The Case Against HIAG Immobilien Holding And One Top-Tier Alternative

Investors often turn to dividend stocks for a reliable source of income. In the Swiss market, dividends on average increased by 5.5% last year, presenting opportunities for steady financial gains. However, it's vital to identify companies that not only offer dividends but can also sustain or grow these payouts over time. HIAG Immobilien Holding presents a cautionary tale with its declining dividend trend, highlighting the importance of careful stock selection in this sector.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.55% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.18% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.46% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.37% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.35% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.84% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.09% | ★★★★★☆ |

Holcim (SWX:HOLN) | 3.50% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.75% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.11% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Underneath we present one of the stocks filtered out by our screen and one to consider sidestepping.

Top Pick

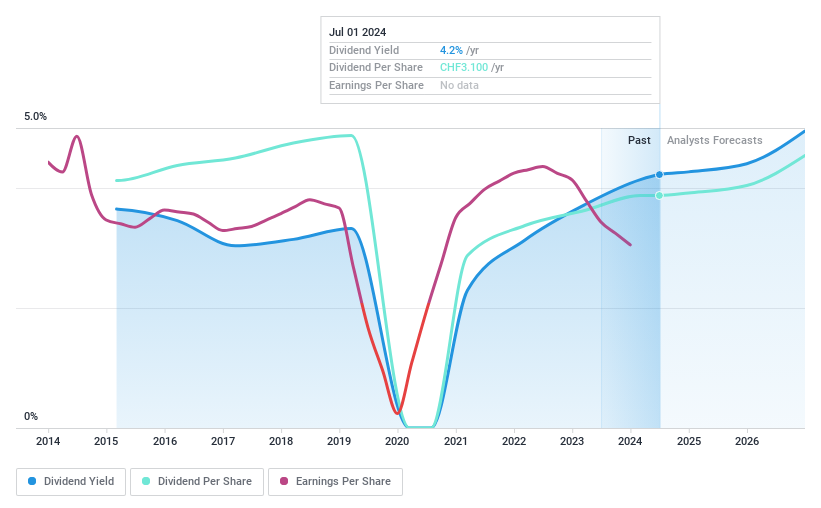

Compagnie Financière Tradition

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA is a global interdealer broker dealing in financial and non-financial products, with a market capitalization of approximately CHF 1.10 billion.

Operations: The revenue segments for the company are distributed across the Americas (CHF 350.89 million), Asia-Pacific (CHF 271.44 million), and Europe, Middle East, and Africa (CHF 431.78 million).

Dividend Yield: 4.2%

Compagnie Financière Tradition reported a solid financial performance in 2023 with revenues rising to CHF 983.3 million and net income increasing to CHF 94.42 million. Its dividend yield stands at 4.2%, slightly below the top Swiss dividend payers, but its dividends are well-supported by a payout ratio of 47.2% and cash payout ratio of 40.8%. Unlike some peers experiencing declining dividends, CFT has consistently grown its dividends over the past decade, demonstrating reliability in its distributions despite a volatile share price recently.

One To Reconsider

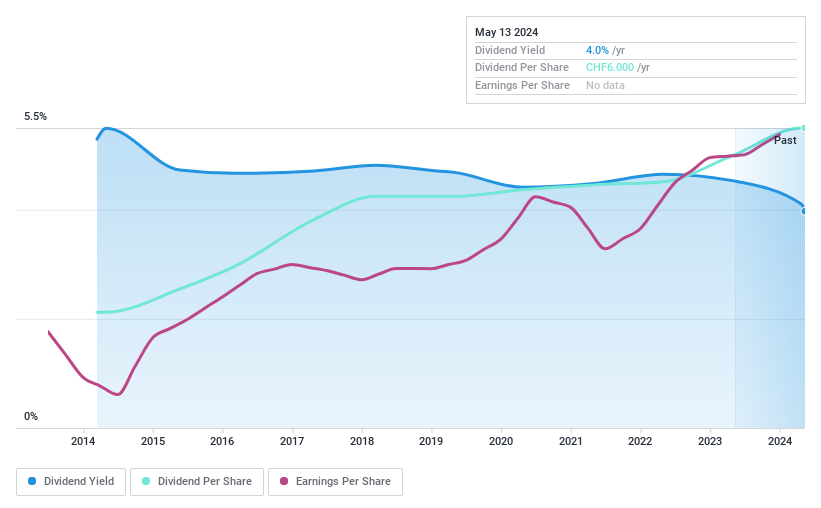

HIAG Immobilien Holding

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: HIAG Immobilien Holding AG specializes in site and project development services across Switzerland, with a market capitalization of approximately CHF 741.95 million.

Operations: HIAG Immobilien Holding AG generates revenue primarily through its Yielding Portfolio (CHF 59.49 million), Development Portfolio (CHF 53.19 million), and Transaction services (CHF 16.71 million).

Dividend Yield: 4.2%

HIAG Immobilien Holding's dividend profile is less appealing due to its unstable and declining payments over the past 9 years, with a current yield of 4.22% that narrowly trails the top Swiss dividend payers. Despite a lower P/E ratio of 15.8x, its dividends are not adequately covered by earnings or cash flows, evidenced by a high cash payout ratio of 199.7%. Additionally, while profit margins have decreased to 34.7%, debt levels remain uncomfortably high relative to operating cash flow.

Next Steps

Discover the full array of 26 Top Dividend Stocks right here.

Already own some of these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:CFTSWX:HIAG and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance