Carl Icahn's Strategic Acquisition in Icahn Enterprises LP

On June 25, 2024, a notable transaction in the financial markets unfolded as Carl Icahn (Trades, Portfolio), through Icahn Capital Management, augmented their holdings in Icahn Enterprises LP (NASDAQ:IEP) by purchasing an additional 20,418,007 shares. This acquisition, priced at $15.85 per share, significantly bolstered the firm's stake in IEP, bringing the total shares held to 406,313,986. This move not only increased the firm's position in IEP by 5.29% but also had a substantial impact on their portfolio, with a 2.64% trade impact.

Investor Profile: Carl Icahn (Trades, Portfolio)

Carl Icahn (Trades, Portfolio), an activist investor renowned for his aggressive investment strategies, focuses on buying undervalued assets, enhancing their value, and realizing a profit upon their recovery. Icahn operates through multiple investment vehicles, including Icahn Partners and Icahn Management LP. His investment philosophy centers on contrarian bets, often engaging with management to implement changes that unlock shareholder value. The firm's approach has consistently been geared towards sectors that are out of favor, underpinning a strategy of turnaround investment.

Details of the Recent Trade

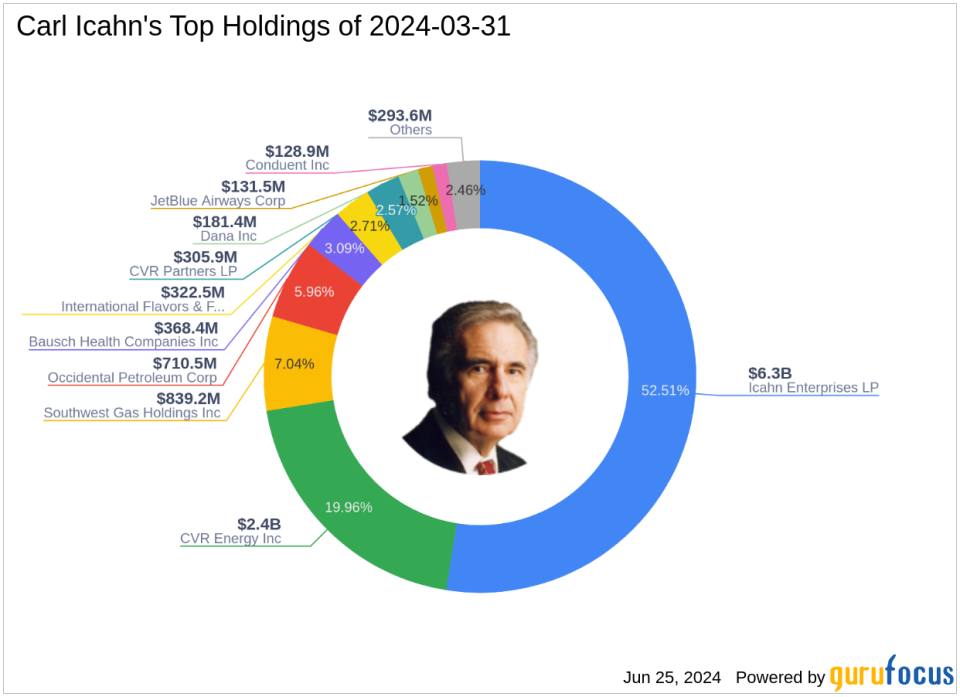

The recent acquisition of IEP shares by Carl Icahn (Trades, Portfolio) underscores a strategic enhancement of the firm's portfolio, where IEP now constitutes 52.61% of the total holdings, with a significant 86.15% stake in the company itself. This transaction aligns with Icahn's historical pattern of deepening investments in core holdings, particularly in sectors like Energy and Utilities, which dominate the firm's investment focus.

Company Overview: Icahn Enterprises LP

Icahn Enterprises LP operates across diverse sectors including Automotive, Energy, and Real Estate, among others, with the Energy segment being the most significant revenue contributor. Founded in 1987 and headquartered in the USA, IEP has been pivotal in various industrial domains, reflecting a complex but strategically diversified business model.

Financial and Market Analysis of IEP

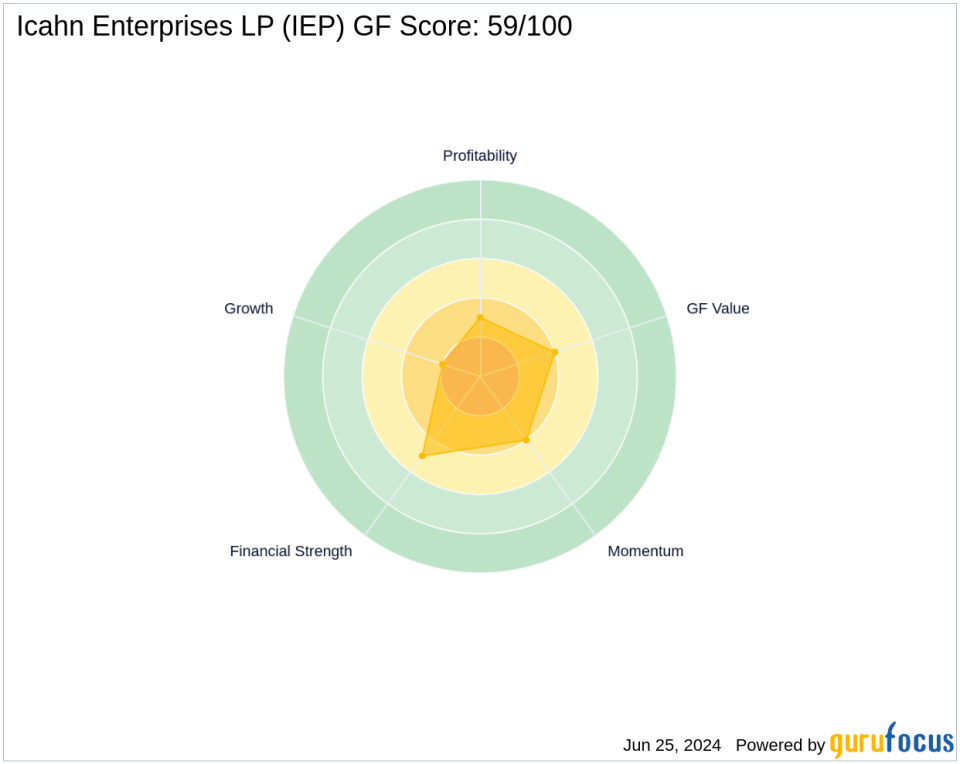

Despite a challenging market environment, IEP's current stock price stands at $15.85, closely aligned with the GF Value of $30.32, suggesting a potential undervaluation. However, the GF Score of 59 indicates a cautious outlook on the stock's future performance potential. The financial health of IEP, characterized by a Balance Sheet Rank of 5/10 and a Profitability Rank of 3/10, suggests moderate stability but underwhelming profitability metrics.

Industry and Sector Dynamics

The Energy and Utilities sectors, where IEP is heavily invested, are currently experiencing significant transformations. Challenges such as regulatory changes and fluctuating commodity prices are reshaping the landscape, influencing IEP's strategic positioning and operational focus within these industries.

Comparative and Competitive Landscape

Within the Oil & Gas industry, IEP's strategic initiatives and diversified business model position it uniquely against competitors. The firm's robust involvement in multiple segments provides a hedge against sector-specific downturns, aligning with Carl Icahn (Trades, Portfolio)'s philosophy of investing in undervalued and out-of-favor sectors.

Conclusion

The recent acquisition by Carl Icahn (Trades, Portfolio) of additional shares in Icahn Enterprises LP is a strategic move that reinforces the firm's commitment to its core investment thesis. This transaction not only strengthens Icahn's influence within IEP but also reflects a calculated bet on the company's turnaround and growth prospects amidst a challenging industry backdrop. Investors and market watchers will undoubtedly keep a close eye on IEP's performance, as these developments unfold.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance