Canada Finds It’s Cheaper to Ship Oil Via Stop in California

(Bloomberg) -- Canada’s newest oil pipeline has turbo-charged exports of the country’s heavy crude to Asia and a diversion through California is making for a longer but potentially cheaper journey.

Most Read from Bloomberg

SpaceX Tender Offer Said to Value Company at Record $210 Billion

Supreme Court Ends OxyContin Settlement, Cracking Sackler Shield

China’s Finance Elite Face $400,000 Pay Cap, Bonus Clawbacks

Bolivia’s President Arce Swears in New Army Chief After Coup Bid

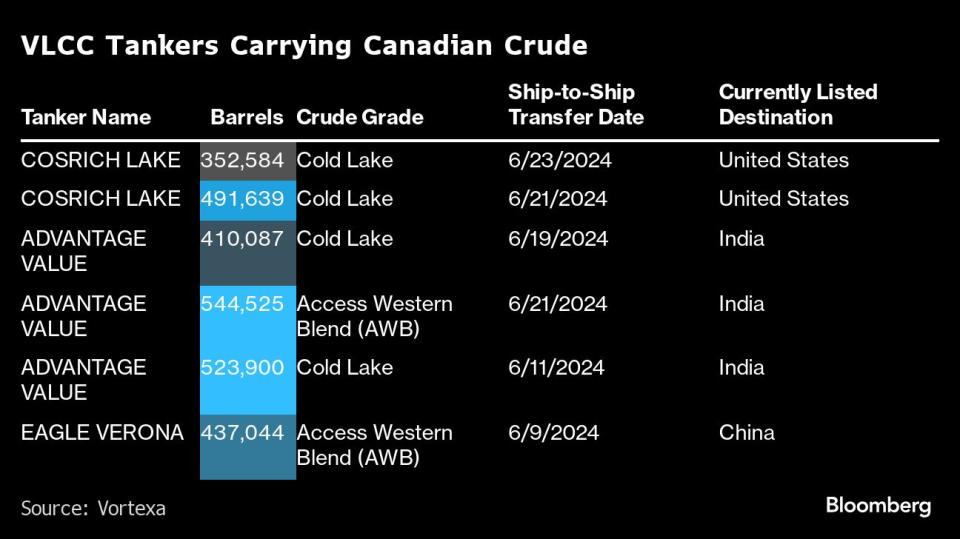

Close to 3 million barrels have been shipped off Vancouver for China or India since the expanded Trans Mountain pipeline began operating in May, almost tripling the capacity of the sole system linking Alberta to a Canadian port. More than 55% of those volumes have first journeyed south to Southern California where the crude was transfered onto very large crude carriers, or VLCCs, according to Vortexa ship tracking data.

The transfers have offset one of the key disadvantages of exporting Canadian crude off the West Coast versus the US Gulf: the port of Vancouver can only accommodate Aframax-size tankers or smaller, which hold less than half of what VLCCs hold. As such, shipping directly from Western Canada to distant markets would typically cost close to twice as much per barrel per day than on VLCCs, according to a ship broker familiar with rates who asked for anonymity because he is not authorized to discuss the information. However, the diversion to California has lengthened the time of the journey to Asia, reducing a key advantage of exporting Canadian crude off the West Coast versus the US Gulf.

The practice is expected to become more common as Aframax tankers are redeployed for making shorter voyages, the broker said. Other’s aren’t as sure.

“Sending an Aframax directly to China is costly, but so are multiple reverse lighterings onto a VLCC off California,” Matt Smith, head analyst at Kpler, said by email. “It seems more likely that direct Aframaxes to Asia will win out because China will take more of the volume.” Using VLCCs for shipments to India is more probable, but India has become increasingly reliant on Russian crude, reducing imports of Canadian oil from the US Gulf.

Another advantage of transferring the oil onto VLCCs is that shippers can simultaneously send other grades of crude from other regions of Americas. For example, the Eagle Varona, which left for China earlier this month, is carrying two Canadian crude grades, Cold Lake and Access Western Blend, plus Castilla crude from Colombia, according to Vortexa.

A record 7 million barrels-plus of oil, mostly Cold Lake, have been shipped off Vancouver this month, the first full month of operations for the 890,000 barrel-a-day Trans Mountain system. The US West Coast, particularly Los Angeles, has been the biggest recipient so far in June with 3.9 million barrels, followed by China, India and Ecuador, according to Vortexa data.

(Adds analyst comment in fifth paragraph.)

Most Read from Bloomberg Businessweek

The FBI’s Star Cooperator May Have Been Running New Scams All Along

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance