Will Brexit mean 'car-mageddon' for the UK's automotive sector?

Of the 1.7m cars rolling off production lines in the UK last year, all but 20pc of those vehicles were destined to spend their lives on foreign roads.

The export market is crucial to Britain’s car makers: the sector has an annual turnover of £77.5bn and, with 80pc of production headed overseas, it accounts for 12pc of the country’s entire goods exports according to industry data.

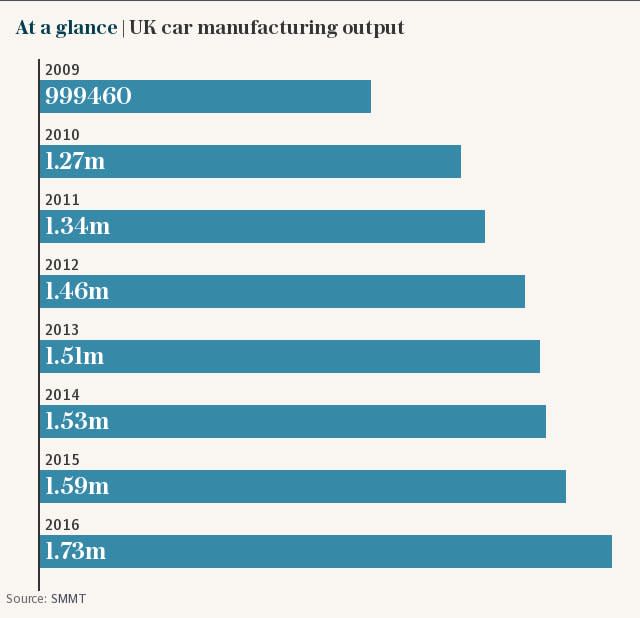

Prior to last year’s referendum on the EU, the sector had been enjoying a more than four-year renaissance as it got back in gear after the global financial crash, with sales and production surging and industry chiefs predicting output would hit a record 2m cars a year in 2020. Employment in the sector was also on the rise, with 169,000 people directly employed in manufacturing and a further 814,000 jobs supported by the sector.

However, those upbeat predictions were thrown into doubt as the implications of last June’s referendum began to come clear.

Car makers had foreseen the likely problems and were among the most vocal, warning about the consequences of leaving the EU.

Ralf Speth, the boss of Jaguar Land Rover, wrote to staff outlining the expected impact of voting to leave, saying “without free and fair trade with 500m people [in Europe] jobs and investment would be put at risk. Even the uncertainty caused whilst the Government tried to negotiate the UK’s exit and make new trade deals would be highly damaging.”

His view was echoed by Torsten Müller-Ötvös, chief executive of BMW-owned Rolls-Royce, who told staff it was “better to be inside the EU than outside”, warning about the consequences on limiting the free movement of goods and workers. The viewpoints of both men had an extra poignancy – both are German and immigration was one of the major flashpoints of the Brexit campaign.

Tony Walker, head of Toyota’s UK manufacturing business, also sounded a warning, saying Brexit was likely to be a “serious threat to the long-term growth and sustainability. That means not that we will shut, but that we would employ less people … that we wouldn’t grow as we would if we were in the EU.”

It can’t be said the alarm bell wasn’t rung and, a few months after the vote, trade association the Society for Motor Manufacturers (SMMT) spelled out the likely impact. According to its calculations, without a trade deal, WTO tariffs mean the price of a European-built car sold in Britain was likely to rise by an average of £1,500, with tariffs and customs costs bringing a £4.5bn bill for British-based manufacturers sending cars abroad.

The SMMT has led the campaign for the industry and what it wants from Brexit – the ambition is no tariffs, no customs and free movement of labour. Although fairly careful with its language prior to the snap election, the body stepped up its campaign in late June.

“It’s time to be brutally honest – our sector needs a comprehensive and bespoke trade agreement,” said Mike Hawes, the SMMT chief executive, warning of a “cliff edge” without a transitional deal after the 2019 Article 50 deadline, which car makers believe is far too short to thrash out a complex deal on tariffs and customs.

For all the rhetoric, car makers do – unlike some sectors – have a little time on their hands. It takes about seven years from the decision to make a new model, to starting production. Nissan needed to make a decision on where to build the new Qashqai and X-Trail – and opted for Sunderland. More recently BMW decided its giant Oxford factory would be the location for an electrically powered Mini.

Other than these decisions, Britain’s car makers don’t have any other pressing model decisions to make, allowing them to wait and see – at least for a short while.

“It’s not about the next model, but the next one and the one after that,” said Phil Harrold, an automotive consultant. “Without certainty about what’s likely to happen, manufacturers are holding off on investment and the longer they wait, the less competitive the UK becomes.”

This wait-and-see is showing in investment in the UK’s car industry, which was £322m in the first half of 2017, down from £1.66bn in 2016 and £2.5bn the previous year. Producing more than 500,000 cars from its Midlands plants, JLR is Britain’s biggest car company and its factories are already running at capacity. To ease this production crunch in Britain, it is building a new factory in Slovakia, and has contracted out production to Austria’s Magna, which will build the electric I-Pace and E-Pace SUV.

Speth recently spoke about how reliant JLR is on EU suppliers for parts, describing the company’s “huge dependency on Europe. You simply can’t buy some components in the UK.” While Tuesday’s news that Britain will seek a transitional deal of up to three years after Brexit in March 2019 is something of a victory for the car industry, what the long-term implications are is still far from clear.

“Wait and see is an apt way to describe what the industry is doing,” said Hawes. “Everyone is scenario planning to work out what the impact is likely to be: will we get a trade agreement, a WTO deal or business as usual? Whatever happens there will not be a part of the business that is unaffected though – manufacturing, R&D, logistics, HR, everything.”

One concern is staffing. It’s bad enough that Britain is already facing a skills shortage, but the car industry is a truly global entity, with international companies shifting staff around on short notice. Not being able to parachute in employees into UK bases might be a deterrent.

It’s tempting to focus on the negatives, but there are those who see opportunity in Brexit. One is Simon Anderson, managing director of LVS, which supplies plastic components used in cars worldwide.

“I’m getting companies calling me now who wouldn’t pick up my calls before the referendum,” says the boss of the Shropshire-based manufacturer, which employs about 80 staff. “They are suddenly realising they could buy parts from me they always purchased abroad and won’t have to deal with tariffs and customs.”

Mr Anderson said he has recently met with a major German manufacturer who told him that the weaker pound in the wake of the referendum means that his prices – once logistics are stripped out – are now on a par with suppliers in the Czech Republic, the country seen as the outsourcer of choice for the German car industry.

When it comes to what the car industry is doing to prepare for Brexit, the best answer is nothing – but planning for everything, while hoping for the best, but being ready for the worst. “It’s hard to make a decision when you don’t know what the situation is – and it seems to be shifting every day,” said Hawes. “The danger of that is manufacturers looking at Britain and putting it in the ‘too hard’ basket because of the uncertainty.”

Yahoo Finance

Yahoo Finance