Brexit is making Brits stay home and spend less

Uncertainty in the final days before the official Brexit deadline has put a drag on consumer spending plans, with fewer people buying cars, booking holidays, and purchasing new homes.

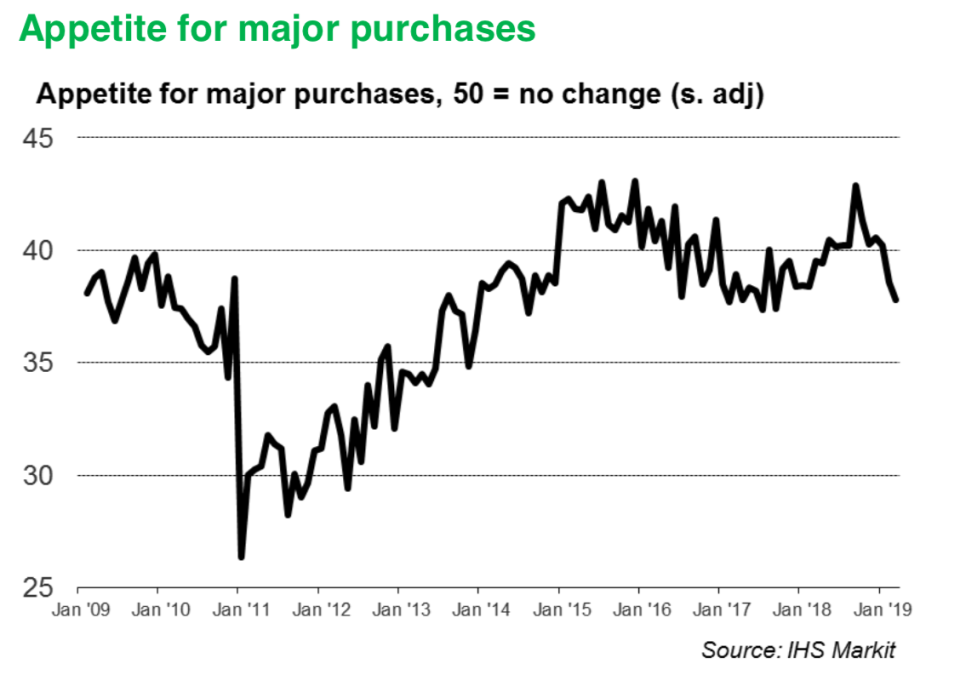

New survey data released Monday from research firm IHS Markit showed consumers were less willing to spend money on big-ticket items this month as they reported feeling squeezed. Additionally, property website Rightmove noted that house price growth had stalled and home sales in February were down 7% compared to last year.

“A sharp drop in UK households’ appetite for major purchases was the main signal that Brexit uncertainty had some impact on consumer spending,” according to Tim Moore, an associate director at IHS Markit.

Consumer appetite for big purchases, including cars and holidays, was close to a five-year low, according to the IHS Markit survey.

READ MORE: Ireland tries to avoid another boom-bust housing cycle as home-building ramps up

The report also showed people are feeling the largest squeeze on their financial wellbeing in just over a year.

A separate report issued on Monday from Rightmove also blamed Brexit uncertainty for weighing down the springtime housing market, when house prices and purchases are normally buoyant.

“Buying activity remains cooler than usual, with hesitation as some buyers await a more settled political climate,” said Miles Shipside, a director and market analyst at Rightmove.

House price growth in March in the UK was up just 0.4% compared to February, the lowest average monthly rise at this time of year since 2011. It’s also well below the average monthly increase of 0.9% that’s occurred over the past seven years.

A 1.1% drop in London home prices in March was the main reason behind the slowdown.

“There’s greater resilience the further away you get from the London market,” Shipside said.

The Rightmove report was based upon the listing data of more than 110,000 homes in February and March.

The IHS Markit report was based on a survey of 1,500 British adults in early March.

Brexit is scheduled to take place on 29 March, though UK lawmakers voted last week to request a deadline extension from the European Union. All 27 EU member states would have to give their approval to push back the divorce date.

READ MORE: Here’s why a Brexit extension will still be painful for the UK economy

Yahoo Finance

Yahoo Finance