Capcom Sees Its Sales in India Passing Those in China in Decade

(Bloomberg) -- Sign up for the India Edition newsletter by Menaka Doshi – an insider's guide to the emerging economic powerhouse, and the billionaires and businesses behind its rise, delivered weekly.

Most Read from Bloomberg

Pakistan Rupee Set to Become Top Performing Currency Globally

Biden Impeachment Hearing Heavy on Politics, Light on Substance

Top Chinese Scientist Claims India Moon Landing Nowhere Near South Pole

Videogame studio Capcom Co. may sell more copies of games in India than in China within a decade as the publisher behind the Resident Evil franchise looks to new markets for long-term growth, according to Chief Operating Officer Haruhiro Tsujimoto.

Key to the Osaka-based company’s strategy are securing local tie-ups to lift the profile and sales of its PC games in emerging markets and expanding its offerings of console-quality titles to smartphones, the 58-year-old executive said in an interview. India is a focus area, he said.

“The market in India will grow exponentially in 5 to 10 years, as college students who enjoy games grow older and the economy develops,” Tsujimoto said. “India’s population has already surpassed China’s. Taking that into consideration, we can expect to do better there than in China.”

Capcom shares rose as much as 5.6% on Monday, the most since July.

The studio, which houses hit franchises such as Street Fighter and Monster Hunter, is seeking partnerships to market its titles in India and Southeast Asia. Local device makers and influencers may help Capcom expand further in high-margin digital downloads, which now earn 90% of total unit-based videogame sales at the company, Tsujimoto said.

Capcom’s presence in India is still tiny, at little more than 100,000 video game copies a year, in part due to its low profile in mobile games and limited sales efforts. Smartphones are the main device by which many young Indians access the Internet, making a wide-ranging portfolio of mobile games essential for Capcom to expand in the country.

The Japanese company targets annual sales in India of as many as two million copies within the next decade to match or even surpass its operations in China, the executive said. India’s overall video games market is seen reaching $1.6 billion in 2027, almost double expected sales in 2023, according to Asia-focused gaming research firm Niko Partners.

The company’s weak presence in free-to-play games is widely seen as a handicap, as mobile games comprise about half of the global video game market according to Newzoo data. But instead of creating such games on its own, Capcom plans to license content to others. This year, it enlisted Pokémon Go creator Niantic Inc. to develop the mobile game Monster Hunter Now, released earlier this month.

Traditional free-to-play smartphone games are “not a good fit with Capcom’s brand,” Tsujimoto said. Instead, the studio will focus on releasing console titles for download on smart devices, he said. Capcom said earlier this month it will release Resident Evil games playable for Apple Inc.’s iPhones and iPads.

“High-quality games should become more playable on a wider range of smartphones in the next few years, and that will give us an opportunity to reach gamers who don’t have consoles and PCs,” Tsujimoto said.

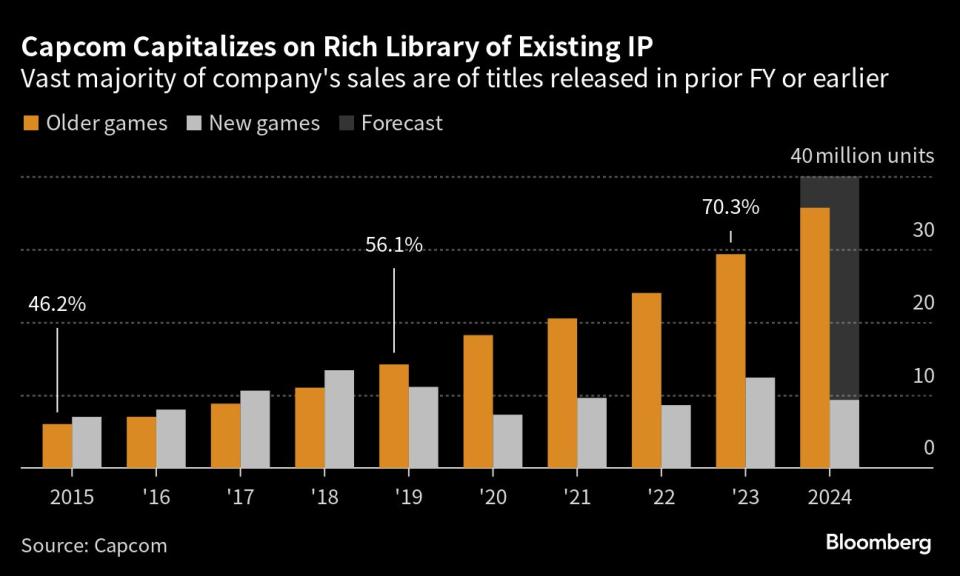

Capcom targets selling more than 100 million copies of games a year, with the majority to come from games released in past fiscal years. And while games makers traditionally waited for console makers and other platform operators to forge new markets, Tsujimoto said it’s up to Capcom to create its own demand.

“Finding and cultivating new markets is our own responsibility, and we will keep doing so aggressively,” he said.

--With assistance from Abhishek Vishnoi.

(Updates with stock reaction in fourth paragraph)

Most Read from Bloomberg Businessweek

A $12 Million Request to Cover a Crypto Scam Sank a Bank CEO

Feeding the World Once Brought the US Untold Influence—No More

Rugby Has a Plan to Get Americans Excited About the Other World Cup

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance