Bucher Industries And Two More Top Swiss Dividend Stocks

The Switzerland market recently experienced a slight downturn, closing marginally lower after a session marked by cautious trading behavior ahead of key economic data from the U.S. This backdrop of tentative investor sentiment and minor fluctuations in major indices sets the stage for considering stable investment options, such as dividend stocks which can offer potential resilience and regular income streams in uncertain times.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.57% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.24% | ★★★★★★ |

Compagnie Financière Tradition (SWX:CFT) | 4.27% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.41% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.38% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.83% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.12% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.75% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.22% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Bucher Industries

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG, with a market cap of CHF 3.73 billion, operates globally in manufacturing and selling machinery, systems, and hydraulic components used in food production and packaging, as well as maintaining roads and public spaces.

Operations: Bucher Industries AG generates revenue through five primary segments: Kuhn Group (CHF 1.42 billion), Bucher Specials (CHF 398 million), Bucher Municipal (CHF 572.50 million), Bucher Hydraulics (CHF 743.60 million), and Bucher Emhart Glass (CHF 523.60 million).

Dividend Yield: 3.7%

Bucher Industries offers a dividend yield of 3.71%, which is lower than the top Swiss dividend payers. Despite a stable 10-year history of dividend payments, current dividends are not well supported by cash flows, with a high cash payout ratio of 127.1%. However, the stock trades at 22.5% below estimated fair value and earnings have grown by 14% annually over the past five years. Future earnings are expected to decline by an average of 5.3% annually over the next three years.

Get an in-depth perspective on Bucher Industries' performance by reading our dividend report here.

Our valuation report here indicates Bucher Industries may be undervalued.

Jungfraubahn Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG operates cogwheel railways and winter sports facilities in the Jungfrau region of Switzerland, with a market capitalization of approximately CHF 1.08 billion.

Operations: Jungfraubahn Holding AG generates revenue primarily through three segments: Jungfraujoch - TOP of Europe at CHF 188.24 million, Experience Mountains at CHF 45.94 million, and Winter Sports at CHF 41.26 million.

Dividend Yield: 3.4%

Jungfraubahn Holding has demonstrated a decade of dividend growth, though its 3.36% yield remains below the Swiss market’s top quartile at 4.27%. The dividends are well-supported by both earnings and cash flows, with payout ratios of 47.8% and 61.7%, respectively. Despite an impressive earnings increase of 81.6% last year, future growth is modestly projected at 2.54% annually. However, the stock's value appears attractive, trading at a 17% discount to its estimated fair value as of April this year.

StarragTornos Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG, a company specializing in the development, manufacturing, and distribution of precision machine tools for various materials, has a market capitalization of CHF 290.83 million.

Operations: StarragTornos Group AG generates CHF 409 million from its machine tools segment.

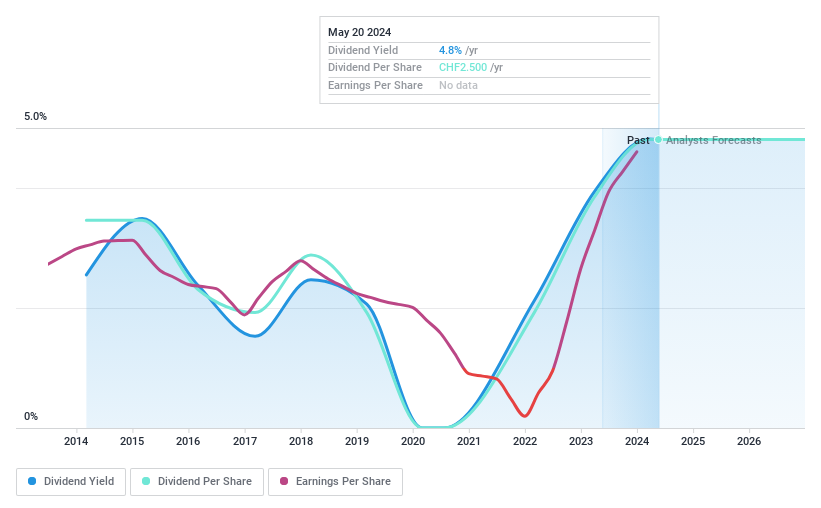

Dividend Yield: 4.7%

StarragTornos Group maintains a low payout ratio of 34.7%, suggesting dividends are well-supported by earnings, despite substantial shareholder dilution over the past year. The company's earnings have surged by 126.5% last year and are expected to grow annually by 10.72%. However, a high cash payout ratio of 110.6% indicates dividends aren't well-covered by cash flows, contributing to dividend volatility over the last decade, although the yield of 4.67% ranks in Switzerland's top quartile.

Make It Happen

Unlock our comprehensive list of 27 Top Dividend Stocks by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BUCN SWX:JFN and SWX:STGN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance