Bull of the Day: Wesco International (WCC)

Wesco International WCC is a global distributor of electrical, industrial, and communications products. Wesco also provides supply chain management and logistics services.

The firm posted a stellar 2022 and its outlook continues to improve as it benefits from secular trends such as electrification, cloud computing, and beyond. Wesco boasts many other solid fundamentals and it is sitting at rather attractive entry points on both the technical front and the valuation side. Plus, Wesco in early March declared its inaugural quarterly cash dividend on common stock.

Rowing with the Current

Wesco’s array of products and services help the company cast a wide net, with offerings that help drive forward crucial segments of the economy such as communications & networking, power generation and distribution, electrical and lighting, security, automation, and renewable energy. Wesco beefed up its reach and portfolio when it acquired Anixter in June 2020.

Wesco splits its business into three core operating segments: Electrical & Electronic Solutions, Communications & Security Solutions, and Utility & Broadband Solutions.

The company is set to benefit for decades to come from the never-ending need for cloud computing and other vital communication services. Wesco is also gaining steam as the U.S. ramps up its spending on renewable energy sources such as solar and battery storage. Solar and battery storage are two of the largest growth areas within all of the broader non-fossil fuel energy segment.

Image Source: Zacks Investment Research

Wesco’s electric vehicle segment should help it expand for years to come. The Alliance for Automotive Innovation said the number of EVs sold globally soared 60% last year. Plus, EVs still accounted for just 10% of U.S. vehicle sales in December 2022, up from around 2% in 2020.

Some projections call for EVs to account for upward of 40% of the market by as soon as 2030. With the massive EV expansion and other electrification efforts in the U.S. and beyond comes the need to invest heavily in revamping, updating, and building out the aging power grids.

Image Source: Zacks Investment Research

Recent Growth and Outlook

Wesco boasts roughly 140K customers across over 50 countries. The Pittsburgh, Pennsylvania-headquarter firm reportedly holds a roughly 15% share of the U.S. electrical distribution market and it could keep slowly adding to its reach.

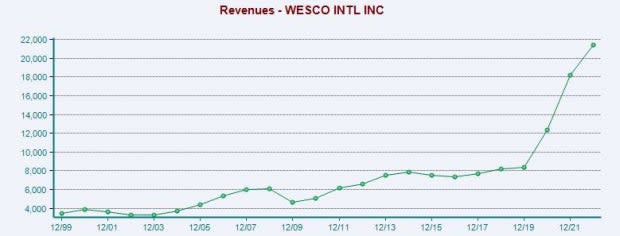

Wesco grew its revenue by 18% YoY in 2022 to $21.42 billion to help its adjusted earnings soar 65%—on top of 48% revenue in both 2021 and 2020.

Better yet, WCC provided upbeat guidance when it reported back in mid-February, with its FY23 consensus earnings estimates up 6% and FY24’s figure 13% higher. Plus, its most recent estimate for 2024 is already 8% higher than the current consensus. All of these positive earnings revisions trends help Wesco land a Zacks Rank #1 (Strong Buy) right now. These recent revisions are part of a long-term upward revisions trend dating back to 2020.

Zacks estimates call for Wesco to follow up this huge stretch of top and bottom line growth with another 7% earnings and revenue growth in 2023 and more growth in 2024.

Image Source: Zacks Investment Research

Price Movement, Valuation & More

Wesco stock has soared 3,000% over the past 20 years for a 19% annualized return. This performance blows away the Zacks Tech sector’s 490% and the S&P 500’s 350%.

More recently, WCC took off following its covid lows, with it up 430% in the past three years vs. Tech’s 50% and its industry’s 135%. Wesco shares have climbed 11% in the last 12 months, while Tech fell 10%.

Thankfully, investors can now scoop up Wesco stock around 20% below its March peaks. The selling came after WCC reached heavily overbought RSI levels.

WCC it now well under neutral RSI levels (50) at 41. The stock also just recently bounced back above its 200-day moving average. Wesco is also trading 45% below its average Zacks price target at around $139 per share.

Wesco’s valuation levels are looking super attractive at the moment. WCC is trading at a 40% discount to its 20-year median and a roughly 66% discount to the Zacks Tech sector at just 7.7X forward 12-month earnings.

Despite its huge run over the last three years, WCC is trading 30% below its three-year median and 50% under its sector to help showcase its impressive and improving earnings outlook.

Image Source: Zacks Investment Research

Wesco has a rather solid balance sheet and it is so confident in its business model despite near-term economic slowdown concerns that it declared on March 3 its first-ever quarterly cash dividend on common shares. The first $0.375 per share dividend was payable on March 31. WCC’s current dividend yield sits at 1.1%.

Bottom Line

Wesco is a stable business that’s been around since the 1920s that’s benefiting from secular tailwinds across various backbones of the entire U.S. and global economy.

Cloud computing and networking infrastructure are only growing more integral. It’s also worth constantly remembering that the most powerful and richest nations in the world are actively helping fuel the broader renewable and EV expansion, alongside Wall Street titans. And these are just some of the areas that Wesco operates in.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WESCO International, Inc. (WCC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance