Some Cadogan Petroleum (LON:CAD) Shareholders Are Down 41%

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Cadogan Petroleum plc (LON:CAD) shareholders for doubting their decision to hold, with the stock down 41% over a half decade. The falls have accelerated recently, with the share price down 36% in the last three months.

Check out our latest analysis for Cadogan Petroleum

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Cadogan Petroleum moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

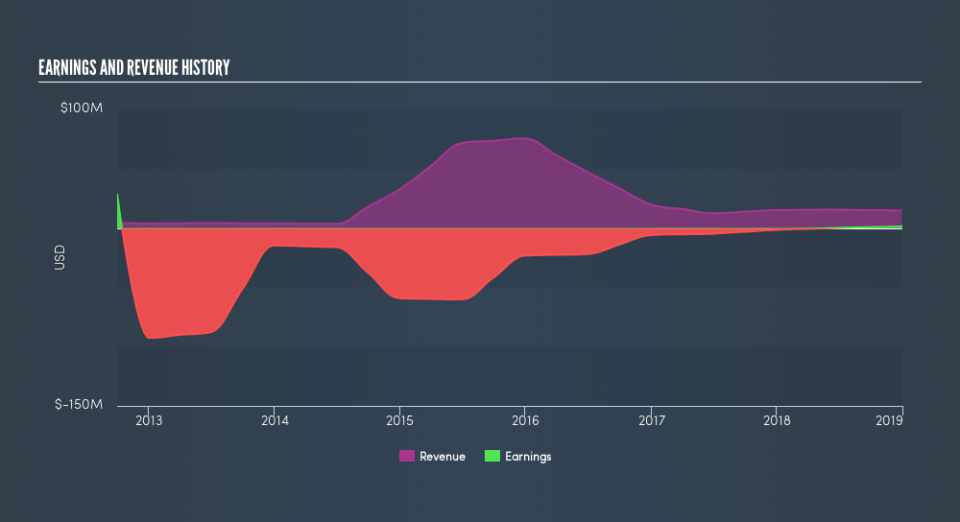

It could be that the revenue decline of 9.9% per year is viewed as evidence that Cadogan Petroleum is shrinking. This has probably encouraged some shareholders to sell down the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Cadogan Petroleum's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Cadogan Petroleum shareholders are down 17% for the year. Unfortunately, that's worse than the broader market decline of 2.4%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10.0% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Is Cadogan Petroleum cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Cadogan Petroleum may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance