Britain's manufacturers haven't been this depressed since the financial crisis

Britain's manufacturing sector has fallen into a deep funk following the Brexit vote, figures out on Monday show.

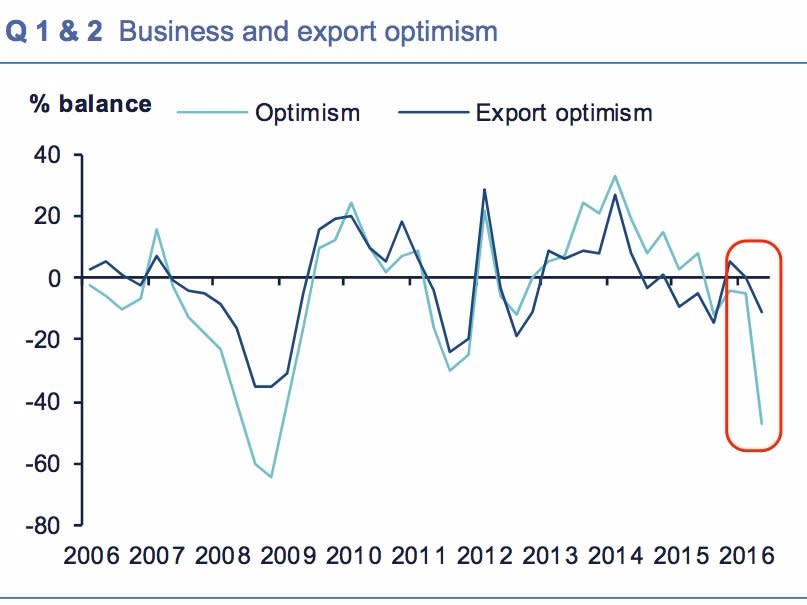

The latest Confederation of British Industry (CBI)'s Industrial Trends Survey gave a confidence reading of -47%, the lowest figure since January 2009 (-64%) when Britain was at the height of the financial crisis. The decline in confidence was also the fastest fall since the same month in 2009.

CBIThe survey of 506 manufacturers across the UK found that expectations for total new orders growth are at their lowest since January 2012.

But despite the pessimism, the CBI predicts that export orders will rise at an above-average pace over the next quarter. Many pro-Brexit campaigners argued that the weakened pound would boost international orders.

And despite the gloom about the outlook for UK manufacturing, the survey found that output rose by 16% in the last 3 months, its strongest growth for 2 years.

Rain Newton-Smith, CBI Chief Economist, says in an emailed statement: "Manufacturers picked up the pace over the second quarter, with output growing solidly. We’re also seeing encouraging signs of a boost to export competitiveness from a weaker sterling.

"But it’s clear that a cloud of uncertainty is hovering over industry, post-Brexit. We see this in weak expectations for new orders, a sharp fall in optimism and a scaling back of investment plans."

NOW WATCH: Uber China is merging with an Apple-backed competitor

See Also:

McDonald's is shaking off Brexit fears and creating 5,000 new UK jobs

Another post-Brexit economic survey shows a collapse in activity — this time in retail

Post-Brexit Britain just got a £275 million investment from a drugs giant

SEE ALSO: German businesses on Brexit: ¯\_(ツ)_/¯

Yahoo Finance

Yahoo Finance