Catch These 5 Big Fishes at Next Dips for Long-Term Gains

Wall Street is set to close a successful first half of 2024 after an impressive 2023. Aside from large-cap stocks, mid caps have also performed well year to date. Though the rally is primarily driven by generative artificial intelligence (AI), several old-economy stocks have also flourished.

The bull run is expected to continue in the second half supported by a resilient U.S. economy, a declining inflation rate, solid earnings results, and Fed’s indication of at least one rate cut of 25 basis points this year and a full 1% cut in the benchmark interest rate in 2025.

Meanwhile, several stocks with strong exposure to AI, have skyrocketed year to date. These stocks have helped the broad-market index — the S&P 500 — to post 31 all-time highs this year and the tech-heavy Nasdaq Composite to surge nearly 18.5% after jumping 43.4% in 2023. Both indexes are currently trading near their all-time highs.

A section of market participants is now skeptical about the continuity of the AI frenzy and the price momentum of these high-flying stocks. I believe a lot more is yet to come for these tech heavyweights and every dip in these stocks will be a good entry point for long-term gains.

After last year’s tremendous performance, many financial experts started claiming that U.S. markets are overvalued. Concerns regarding the overvaluation of stocks, especially technology stocks, have stuck around since the beginning of this year.

On Jan 5, I wrote that buying on the dip would be the best strategy this year. (Read: Best Investment Strategy for 2024: Buy on the Dip). In the first half, this strategy has proven right. Every dip in stocks, especially in tech giants, has resulted in more aggressive returns in a short span. This trend is likely to last in the second half, too.

Top Picks

Here, I have selected five U.S. behemoths with robust upside left for the long term. Every dip in their stock prices should call for a prudent buy to maximize long-term returns.

The chart below shows the price performance of five picks year to date.

Image Source: Zacks Investment Research

NVIDIA Corp. NVDA is expected to benefit in two ways. Demand for its Hopper chips remains strong owing to the significant adoption of generative AI and an industry-wide shift from central processors to NVDA-made accelerators. On the other hand, demand is likely to outpace supply, resulting in price hikes for NVIDIA chips.

This undisputed global leader in the generative AI chipset developer space is aggressively differentiating its products. On May 22, CEO Jensen Huang said that the company’s next-generation AI chip, Blackwell Ultra, would be the next driver. These chips will be available in data centers in the fourth quarter of fiscal 2025.

On Jun 2, NVDA unveiled its new AI chip architecture called “Rubin.” The Rubin architecture will have new GPUs to launch AI systems, CPUs and networking chips. Rubin is set to be introduced in 2026. NVIDIA will introduce an Ultra version of Rubin in 2027.

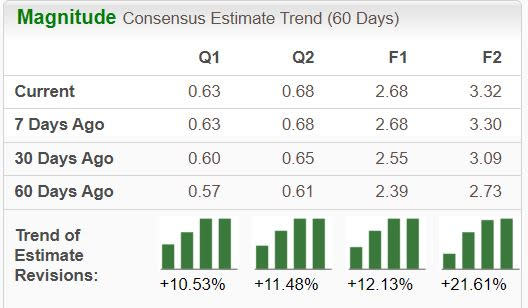

NVDA has an expected revenue and earnings growth rate of 92.6% and more than 100%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 10.7% over the last 30 days.

Image Source: Zacks Investment Research

The company currently has a long-term (3-5 years) earnings growth rate of 37.6%. It recorded positive earnings surprises in the last four reported quarters, with an average beat of 18.4%.

The stock price has soared more than 138.5% year to date. Despite this, the average price target of brokerage firms represents an increase of 2.7% from the last closing price of $118.11. The brokerage target price is currently in the range of $69-$200. Thus, every dip has a strong upside potential. Finally, NVIDIA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Micron Technology Inc. MU has been benefiting from the enormous growth of AI applications that boosted demand for its high bandwidth memory chips. MU is a major producer of memory chips used in NVIDIA’s GPUs. MU is benefiting from improved market conditions, robust sales executions and strong growth across multiple business units.

Micron Technology anticipates the pricing of DRAM and NAND chips to increase, thereby improving its revenues. The pricing benefits will primarily be driven by rising AI servers, causing a scarcity in the availability of cutting-edge DRAM and NAND supply. Also, 5G adoption in IoT devices and wireless infrastructure will spur demand for memory and storage.

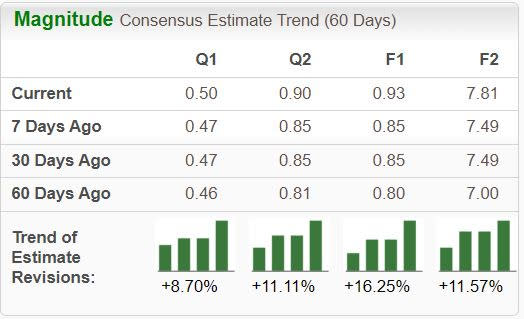

Micron Technology has an expected revenue and earnings growth rate of 58.9% and more than 100%, respectively, for the current year (ending August 2024). The Zacks Consensus Estimate for current-year earnings has improved 9.4% over the last seven days. It recorded positive earnings surprises in the last four reported quarters, with an average beat of 69.6%.

Image Source: Zacks Investment Research

The stock price of Micron Technology has climbed 62.9% year to date. Notwithstanding this, the average price target of brokerage firms represents an increase of 7.3% from the last closing price of $139.01. The brokerage target price is currently in the range of $100 -$225. The stock carries a Zacks Rank #2 (Buy) at present.

Super Micro Computer Inc. SMCI has benefited on the back of robust demand for severs powered by high-end generative AI chipsets. SMCI designs, develops, manufactures, and sells energy-efficient, application-optimized server solutions based on the x86 architecture.

An astonishing rise in demand for high-performance rack servers boosted SMCI’s top and bottom lines. The company makes servers using NVIDIA processors. Super Micro Computer is positioned as a leading provider of one-stop-shop, high-performance rack servers capable of powering advanced AI applications.

SMCI’s solutions include a range of rack mount and blade server systems, as well as components. SMCI’s Server Building Block Solutions provide benefits across many environments, including data center deployment, high-performance computing, high-end workstations, storage networks and standalone server installations.

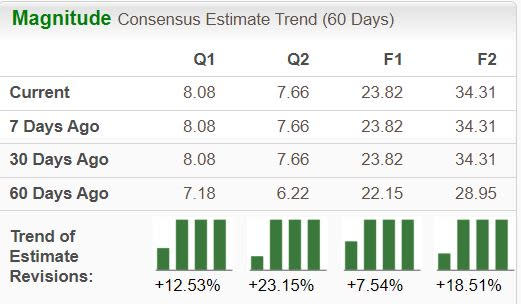

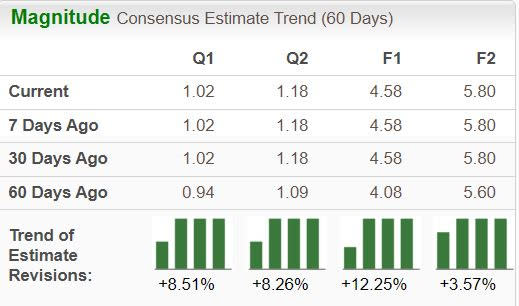

SMCI has an expected revenue and earnings growth rate of 60.1% and 44.1%, respectively, for next year (ending June 2025). The Zacks Consensus Estimate for next-year earnings has improved 18.5% over the last 60 days.

Image Source: Zacks Investment Research

The company currently has a long-term earnings growth rate of 52.4%. It recorded positive earnings surprises in the last four reported quarters, with an average beat of 7%.

The stock price has skyrocketed 191% year to date. Yet, the average price target of brokerage firms represents an increase of 8.3% from the last closing price of $826.98. The brokerage target price is currently in the range of $285-$1,500. Super Micro Computer currently carries a Zacks Rank #3 (Hold). However, analyzing the above positives, this stock is a potential candidate to enter a Zacks Buy Rank (Rank #1 or 2).

Dell Technologies Inc. DELL has expanded its AI offerings in partnership with NVIDIA with "new server, edge, workstation, solutions and services advancements." On May 20, DELL announced the new Dell PowerEdge XE9680L server, which "offers direct liquid cooling and eight NVIDIA Blackwell Tensor Core GPUs for fast processing in a compact form factor."

DELL is benefiting from strong demand for AI servers driven by the ongoing digital transformation and heightened interest in generative AI applications. DELL’s PowerEdge XE9680 AI-optimized server is in demand. Strong enterprise demand for AI-optimized servers is aiding DELL.

Dell Technologies has an expected revenue and earnings growth rate of 9.4% and 9.7%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.6% over the last 30 days.

Image Source: Zacks Investment Research

The company currently has a long-term earnings growth rate of 11.8%. It recorded positive earnings surprises in the last four reported quarters, with an average beat of 27.7%.

The stock price of this Zacks Rank #1 company has jumped 79.9% year to date. Despite this, the average price target of brokerage firms represents an increase of 10% from the last closing price of $137.56. The brokerage target price is currently in the range of $97-$186.

Amazon.com Inc. AMZN is gaining on solid Prime momentum owing to ultrafast delivery services and a strong content portfolio. A deepening focus on generative AI is a major plus. Strengthening relationships with third-party sellers is a positive for AMZN.

The strong adoption rate of AWS is aiding AMZN’s cloud dominance. Improving Alexa skills along with robust smart home offerings are tailwinds. The advertising business is also pretty robust. AMZN enjoys a strong global presence and solid momentum among small and medium businesses. Growing capabilities in grocery, pharmacy, healthcare and autonomous driving are its other positives.

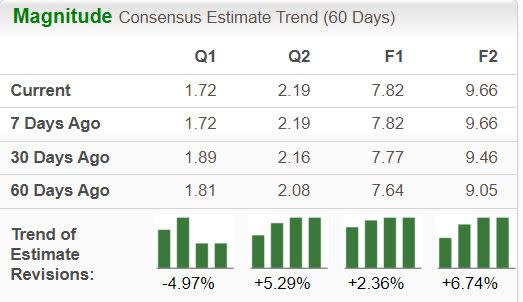

Amazon.com has an expected revenue and earnings growth rate of 11% and 57.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 12.3% over the last 60 days.

Image Source: Zacks Investment Research

The company currently has a long-term earnings growth rate of 29.6%. It recorded positive earnings surprises in the last four reported quarters, with an average beat of 48.2%.

The stock price of Amazon.com has surged 22.2% year to date. The average price target of brokerage firms represents an increase of 16.9% from the last closing price of $185.57. The brokerage target price is currently in the range of $140-$246. The stock presently carries a Zacks Rank #3. However, analyzing the above positives, this stock is a potential candidate to enter a Zacks Buy Rank (Rank #1 or 2).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance