch Shell plc RDS.A, Italy's Edison and Portugal's Galp for the same.

New U.S. LNG suppliers are revolutionizing the fuel market. The latest contract does not bind the buyer to any specific destination and also offers them with new trading prospects. This was not possible under rigid agreements between producers and end users under conventional markets.

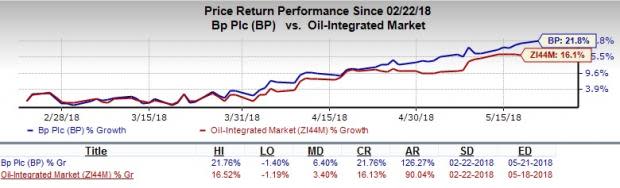

Price Performance

During the past three months, BP’s shares have gained 21.8% compared with the industry’s 16.1% rally.

Zacks Rank & Other Key Picks

BP currently sports a Zacks Rank #1 (Strong Buy).

A few other top-ranked players in the same sector are Nine Energy Service, Inc NINE and CVR Refining, LP CVRR. Both these stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nine Energy Service is engaged in delivering onshore completion and production services to unconventional oil and gas resource development. The company pulled off a positive earnings surprise of 28.57% in the preceding quarter.

Sugar Land, TX-based CVR Refining is an independent downstream energy partnership with refining and associated logistics properties in the Midcontinent United States. The company delivered an average positive earnings surprise of 7.05% in the last four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVR Refining, LP (CVRR) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

Nine Energy Service, Inc. (NINE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance