Buy These 3 Beaten-Down MedTech Stocks for a Turnaround Soon

The U.S. stock market’s remarkable 14-year bull run, while setting a new record in American history, has made investors apprehensive about a bubble burst looming around the corner. Veteran investor John Hussman’s remarks on the current market conditions draw a comparison to the extreme valuations right before the historic 1929 and 2021 clashes.

As quoted in a Markets Insider report, the strategist warns that investors’ optimism has driven the market to record highs following the U.S. Federal Reserve’s recent policy update confirming the rate cut expectations in 2024. In contrast to the investor sentiment, Hussman maintains a bearish outlook, warning of a potential downturn. Citing the dramatic escalation of debt levels since the 2008 crisis, expert Jim Rogers has also voiced concerns about the possibility of a very big correction in the coming months.

Both Canada and the European Union took attention this week as their respective central banks announced cuts in key lending rates preceding the Fed’s highly-anticipated move. Meanwhile, the stubborn inflation is gradually making it unlikely for the U.S. interest rate cuts, with financial firm Stifel predicting a 10% drop in the S&P 500 by the end of the third quarter of 2024.

In the macroeconomic sphere, messy geopolitical turmoil, including the Israel-Hamas conflict in the Middle East, the Russia-Ukraine war and growing China-Taiwan tensions, has led to surging raw material costs and supply-chain disruptions, leading to margin pressure for numerous companies across several industries.

Amid all these challenges, investing in MedTech stocks has historically provided a degree of safety due to their consistent demand for products and services. However, not all MedTech stocks can be a safe bet now as most of the blue-chip stocks have currently reached their highest potential because of the market bull run.

Here, we have picked companies like Option Care Health OPCH, Lantheus LNTH and Hologic HOLX, which, even in spite of being fundamentally strong, are trading below their actual worth. This should appeal to investors seeking stability in volatile times.

Detailed Analysis

With the market signaling a potential correction, investing in these three fundamentally-strong MedTech companies can be a strategic move. Their undervalued aspect makes them less prone to significant price declines compared to more expensive stocks. To narrow down the list, we have selected those companies with a Value Score of A or B, together with a strong Zacks Rank.

The Illinois-based infusion service provider, Option Care Health, designed its investment strategy to enable continued growth and unlock clinical labor efficiency. In 2023, the company expanded the ambulatory infusion network to 164 suites and more than 660 chairs nationwide. This year, it entered a multi-year commercial partnership with Palantir Technologies to leverage the AI platform across its operations. In the last earnings release, growth from the Chronic therapy outpaced acute therapy growth, much to the company’s surprise.

It also boasts robust patient satisfaction remains at 93%, with a Net Promoter Score of 76.2. Impressively, Option Care came out strong from the Change Healthcare cybersecurity incident due to its resilient capital structure and overall liquidity position. The “distraction” reinforced investing in its cybersecurity, enterprise risk management process and advanced technology to remain agile in response. The company will continue to execute its commercial priorities, drive operational excellence, expand its capabilities and explore new vectors of growth.

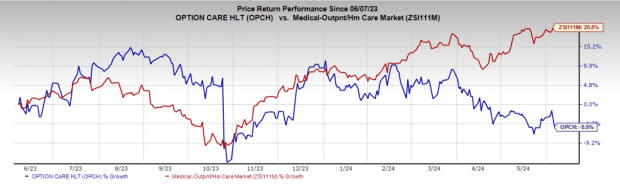

Image Source: Zacks Investment Research

Option Care Health carries a Zacks Rank #2 (Buy) and a Value Score of B at present. OPCH’s forward 12-month Price/Sales ratio remains at 1.02, lower than its median of 1.14, as well as much discounted compared to 3.99 for the S&P 500 index. The stock has declined 5.5% in the past year against the industry’s 20.8% rise.

However, at the same time, it has an earnings yield of 4.01% compared with the industry’s 3.87% yield. OPCH projects 15.71% earnings growth for 2025. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Our next pick, the radiopharmaceutical-focused company, Lantheus, is determined to lead the industry through operational excellence and ongoing innovation in diagnostics and therapeutics, further enhanced by AI. A pivotal driver to the company’s growth is PYLARIFY (piflufolastat F 18), the only commercially available PSMA (prostate-specific membrane antigen)-PET (positron emission tomography) imaging agent for prostate cancer, with sales potentially reaching $1 billion this year.

Considered a milestone step in pediatric medicine, Lantheus’ DEFINITY is now FDA-approved as an ultrasound-enhancing agent for use in pediatric patients with suboptimal echocardiograms. Its existing pipeline, which includes investigational assets like PNT2002, PNT2003 and MK-6240, offers promising opportunities for future growth and significantly improves patients’ lives. Furthermore, the company is leveraging its financial strength to seize attractive business development opportunities, such as Perspective Therapeutics, Inc., which helps grow its pipeline and aligns best with its expertise in radiopharmaceuticals.

Image Source: Zacks Investment Research

Lantheus carries a Zacks Rank #2 and a Value Score of A at present. LNTH’s forward 12-month Price/Sales ratio remains at 3.72 compared to its median of 3.42. However, the stock is discounted compared to 3.99 for the S&P 500 index. The stock has declined 9% in the past year against the industry’s 3.4% rise.

This stock, too, indicates huge future potential with an earnings yield of 8.72% compared with the industry’s 0.07% yield. For 2024, LNTH projects an earnings growth of 14.13%.

Our final pick on the list, Hologic, produces premium diagnostics products, medical imaging systems and surgical products focused on women's health. The company’s strong growth in the past four years reflects a combination of multiple durable growth drivers purposely built into each of its businesses. As for the next phase, its growth strategy emphasizes menu adoption and driving more volume by focusing on existing customers and expanding into new geographies, alongside diversifying its menu.

In Breast Health, Hologic broadened its product offering from imaging to cover the entire breast cancer care continuum, including biopsy and surgery. Its international business has grown 40% larger than it was in 2019, and the company still exerts about being in the early days of global opportunities. With more than $2 billion in cash and strong cash flow, it is well-equipped to fund key in-house initiatives, pursue M&A opportunities and share repurchases. The company’s recent $310 million (approx.) deal to acquire Endomagnetics Ltd complements and expands its existing breast surgery portfolio.

Image Source: Zacks Investment Research

Hologic carries a Zacks Rank #2 and a Value Score of B at present. HOLX’s forward 12-month Price/Sales ratio remains at 4.18, lower than its median of 4.31 and also much discounted compared to 3.99 for the S&P 500 index. The stock has declined 5.4% in the past year against the industry’s 7.7% rise.

Meanwhile, it has an earnings yield of 5.47% against the industry’s -7.25% yield. HOLX projects 3.03% earnings growth for fiscal 2024.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Option Care Health, Inc. (OPCH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance