Camping World (NYSE:CWH): Strongest Q1 Results from the Vehicle Retailer Group

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the vehicle retailer industry, including Camping World (NYSE:CWH) and its peers.

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

The 4 vehicle retailer stocks we track reported a slower Q1; on average, revenues missed analyst consensus estimates by 1.1%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and while some of the vehicle retailer stocks have fared somewhat better than others, they collectively declined, with share prices falling 3.8% on average since the previous earnings results.

Best Q1: Camping World (NYSE:CWH)

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

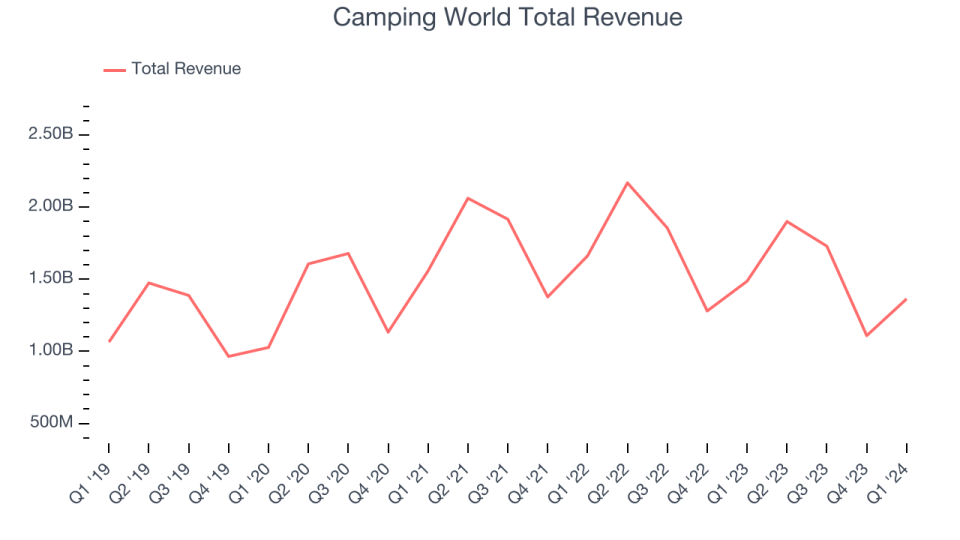

Camping World reported revenues of $1.36 billion, down 8.3% year on year, falling short of analysts' expectations by 4.4%. It was a strong quarter for the company: While same store sales were down meaningfully and have been down for multiple quarters, this quarter's figure beat expectations. Adjusted EBITDA also exceeded expectations.

Marcus Lemonis, Chairman and Chief Executive Officer of Camping World Holdings, Inc. stated, “Our intentional efforts to drive down invoice pricing and widen the consumer affordability funnel resulted in our new unit sales meaningfully outpacing broader RV industry trends. We drove record new unit market share for January and February. Our same store new vehicle unit volume increased double-digits in the quarter, with momentum continuing through April.”

Camping World delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 11.2% since the results and currently trades at $17.81.

Is now the time to buy Camping World? Access our full analysis of the earnings results here, it's free.

CarMax (NYSE:KMX)

Known for its transparent, customer-centric approach and wide selection of vehicles, Carmax (NYSE:KMX) is the largest automotive retailer in the United States.

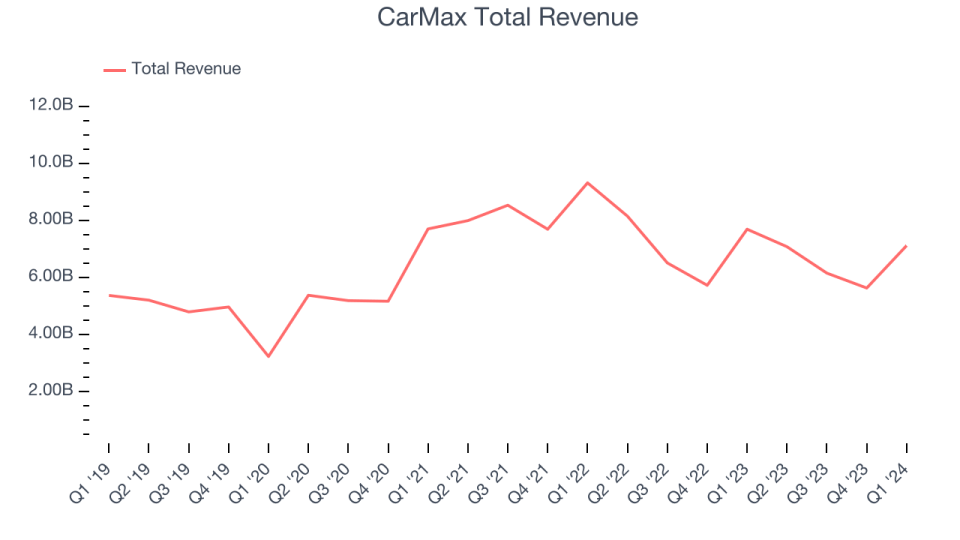

CarMax reported revenues of $7.11 billion, down 7.5% year on year, falling short of analysts' expectations by 0.8%. It was a decent quarter for the company, with a solid beat of analysts' gross margin estimates.

The stock is up 3% since the results and currently trades at $73.5.

Is now the time to buy CarMax? Access our full analysis of the earnings results here, it's free.

Weakest Q1: America's Car-Mart (NASDAQ:CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

America's Car-Mart reported revenues of $364.7 million, down 5.8% year on year, in line with analysts' expectations. It was a weak quarter for the company, with a miss of analysts' gross margin and earnings estimates.

America's Car-Mart pulled off the biggest analyst estimates beat in the group. The stock is down 2% since the results and currently trades at $60.25.

Read our full analysis of America's Car-Mart's results here.

Lithia (NYSE:LAD)

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

Lithia reported revenues of $8.56 billion, up 22.7% year on year, falling short of analysts' expectations by 0.1%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Lithia delivered the fastest revenue growth among its peers. The stock is down 5% since the results and currently trades at $251.26.

Read our full, actionable report on Lithia here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance