How Britain is on the cusp of another general election and a delayed Brexit

Prime minister Theresa May only just survived a rebellion by her own MPs back in December. But after a devastating defeat in parliament over her Brexit deal last night, she now faces a no-confidence vote — further paving the way for a potential general election.

As promised, the leader of the opposition party Jeremy Corbyn, tabled a motion of no-confidence in the immediate aftermath of the crushing defeat. Corbyn said this would allow the Commons to “give its verdict on the sheer incompetence of this government.”

Today, members of Parliament (MPs) will debate the confidence motion for about six hours following Prime Minister’s Questions at 12pm local time. The confidence vote will then take place at 7pm.

Considering the political climate at the moment, there is a distinct possibility of both a delayed Brexit and another general election.

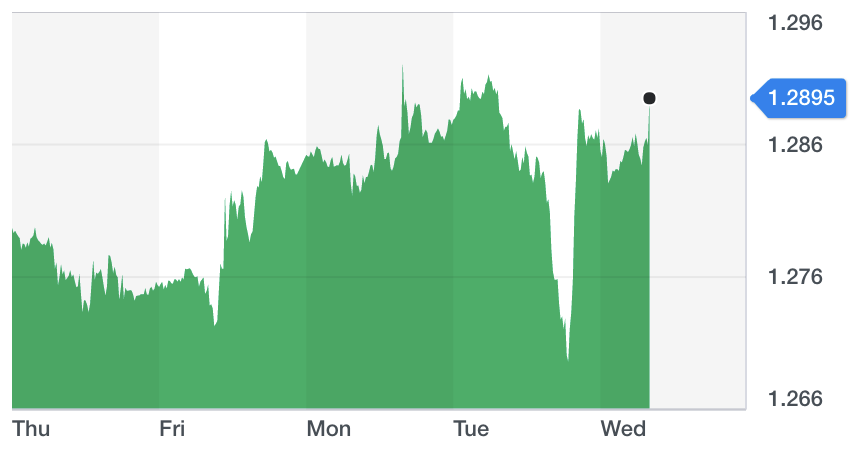

If the government wins, then May and her cabinet stay in place. There is an expectation from the markets that May and the government will be safe, which has been reflected in the rebound to the pound overnight.

“GBP is steady after wild overnight gyrations, neither helping nor hindering the FTSE, after UK PM May’s overwhelming Brexit vote defeat,” said Mike van Dulken, head of research at Accendo Markets. “Despite falling as low as -1.7% at one point, Sterling is back to square one as the Parliamentary calculus remains unchanged and the PM is likely to remain in power, even after today’s no confidence vote.”

Laith Khalaf, senior analyst at Hargreaves Lansdown said in a statement:

“The pound has become the market’s Brexit barometer, and it’s been a volatile night as currency markets digest proceedings in Westminster.

“Sterling gained ground following the vote, but only recovered ground it lost earlier in the day. Markets think a softer Brexit may start to take shape now the vote has failed, as parliament gains greater control of the process. This is a change in dynamic, as previously government failures have heightened expectations of a hard Brexit, and have weighed sterling down.

“The reality is there’s no correct price for sterling until there’s greater resolution on the direction of Brexit, what we have right now is a middle ground between competing possibilities.”

What if the government loses the vote?

However, there are three other outcomes if the government loses the vote.

Firstly, under the Fixed-Term Parliaments Act, there will be a question of where to go next — is there a clear, viable alternative government? If the answer is ‘yes,’ May is likely to resign and a new prime minister is appointment.

At the moment, it does not look like that’s the case, due to the level of Conservative party in-fighting for the last couple of years. May has also been strident on keeping her position and promised she will step down after Brexit actually happens, in order to secure her role after the rebellion by her own MPs last month.

So if the answer is ‘no,’ another question is raised — can the government win a confidence vote in 14 days? If the answer is ‘yes,’ then the government can continue but will likely have modified policies. If the answer is ‘no,’ then a general election is likely.

May called a snap general election back in 2017, meaning the next one should be in 2022.

If a general election happens, then an extension to Article 50 — the official notification that Britain would leave the EU and thereby starting a two-year process to discuss a deal — would have to happen as there is not enough time to hold a snap election before 29 March, 2019.

Investment bank Citi said late yesterday there is now a “very high” chance that Brexit will be delayed.

“After tonight’s emphatic rejection, small tweaks won’t get the deal over the line,” Citi said. “The probability of Article 50 extension is now very high, and the stock of Article 50 revocation is rising too,” they added, referring to the legal mechanism that triggered the exit process.

Earlier this week, one of the world’s most reputable think tanks — the Economist Intelligence Unit (EIU) — said that Brexit will not happen on 29 March and that a ‘no-deal Brexit’ is the least likely scenario right now.

READ MORE: It’s more likely Brexit will not happen on 29 March, than no-deal — EIU

Yahoo Finance

Yahoo Finance