Broadcom (AVGO) Up 42.1% in 2024: Is it Worth Watching?

Since its inception, Broadcom Inc. AVGO has provided generous returns to its shareholders. The company provides various services and is a market leader in data centers and AI Ethernet switching. Its stock has gone up this year mainly on AI-optimism.

Over the last decade, Broadcom has expanded appreciably. In 2016, Singapore-based Avago Tech acquired Broadcom for $37 billion and took on the Broadcom brand name. Since 2018, the company has expanded by acquiring CA Technologies for $19 billion, Symantec’s enterprise security business for $11 billion, and, more recently, VMware for $69 billion.

Earlier this month, Broadcom reported second-quarter fiscal 2024 earnings of $10.96 per share, which beat the Zacks Consensus Estimate of $10.79 and increased 6.2% year over year. Net revenues jumped 43% year over year to $12.48 billion, surpassing the Zacks Consensus Estimate of $12.04 billion. AI turned out to be the biggest driver of revenues with AI-related revenues surging 280% year over year to $3.1 billion. Broadcom management currently considers this revenue one-fifth of its total business.

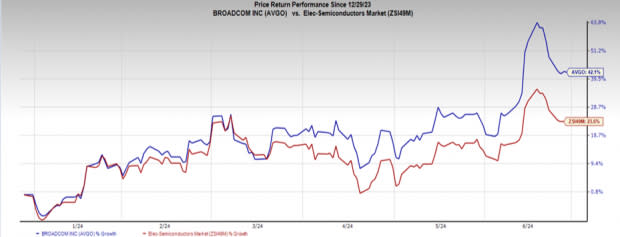

Broadcom’s stock has risen 42.1% compared with the Zacks Electronics - Semiconductors sub-industry’s growth of 23.5% year to date.

Image Source: Zacks Investment Research

Broadcom will soon start to ship its range of chipsets that support the AI clusters used by companies such as Alphabet GOOGL and Meta Platforms META. As a result, for fiscal 2024, the company expects revenues of $51 billion. Out of this, $11 billion is projected to be from AI-related revenues backed by Google and Meta Platforms. Broadcom’s fortunes are also getting a boost from a demand for custom ASIC solutions for AI compute accelerators from giant tech companies.

Thus, through organic growth and wise acquisitions, Broadcom has developed into one of the largest global technology companies serving the semiconductor and software sectors. Its expected earnings growth rate for the current year is 12.2%. The Zacks Consensus Estimate for its next-year earnings has improved 3.3% over the past 60 days. Though it currently carries a Zacks Rank #3 (Hold), it is expected to be upgraded in the coming months. Prudent investors should closely monitor its progress. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance