Bull of the Day: PDD Holdings Inc. (PDD)

If you can stomach the additional uncertainty that comes with investing in Chinese equities, I believe that PDD Holdings Inc. PDD may be one of the best opportunities in the market today.

PDD Holdings Inc., best known for its social commerce platform Pinduoduo is growing sales and earnings at an impressive pace, and currently enjoys both a deeply discounted valuation and a top Zacks Rank.

Annual sales have climbed from $4.3 billion in 2019 to $41.4 billion in the trailing 12 months and are forecast to grow another 64% this year and 29% next year.

Furthermore, the company has a rock-solid balance sheet and boasts a highly profitable business model, unencumbered by negative earnings like many other high-growth companies.

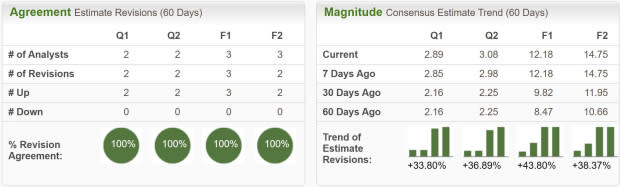

PDD's Hefty Earnings Revisions

Analysts have not held back in their estimates for earnings going forward, upgrading PDD to a Zacks Rank #1 (Strong Buy) rating.

FY23 earnings estimates have been raised by 44% and are expected to climb 85% YoY to $12.18 per share. FY24 earnings estimates have increased by 38% and are projected to grow 21.1% YoY to $14.75 per share.

Management has clearly prioritized cash flowing, as EPS have grown from $1.11 in 2021 to $7.58 per share in the trailing twelve months, which is a CAGR of 61%.

Image Source: Zacks Investment Research

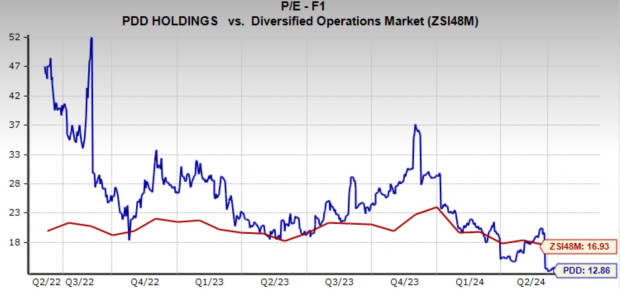

PDD Holdings Discount Valuations and Huge Earnings Expansion

The most compelling factor of this trade is the current valuation at which PDD Holdings Inc. is trading.

Today, it trades at a one-year forward earnings multiple of 12.9x, which is below the industry average and well below its two-year media of 24x.

Along with the incredible earnings growth forecasts, PDD has an extremely appealing PEG Ratio, which discounts the earnings multiple by earnings growth.

PDD's EPS are expected to grow 50.3% annually over the next 3-5 years. With a forward earnings multiple of 12.9x, this translates to a PEG Ratio of just 0.26.

Image Source: Zacks Investment Research

PDD Stock's Market-Beating Returns

A final element to consider when looking at PDD stock is the relative momentum it has demonstrated. Over the last year, the stock has rallied 107%, while the Nasdaq 100 has gained 30% and the Chinese Tech ETF KWEB has gained just 5%.

Even more impressive is that the stock still has such a cheap valuation following such price appreciation.

Image Source: TradingView

Bottom Line

For investors who can handle the added uncertainty and volatility of holding an international stock like PDD Holdings Inc., it may be one of the most compelling ideas today.

With a bargain valuation, high earnings and sales growth, a digital-first business and strong momentum, PDD has all the bullish catalysts I like to look for in a stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PDD Holdings Inc. Sponsored ADR (PDD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance