Business activity slumps further amid threat of recession, report shows

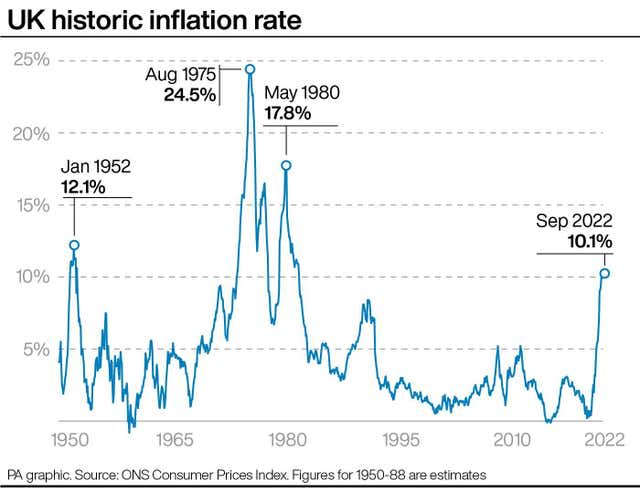

Stubbornly high inflation and the looming threat of recession saw activity slump at Scottish firms last month – with a warning that worse is to come.

The Royal Bank of Scotland’s Business Activity Index fell to 45.8 in October, down 2.2 points from the month before as growth in employment further weakened and the drop in new orders quickened.

Anything above 50 shows growth, while a number below that shows business activity falling. Last month was the third in a row which saw the figure dip.

Judith Cruickshank, chairwoman of the bank’s Scotland board, said: “The downturn in activity quickened on the month, as stubbornly high inflationary pressures, the ongoing cost of living and a threat of recession deterred growth.”

The bank said the downturn in incoming new business north of the border outpaced the UK-wide average, but the confidence of firms was broadly in line with the national average.

The rate of job creation in Scotland has remained softer than that seen at the UK level, which also slowed in October, resulting in the lowest intake of workers in 18 months.

The bank warned things are unlikely to improve in the near future.

“As we proceed into the final quarter of the year, market conditions are set to become more challenging,” said Ms Cruickshank.

“The aggressive interest rate hikes, the decline in the value of sterling against the dollar, and the rebound in post-Covid demand phasing out, all amidst the ongoing cost of living and energy crises, all point to an extremely difficult period for Scotland.”

The bank said October showed a robust rise in input costs for Scotland’s businesses – the amount firms spend to create a product or provide a service – with the run of inflation being taken to 29 months.

But despite being high, the Royal Bank of Scotland said input price inflation north of the border was softer than the UK average.

Yahoo Finance

Yahoo Finance