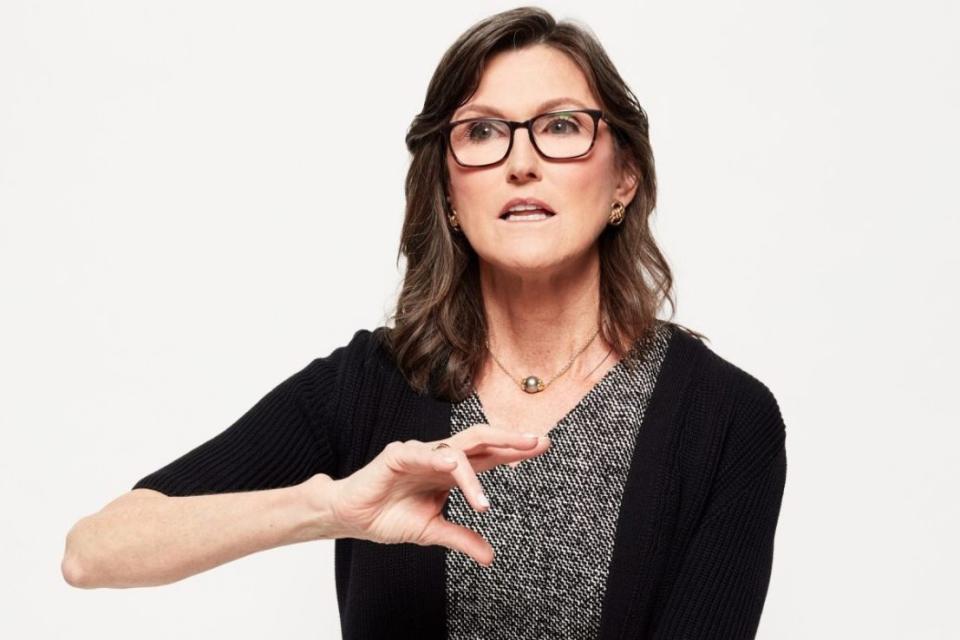

Cathie Wood on losing $14bn, Trump and where the UK has an edge over the US

Cathie Wood has an answer to those who accuse her of losing billions of her investors’ money through her flagship ARK fund: “We can’t tell them not to buy it, and we can’t fire our clients”.

In February, data analytics firm Morningstar calculated that exchange traded funds (ETFs) managed by ARK Invest, headed by Wood, have wiped out a total of $14.3bn in shareholder value over the last 10 years.

Ark’s flagship fund, the ARK Innovation ETF, accounted for most of those losses.

The group’s flagship fund attracted massive attention in 2020 after more than doubling during the year, before dropping 26 per cent and 67 per cent in 2021 and 2022.

Speaking to City A.M., Wood described the research as “very disingenuous and very unsophisticated,” arguing that the compound annual rate of return for ARK’s flagship fund has remained above 10 per cent since its beginning.

She blamed the poor performance across 2021 and 2022 on the recent volatile economy and higher for longer interest rates, which saw tech stocks crash across the board.

“Can we fire our clients? Which is what they seem to be suggesting,” said Wood. She added: “We can’t tell people not to buy; we’re an ETF”.

She said investors should consider the risk of the ARK fund before investing, as “we run a strategy that is clearly volatile and very focused.”

She added that the fund had to pass “very sophisticated screens” to be listed on the investment platforms of companies like Morgan Stanley or UBS.

Cathie Wood on Donald Trump

Looking ahead, Wood said she had “no idea” who would win the 2024 election but argued that both parties had serious pitfalls when encouraging innovation.

The CEO also echoed former president Donald Trump’s comments on his appeal to black voters, which have been condemned as racist by black civil rights groups.

“Trump’s on trial and his poll numbers have been going up and one of the reasons why is ethnic minorities,” she claimed.

“And I think the reason is they are put on trial and in jail, no questions asked, and they actually see this guy going through the same process.”

“Donald Trump is delusional to think that his criminality would be an attractive quality to Black voters,” said Derrick Johnson, NAACP president, when Trump made similar comments in February.

“He has taken advantage of an inherently racist system, while Black Americans have been abused by it. We are not the same.”

Cathie Wood on the UK beating out the US on tech

Last week, ARK Invest launched its first products in Europe, including its ARK Innovation ETF, and a new Artificial Intelligence & Robotics ETF, built specifically for the European market.

While the UK does not have “a big venture capital community here” compared to the US, Wood said that as the cost of technology continues to fall, this should allow innovation to flourish.

“In the US, especially in the last few years, regulations are impeding technology,” said Wood, stating that she had seen entrepreneurs leaving the US in a wave of “regulatory arbitrage”.

She pointed to digital assets as a key area where the US Securities and Exchange Commission had made innovation “impossible”, leaving the UK as a possible destination for new products.

“The UK has one financial regulator, and we have six, and they’re all vying for power,” she said.

Yahoo Finance

Yahoo Finance