At £4.76, is the Aviva share price a steal? Here’s what the charts say!

After a strong 2023, the Aviva (LSE: AV.) share price has kept up its fine form in 2024. Year to date, the stock has climbed 9.8%.

That means in the last 12 months, the insurance stalwart is up 19.7%. In the previous five years, it has returned 15.5%. It far outperforms the FTSE 100 on all three of those timescales. Looking back, Aviva has proved to be a shrewd investment.

But now at £4.76 a pop, is it a smart time to consider buying some shares today? I’ve had Aviva on my watchlist for a while. I want to find out if there’s any value left to squeeze out of its share price in the long run.

Price-to-earnings

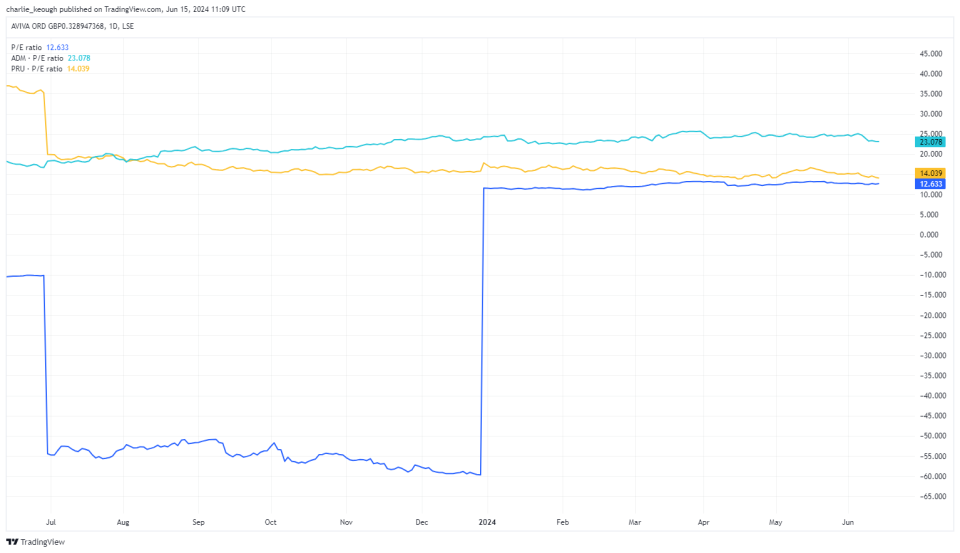

I want to first measure this by looking at its price-to-earnings (P/E) ratio. This is one of the best and most common valuation metrics around.

The Footsie average P/E is around 11. Therefore, and as seen below, Aviva’s P/E of 12.6 may not scream value on the surface.

Nevertheless, I still think that looks like good value. Not only is that cheaper than its historical average (14), but it’s also cheaper than peers such as Admiral Group and Prudential. Based on that, I see value in it at £4.67.

Created with TradingView

Dividend yield

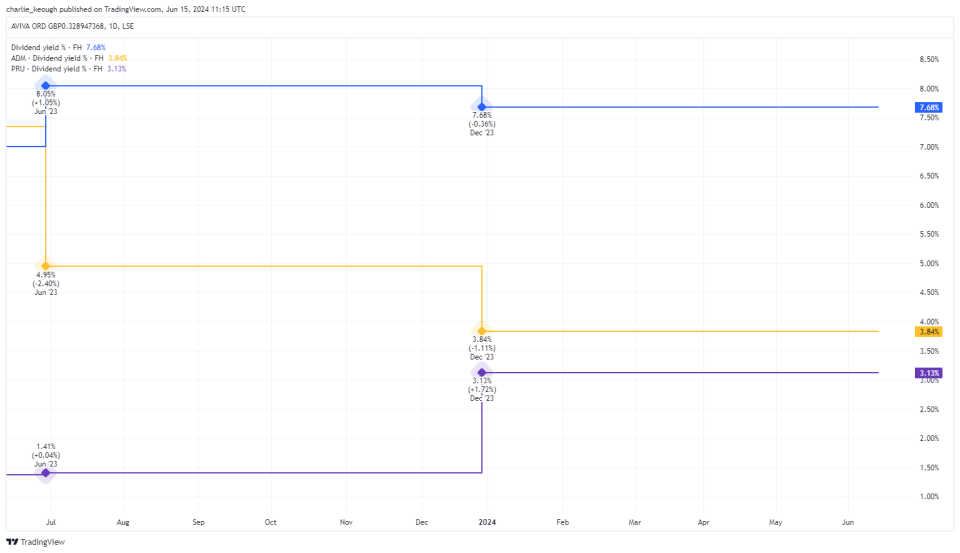

I also want to look at its dividend yield. As an investor who’s keen to continuing building a portfolio filled with high-quality stocks producing stable streams of passive income, this is important.

As the chart below shows, Aviva yields a mighty 7.7%. That’s over double the Footsie average (3.6%). It’s also considerably higher than both Admiral Group and Prudential’s payouts. Again, this signals that Aviva looks like an investment worth considering today.

Created with TradingView

A strong business

So, the stock looks appealing at its current price. But I also want to dig deeper into how the business is performing.

Overall, I’m impressed with what I see. Operating profit was up, and costs were down. The firm achieved its £750m cost reduction target a year early.

In Q1 of this year, it provided further positive news. Sales grew in its capital-light businesses. Aviva also continues with its streamlining business to focus on its core markets. Recently, it completed the exit from its Singapore joint venture for just shy of £1bn, “further simplifying the group’s geographic footprint”.

The risks

Every investment comes with risks. There are a few I see with Aviva.

For example, streamlining leaves the insurance giant relying on just a few markets. Any blips in those could see the share price stumbling.

To add to that, many are predicting the UK economy will continue to struggle for growth in the months to come, which will weigh down on the business. We’ve got a general election to deal with as well as further issues such as inflation and interest rate cuts.

Time to buy?

But all things considered, I think Aviva looks like good value today. It’s a stock I’ve been keeping a close eye on. If I have the cash this month, I plan to buy some shares and start building up my position.

The post At £4.76, is the Aviva share price a steal? Here’s what the charts say! appeared first on The Motley Fool UK.

More reading

Charlie Keough has no position in any of the shares mentioned. The Motley Fool UK has recommended Admiral Group Plc and Prudential Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance