CCCC Design & Consulting Group And Two More Top Dividend Stocks In China

As global markets show varied trends, China's market faces challenges with declining home prices and mixed economic signals, influencing investor sentiment. In such an environment, dividend stocks like CCCC Design & Consulting Group can offer investors potential stability and regular income streams, aligning well with the cautious optimism seen in broader financial strategies.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.47% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.69% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.73% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.59% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.19% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.65% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.72% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.19% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.45% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.62% | ★★★★★★ |

Click here to see the full list of 227 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

CCCC Design & Consulting Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CCCC Design & Consulting Group Co., Ltd., operating in China, focuses on the research, development, manufacturing, and sale of cement and commercial concrete with a market capitalization of CN¥19.05 billion.

Operations: CCCC Design & Consulting Group Co., Ltd. generates CN¥12.90 billion from the production and sale of cement products and commercial concrete.

Dividend Yield: 4%

CCCC Design & Consulting Group Co., Ltd. offers a dividend yield of 3.98%, ranking in the top 25% in the Chinese market, yet its sustainability is questionable as dividends are not well covered by earnings or cash flows, indicating potential volatility as observed over the past decade. Despite this, the company's Price-To-Earnings ratio stands at an attractive 10.6x compared to the broader market's 29.5x, suggesting relative undervaluation. Recent financials show a dip in revenue from CNY 2.75 billion to CNY 2.14 billion year-over-year for Q1 2024, although net income rose to CNY 91.99 million from CNY 64.61 million in the same period last year.

Bank of Beijing

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Beijing Co., Ltd. offers a range of banking services to individual and corporate clients in China, with a market capitalization of approximately CN¥119.25 billion.

Operations: Bank of Beijing Co., Ltd. generates its revenue primarily through various banking services catered to both personal and corporate clients across China.

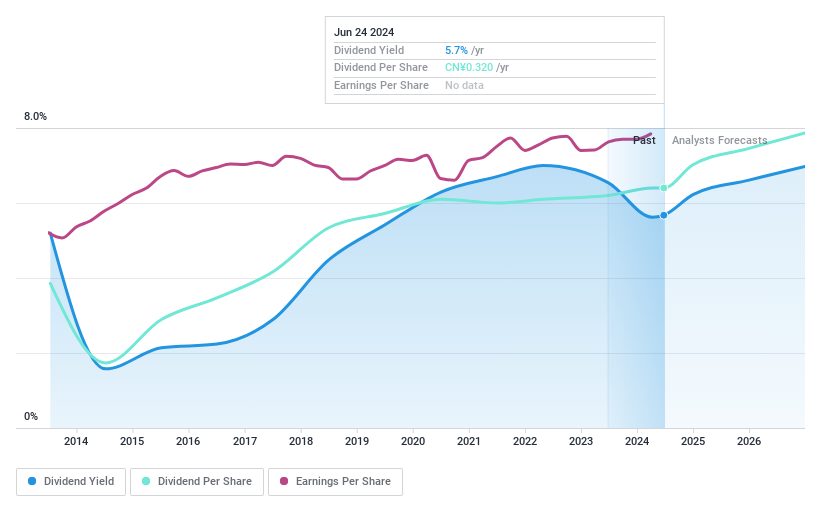

Dividend Yield: 5.7%

Bank of Beijing Co., Ltd. presents a mixed scenario for dividend investors, offering a competitive yield of 5.67%, which places it in the top quartile of Chinese dividend stocks. The dividends are currently well-covered by earnings with a payout ratio of 29.7%, and this trend is expected to continue over the next three years. However, despite a decade-long history of increasing dividend payments, the company's dividends have shown volatility and unreliability in growth consistency. Recent financials indicate steady performance with net income rising to CNY 7,864 million in Q1 2024 from CNY 7,493 million year-over-year, supporting its current dividend commitments.

Take a closer look at Bank of Beijing's potential here in our dividend report.

Upon reviewing our latest valuation report, Bank of Beijing's share price might be too pessimistic.

Bros Eastern.Ltd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bros Eastern Co., Ltd is a company focused on the research, development, manufacture, and marketing of dyed mélange yarns, with a market capitalization of approximately CN¥7.65 billion.

Operations: Bros Eastern Co., Ltd generates its revenue primarily through the production and sale of dyed mélange yarns.

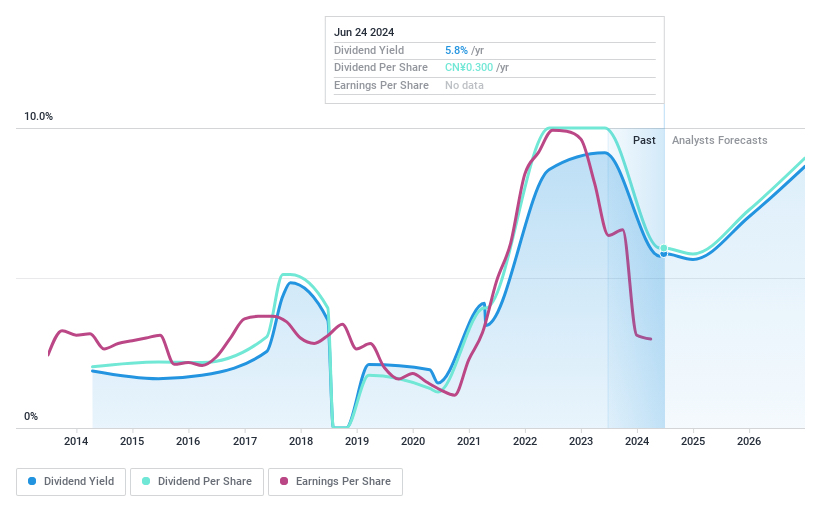

Dividend Yield: 5.8%

Bros Eastern Ltd. faces challenges in sustaining its dividend, evidenced by a high payout ratio of 92% and unreliable dividend payments over the last decade. Despite a dividend yield of 5.81%, placing it in the top 25% for Chinese dividend stocks, its dividends are not well supported by earnings or cash flows. Recent financials show a decline in net income from CNY 1,562.72 million to CNY 504.04 million year-over-year, further straining its ability to maintain dividends at current levels.

Turning Ideas Into Actions

Reveal the 227 hidden gems among our Top Dividend Stocks screener with a single click here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600720 SHSE:601169 and SHSE:601339.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance