Britons have spent £4 million on mince pies already

Christmas gets earlier and earlier each year, it seems, and British shoppers have already spent £4 million on mince pies.

With still nine weeks until the big day, consumers have been stocking up on traditional festive favourites.

Aside from mince pies, £69 million of chocolate confectionery boxes have been bought in the last four weeks – a near threefold increase on sales in August.

MORE: Aldi wins crown for best Christmas pudding in taste-test

And Brits have splashed out £1.1 million on Christmas puddings, according to figures from retail analysts Kantar Worldpanel.

The early Christmas push has seen supermarket sales increase in value by 3.1% over the 12 weeks to 8 October 2017, compared with the same period last year.

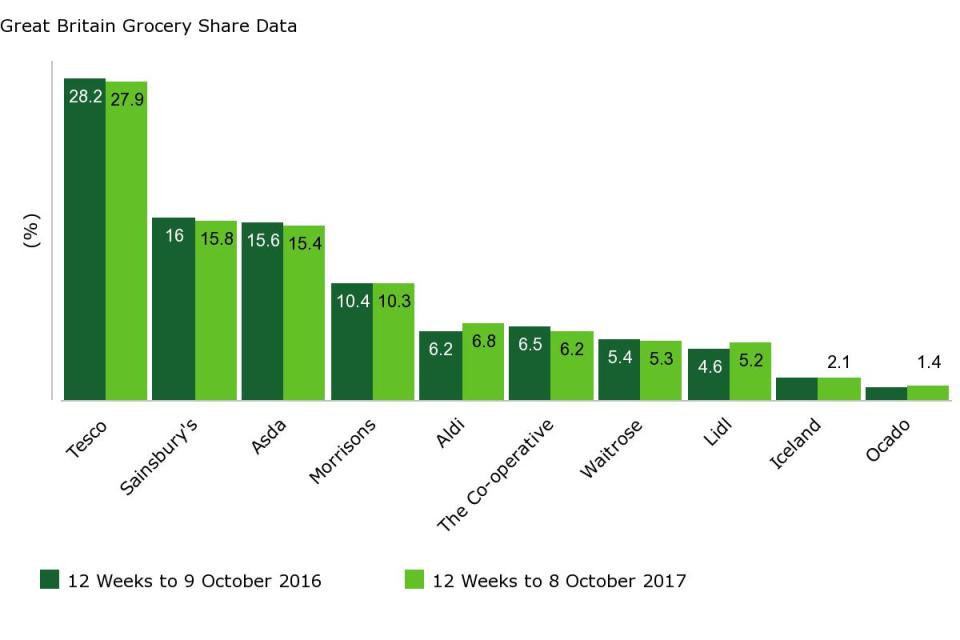

Kantar said it was a mixed picture for the major retailers – each of the big four has grown sales but seen a decrease in market share as smaller operators “continue to entice new customers through their doors”.

Morrisons was the fastest growing of the large supermarkets this period, increasing sales by 2.8% – although its overall market share fell by 0.1 percentage points to 10.3%.

MORE: Reverse Brexit to have ‘positive’ effect on UK economy – OECD

The remaining big four have each continued to increase sales every month since April.

Tesco saw sales grow by 2.1%, though share was down 0.3 percentage points to 27.9% – still by far and away Britain’s favourite supermarket.

Asda posted sales up 1.8%, driven by its own-label brands which now account for 45% of sales. And sales at Sainsbury’s increased 1.9% on last year, taking a 15.8% market share, down 0.2 percentage points.

The traditional big hitters will still be casting a wary eye on newcomers, Aldi and Lidl, however.

Kantar reported that the discount supermarkets collectively added an additional £390 million in sales this quarter, which accounts for half of the growth across the entire market.

MORE: M&S ups price of Percy Pigs – but packet size stays the same

Lidl remains Britain’s fastest growing supermarket, up by 16%, while Aldi grew by 13.4%.

Share increased for both retailers by 0.6 percentage points, up to 5.2% of the market for Lidl and 6.8% for Aldi.

Surprisingly, fewer than one in five people (18%) shop online for their groceries. Ocado is the biggest presence in the online market.

Recent stories about food hygiene and safety issues with the poultry supply chain have not materially dented chicken sales; fresh poultry sales have remained flat in the month of September, while chilled processed poultry has increased in value by 6%.

Yahoo Finance

Yahoo Finance