Builder Sentiment Dips in June Amid High Mortgage Rates

Elevated mortgage rates are deterring many potential homebuyers, as rates remain around 7%. Homebuilders are not only dealing with high mortgage rates but also facing increased costs for construction and development loans. They are struggling with persistent labor shortages and a scarcity of buildable lots. These factors combined are dampening builder confidence, making it a challenging environment for the home building industry.

Key Takeaways

Builder confidence in newly built single-family homes declined by two points in June from May to reach a level of 43, as reported by the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This marks the lowest level of builder confidence since December 2023, reflecting ongoing challenges in the housing market.

In June, all three HMI component indices reported declines, marking the first time since December 2023 that all indices fell below the key threshold of 50. The HMI index tracking current sales conditions dropped three points to 48, while the component measuring sales expectations for the next six months dropped four points to 47. The gauge measuring the traffic of prospective buyers fell two points to 28.

Analyzing the three-month moving averages for regional HMI scores, the Northeast maintained stability at 62. In contrast, the Midwest saw a three-point slump to 47, the South experienced a similar decline to 46 and the West recorded a two-point drop to 41. These changes reflect current challenges in the housing market, impacting builder sentiment across different regions.

The latest HMI survey indicated that 29% of builders reduced home prices in June to stimulate sales, marking the highest share since January 2024 (31%) and surpassing the May rate of 25%. Despite this, the average price cut remained unchanged at 6% for the 12th consecutive month. The use of sales incentives rose to 61% in June from 59% in May, reaching its highest level since January 2024 (62%). These trends reflect ongoing efforts by builders to attract buyers amid current market conditions.

Fed Policy and High Mortgage Rates: Impact on Housing Market

NAHB chief economist Robert Dietz noted that the current challenge posed by high shelter inflation, which stands at a 5.4% year-over-year rate, hindering the Federal Reserve's efforts to reach its 2% inflation target. Dietz emphasized that expanding the nation's housing supply is crucial to lowering shelter inflation and bringing overall inflation closer to the target. He suggested that improving the interest rate environment for construction and development loans would support these efforts.

On Jun 12, 2024, the Federal Reserve decided to maintain interest rates at a 23-year peak and revised its anticipated rate cuts for this year to one, down from the previous estimate of three. Fed officials increased their forecast for rate cuts in 2025, now expecting a median of four additional cuts, up from the previous estimate of three. These adjustments could potentially influence homebuilder sentiment by impacting mortgage rates and construction financing costs, pivotal factors in the housing market's health.

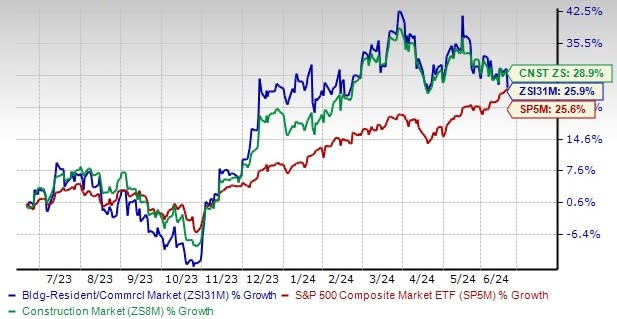

Image Source: Zacks Investment Research

The Zacks Building Products - Home Builders industry has underperformed the broader Zacks Construction sector in the past year. Over this period, the industry has gained 25.9% compared with the broader sector’s rise of 28.9%. However, the industry has outperformed the Zacks S&P 500 Composite’s rally of 25.6% in the same time frame.

Despite challenging market conditions, select homebuilders such as PulteGroup, Inc. PHM, Tri Pointe Homes, Inc. TPH, Taylor Morrison Home Corporation TMHC and KB Home KBH are leveraging company-specific tailwinds to navigate and thrive.

Discussions on Homebuilders Mentioned Above

PulteGroup: Based in Atlanta, GA, PulteGroup currently carries a Zacks Rank #1 (Strong Buy). Shares of the company have gained 48.4% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

PHM’s EPS estimates for 2024 have increased to $12.89 from $11.77 in the past 60 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 12.5%. Earnings for 2024 are expected to grow 10% year over year.

Tri Pointe: Based in Incline Village, NV, Tri Pointe currently sports a Zacks Rank #1. Shares of the company have gained 16.2% in the past year.

TPH’s EPS estimates for 2024 have increased to $4.49 from $3.66 in the past 60 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 30.1%. Earnings for 2024 are expected to grow 30.1% year over year.

Taylor Morrison: Based in Scottsdale, AZ, this homebuilder flaunts a Zacks Rank #1. Shares of the company have gained 16.9% in the past year.

TMHC’s EPS estimates for 2024 have increased to $7.62 from $7.29 in the past 60 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 15.6%. Earnings for 2024 are expected to grow 0.7% year over year.

KB Home: Based in Los Angeles, CA, this homebuilder carries a Zacks Rank #2 (Buy). The stock has gained 33.3% in the past year.

KBH’s EPS estimates for 2024 have remained unchanged at $8.01 in the past 30 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 18.4%. Earnings for 2024 are expected to grow 13.9% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

Tri Pointe Homes Inc. (TPH) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance