Breaking Down PayPal (PYPL) Stock Before Q3 Earnings

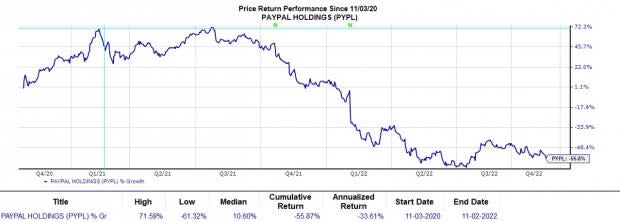

With PayPal PYPL still trading 65% off its highs, it is another tech stock investors will be closely eying when it reports Q3 earnings on Thursday, November 3. Despite being one of the largest online payment solution providers, the stock has been far from immune to challenges in the economy.

PayPal’s stock began to falter before increased operating headwinds and rising inflation. During Q1 last year, Wall Street began to question if the company could sustain its impressive growth. Increasing competition from Alphabet’s GOOGL Google Wallet among other alternative payment solution sources started to wear on investor sentiment surrounding the premium paid for PYPL stock. Block SQ and many of the big banks have also become respectable competitors.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Overview

PayPal, previously Confinity, was founded in 1998 and went public in 2002. The company was bought by eBay EBAY shortly after. PayPal is a pioneer in innovating the way consumers can pay for online products. Before PayPal’s services, many payments on retail sites like eBay were being paid by checks and money orders, causing delays for products to be delivered while waiting for checks to be cleared.

In 2014, Wall Street juggernaut and large shareholder Carl Icahn demanded the company split from eBay. This resulted in the company again operating as a single, publicly-traded company the following year. PYPL’s growth continued to accelerate after acquiring Xoom in 2015 which expanded its business internationally.

Recently, PYPL’s growth has started to slow making management of the current economic downturn a pivotal moment for the company. Last quarter, revenue grew 9% to $6.8 billion. PYPL beat earnings expectations by 9% at $0.93 per share. This caused the stock to spike 13% the following day. However, earnings were still down 19% from $1.15 in Q2 2021. Wall Street will be monitoring if the company was able to close the gap during Q3.

Q3 Outlook

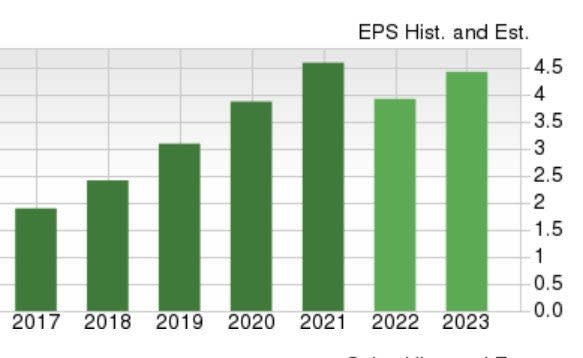

The Zacks Consensus Estimate for PYPL’s Q3 earnings is $0.95 per share, which would represent a -14% decline from Q3 2021. Sales for Q3 are expected to be up 10% at $6.82 billion. This is an indication that outside of slowing growth, operating costs are weighing on the stock as well.

Earnings estimates for the period have remained unchanged throughout the quarter. Year over year, PYPL earnings are expected to decline -14% but rebound and climb 20% in FY23 at $4.75 per share. Top line growth is expected, with sales projected to be up 10% this year and rise another 12% in FY23 to $31.27 billion.

Performance & Valuation

Year to date, PYPL is down -58% to underperform the S&P 500’s -20% and the Nasdaq’s -33%. PYPL is still up +114% over the last 8 years since operating independently again but still underperformed the benchmark and the Nasdaq.

Image Source: Zacks Investment Research

Investors are hoping the company can regain its impressive growth. After reaching 52-week highs of $231.92 last November, PYPL now trades around $79 per share. At current levels, PYPL has a P/E of 28.7X. This is near its peer group’s 29.8X. Even better, PYPL trades nicely below its 8-year high of 87.8X and the median of 44.5X since becoming independent.

Image Source: Zacks Investment Research

Bottom Line

PayPal stock could use another strong earnings beat, and stronger than expected guidance could help sustain a rally. Wall Street will want to see if the company can offer any early outlook into FY23 and perhaps confirm what is expected to be a return to growth.

PYPL currently lands a Zacks Rank #3 (Hold) and its Internet-Software Industry is in the top 37% of over 250 Zacks Industries. PYPL trades more attractively than it has in the past and long-term investors could be rewarded again for holding the stock. The Average Zacks Price Target suggests 57% upside from current levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance