Brexit is crushing London's luxury housing market

The uncertainty surrounding Brexit will have a brutal impact on London's luxury property market, according to a report by estate agents Savills.

Savills predicts that the capital value of prime property in central London will fall by 9% in 2016 when compared to the year before. In the rest of London, it is predicted to fall by 5%.

The report says that post-referendum uncertainty has compounded the impact of successive tax rises on expensive property in the capital, and will delay the sector's return to growth.

Here is the chart:

Mark Esau / Flickr, CC

Value fluctuations in the market are expected to hover around zero in 2017 and 2018 as Brexit negotiations play out, before returning to growth in 2019.

Stamp duty rises in December 2014 and April 2016 had the biggest impact on prime central London markets, where property values average around £4 million. Prices were -8.1% below their 2014 peak by the time of the referendum, and that includes a fall of -2.2% in the first six months of this year.

Lower value, outer London prime markets – where the average property price is £2 million – were less affected by the 2014 rise in stamp duty. That is why values rose by 2.3% in 2015. But the 3% stamp duty rise this year, combined with pre-referendum nerves, did suppress growth, and that is why capital values are expected to decline by 5%.

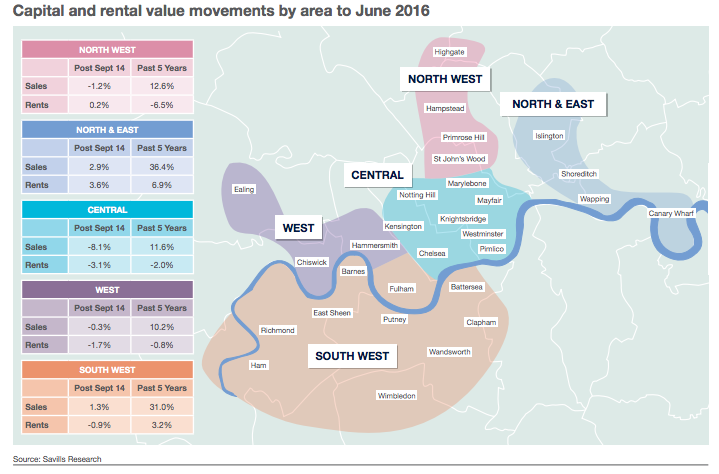

Here is the chart broken down by area (rental movements are also included):

Mark Esau / Flickr, CC

Mortgage lending constraints and greater caution around job security in the financial sector are also seen as key factors in the capital's declining prime market this year.

In the long-run, however, the news appears more positive.

“The market will inevitably remain susceptible to fluctuations in buyer sentiment, but there is nothing to suggest the impact of the vote to leave will echo that of the global financial crisis,” said Lucian Cook, Savills UK's head of residential research.

“The summer market was slow but certainly not moribund, and the currency advantage brought international buyers back into the market."

Cook also said that London's infrastructure, and its position as a global financial centre, will ensure a return to high levels of capital growth in the prime market.

“We know the prime London markets have generally rebounded strongly after a period of adjustment," he said.

NOW WATCH: The 'Mrs. Doubtfire' house is on sale for $4.45 million — here’s what it looks like 23 years later

See Also:

Yahoo Finance

Yahoo Finance