California Bancorp (CALB) Reports Modest Annual Income Growth Amid Economic Challenges

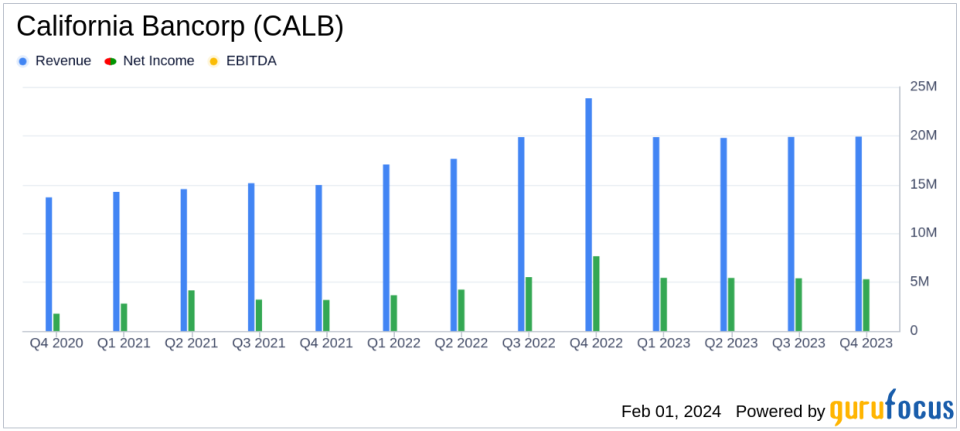

Net Income: Q4 net income slightly decreased to $5.3 million from $5.4 million in Q3 2023, and down from $7.7 million in Q4 2022.

Diluted EPS: Q4 diluted earnings per share (EPS) were $0.63, a slight decrease from $0.64 in Q3 2023 and down from $0.91 in Q4 2022.

Net Interest Income: Q4 net interest income remained stable at $18.6 million compared to Q3 2023, but decreased from $21.9 million in Q4 2022.

Annual Performance: For the twelve months ended December 31, 2023, net income increased by 2% to $21.6 million, with diluted EPS growing to $2.56 from $2.51 in 2022.

Asset Quality: Non-performing assets to total assets increased to 0.19% in Q4 2023 from 0.06% in both Q3 2023 and Q4 2022.

Capital Adequacy: Shareholders equity grew to $196.5 million, with capital ratios well above regulatory standards for "well-capitalized" institutions.

On January 30, 2024, California Bancorp (NASDAQ:CALB), the holding company for California Bank of Commerce, released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, serving business and professional corporations in the San Francisco Bay Area, reported a slight decrease in net income for the fourth quarter, while achieving a modest increase in annual net income despite a challenging economic environment.

Financial Performance and Challenges

For the fourth quarter of 2023, California Bancorp reported a net income of $5.3 million, a marginal decrease from the third quarter's $5.4 million and a more significant drop from $7.7 million in the fourth quarter of the previous year. The diluted earnings per share (EPS) followed a similar trend, with a fourth-quarter figure of $0.63, down from $0.64 in the third quarter and $0.91 in the same quarter of the previous year.

Despite these quarterly fluctuations, the company's annual performance showcased resilience, with a 2% increase in net income to $21.6 million for the twelve months ended December 31, 2023, compared to $21.1 million for the same period in 2022. The diluted EPS for the year also saw a slight increase to $2.56 from $2.51 in 2022.

Financial Achievements and Industry Significance

Steven Shelton, CEO of California Bancorp, highlighted the company's record level of earnings in 2023, emphasizing the strength of their franchise and ability to perform well under various economic conditions. The company's conservative approach to loan production and balance sheet management contributed to a return on assets remaining above 1%. The bank's strong balance sheet, high capital levels, liquidity, and reserves position it well for continued financial performance in 2024, even if macroeconomic challenges persist.

California Bancorp's net interest income for the fourth quarter was $18.6 million, consistent with the previous quarter but down from $21.9 million in the fourth quarter of 2022. The annual net interest income increased by 5% to $74.6 million, attributed to a more favorable mix of earning assets and higher yields. However, the net interest margin for the fourth quarter decreased to 3.88% from 4.32% in the same period last year, primarily due to an increase in the cost of deposits.

Non-interest income for the fourth quarter was $1.3 million, consistent with the previous quarter but down from $2.0 million in the fourth quarter of 2022. The annual non-interest income decreased to $4.9 million from $7.4 million, mainly due to a decrease in service charges, loan-related fees, and the absence of a gain recognized in the previous year from the sale of a portion of the solar loan portfolio.

Non-interest expense for the fourth quarter increased to $12.2 million from $11.9 million in the third quarter and $11.7 million in the fourth quarter of 2022. The annual non-interest expense also saw a 6% increase to $47.5 million, reflecting investment in infrastructure to support the company's growth.

The efficiency ratio, a measure of non-interest expense to revenues, worsened to 61.36% in the fourth quarter from 49.17% in the same period last year. This increase indicates higher costs relative to revenue.

Balance Sheet and Asset Quality

Total assets as of December 31, 2023, were $1.99 billion, a slight increase from the previous quarter but a 3% decrease from the previous year. Gross loans saw a 1% decrease to $1.56 billion from the previous quarter and a 2% decrease from the previous year. Total deposits decreased by 5% to $1.63 billion from the previous quarter and by 9% from the previous year.

Asset quality showed some signs of strain with non-performing assets to total assets increasing to 0.19% in the fourth quarter from 0.06% in both the previous quarter and the same quarter of the previous year. The allowance for credit losses on loans increased slightly to $16.0 million, or 1.03% of total loans, at the end of the fourth quarter.

Shareholders equity grew to $196.5 million, and the company's capital ratios remained well above the regulatory standards for "well-capitalized" institutions, indicating a strong capital position.

California Bancorp's performance in 2023 demonstrates a solid foundation and conservative management that may appeal to value investors seeking stability in the banking sector. The company's ability to navigate economic headwinds and maintain a robust balance sheet positions it for potential growth and profitability in the coming year.

Explore the complete 8-K earnings release (here) from California Bancorp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance