Celanese (CE) Surpasses Earnings and Sales Estimates in Q3

Celanese Corporation CE logged earnings from continuing operations of $4.67 per share in third-quarter 2021, up from $1.76 in the year-ago quarter.

Barring one-time items, adjusted earnings were $4.82 per share, up from $1.95 in the year-ago quarter. The figure surpassed the Zacks Consensus Estimate of $4.71.

Revenues of $2,266 million increased around 61% year over year and beat the Zacks Consensus Estimate of $2,171.9 million. The company benefited from pricing and volume increases on a sequential comparison basis amid headwinds from supply-chain constraints and cost inflation. It saw more than $100 million in sequential cost inflation across its businesses in the reported quarter.

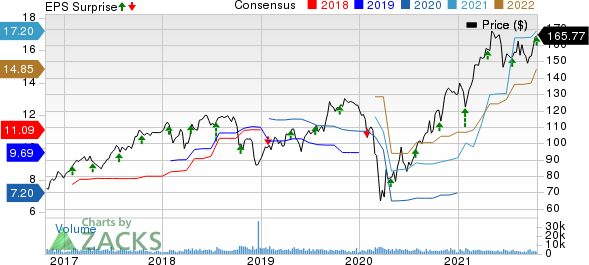

Celanese Corporation Price, Consensus and EPS Surprise

Celanese Corporation price-consensus-eps-surprise-chart | Celanese Corporation Quote

Segment Review

Net sales in the Engineered Materials unit were $684 million in the third quarter, up 30% year over year. The segment benefited from price increase initiatives amid supply and inflationary challenges. Volumes fell 2% compared with the last quarter, impacted by lost production due to sourcing constraints and a decline in global auto builds amid semiconductor supply shortages.

The Acetyl Chain segment posted net sales of $1,489 million, up around 92% year over year. The segment witnessed sequential increase in prices and volume. Pricing rose 3% sequentially as the business offset a moderation in acetic acid pricing in China. Volume rose 3% sequentially as Acetyl Chain sourced the second highest-ever volume of third-party acetyls to address higher customer demand.

Net sales in the Acetate Tow segment were $128 million, essentially flat year over year. The company witnessed stable pricing and sequential volume decline in the segment.

Financials

Celanese ended the quarter with cash and cash equivalents of $1,340 million, up around 118% year over year. Long-term debt rose around 19% year over year to $3,724 million.

Celanese generated record operating cash flow of $630 million and free cash flow of $520 million in the third quarter. Capital expenditures amounted to $102 million.

The company also returned $376 million to shareholders through dividend payouts and share repurchases during the third quarter.

Outlook

Celanese stated that demand for its products remains strong in most end markets as it enters the fourth quarter. It sees pent-up demand across Engineered Materials and Acetyl Chain units to more than offset any impact of typical year-end seasonality. Notwithstanding the sourcing and logistics headwinds, the company expects to deliver fourth-quarter adjusted earnings of roughly $5.00 per share.

With the anticipated closing of the Santoprene acquisition in the fourth quarter, Celanese expects to have deployed more than $2.7 billion in 2021 on merger and acquisitions, organic investments and share repurchases to drive future earnings growth. The company said that these actions position it well in a strong demand environment to deliver adjusted earnings of at least $15.00 per share in 2022.

Price Performance

Celanese’s shares have gained 40.4% in the past year against 17.6% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Celanese currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks worth considering in the basic materials space include Nutrien Ltd. NTR, Methanex Corporation MEOH and Steel Dynamics, Inc. STLD, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nutrien has an expected earnings growth rate of 169.4% for the current year. The stock has also rallied around 67% over a year.

Methanex has a projected earnings growth rate of 429% for the current year. The company’s shares have shot up around 53% in a year.

Steel Dynamics has a projected earnings growth rate of 454.9% for the current year. The company’s shares have surged around 96% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance