Canada’s Stock Rally Is the Opposite of Tech-Driven Surge in US

(Bloomberg) -- Canadian stocks are enjoying a broad-based rally this year — the exact opposite of equities in the US, which have been carried by just a handful of names.

Most Read from Bloomberg

Biden Vows to Stay in 2024 Race Even as NATO Gaffes Risk His Campaign

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

US and Germany Foiled Russian Plot to Kill CEO of Arms Manufacturer Rheinmetall

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

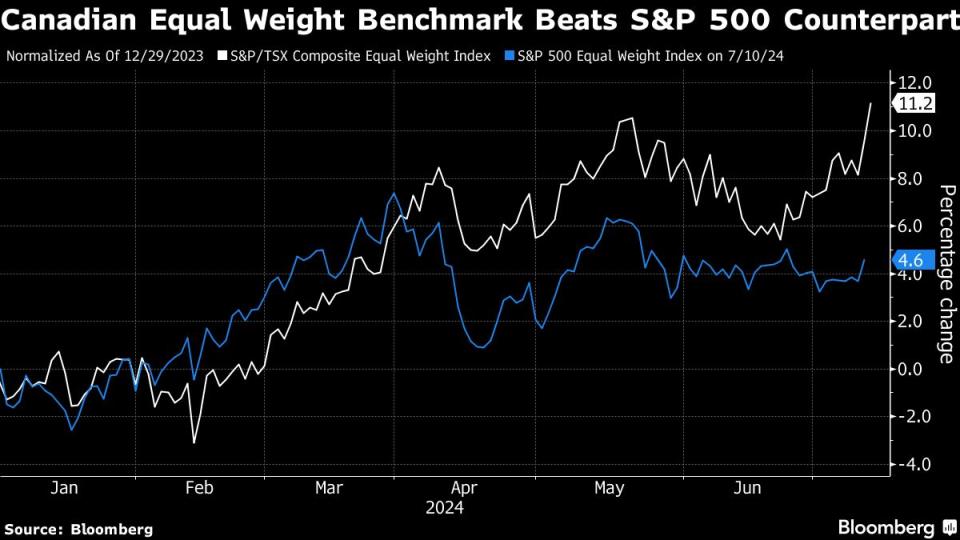

For every stock that has fallen on the benchmark in Toronto, two have advanced year-to-date, revealing a strong foundation beneath a rally in the S&P/TSX Composite Index. A version of the index that strips out market-cap bias has jumped 11% this year, outperforming its cap-weighted peer at home and the equal weight S&P 500 Index in the US.

“In Canada, you have had more opportunity within every sector to find names that have worked,” Mike Archibald, AGF Investments vice-president and portfolio manager, said.

In contrast, Archibald said the S&P 500 currently has become so dependent on a few stocks that it exhibits “the highest weighting for the top 10 that we’ve ever seen.”

Concentration risk in the S&P 500 was evident on Thursday, when weakness in a handful of high-flying technology stocks pushed the entire S&P 500 down by as much as 1%.

“Breadth can stay thin for a while, but it also means that the market could be more sensitive to any sort of negative news and some sort of shock to the system,” Globe Invest Capital Management CEO and managing director Christine Poole said. “You’ve got a handful of stocks, maybe even one stock, leading the charge.”

The largest firms based on market value have actually held back the equity markets in Canada. Firms including Shopify Inc., Toronto-Dominion Bank and Bank of Montreal have acted like boat anchors on the Toronto market-weight index. The country’s Big 3 telecommunications stocks — BCE Inc., Rogers Communications Inc. and Telus Corp. – have also been a major drag.

To be sure, the S&P 500 has outperformed the S&P/TSX Composite this year — both the equal-weight and the cap-weighted versions. And investors who have been underweight the US have likely underperformed, as the artificial-intelligence investing craze has pushed Nvidia and other big tech stocks higher.

On the other hand, strategists see more upside in the Canadian benchmark, with 12% gains expected versus 6.5% for the S&P 500 over the next 12 months, according to data compiled by Bloomberg.

“Relative to the S&P 500, the TSX is trading at a significant discount. It does have a fairly wide valuation gap relative to where it normally sits,” Philip Petursson, IGM Financial chief investment strategist, said. “You could see some catch-up.”

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance