Centene (CNC) to Post Q3 Earnings: What's in the Cards?

Centene Corporation CNC is slated to release third-quarter 2022 results on Oct 25, before the opening bell.

Q3 Estimates

The Zacks Consensus Estimate for Centene's third-quarter earnings per share is pegged at $1.22, indicating a decline of 3.2% from the prior-year quarter's reported figure.

The consensus mark for revenues stands at $35.5 billion, suggesting growth of 9.5% from the year-ago quarter’s figure. Our estimate indicates total revenues of $35.3 billion for the third quarter.

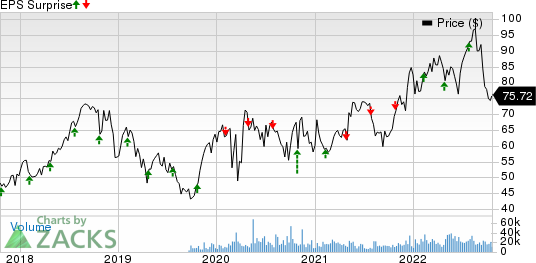

Earnings Surprise History

Centene contains a strong earnings surprise record. Its bottom line surpassed estimates in three of the trailing four quarters and missed the same once, the average surprise being 2.99%. This is depicted in the chart below:

Centene Corporation Price and EPS Surprise

Centene Corporation price-eps-surprise | Centene Corporation Quote

Factors to Note

Revenues of Centene are likely to have increased on the back of improved premium and service revenues in the third quarter. Premiums are expected to have been driven by the growing membership across CNC’s Medicaid, Medicare and Marketplace businesses that form part of its government business.

Premiums remain the most significant contributor to a health insurer’s top line. Sound performances of Centene’s government business fetched several contract wins that enabled it to foray into different U.S. regions. This, in turn, might have also strengthened its membership in the to-be-reported quarter.

The Zacks Consensus Estimate for Centene's premiums is pegged at $31.4 billion, indicating an improvement of 8.8% from the prior-year quarter’s reported figure. Our estimate for the metric is $30.7 billion.

A diversified service offering suite comprising Medicaid, Medicare, commercial programs, prescription drug plan (PDP) and correctional healthcare services is likely to have boosted service revenues of Centene in the third quarter. The consensus mark for the service revenues stands at $2.2 billion (suggesting a 33.6% surge from the year-ago quarter’s tally), while our estimate indicates the metric to be $2.8 billion.

The commercial healthcare business of Centene is likely to have gained on prudent pricing actions in the to-be-reported quarter.

In spite of several cost-cutting efforts, the bottom line of Centene is expected to have taken a hit in the third quarter. This is because of elevated operating costs stemming from higher medical costs, cost of services, and selling, general and administrative expenses.

In addition, lower investment and other income might have hampered CNC’s margins. The Zacks Consensus Estimate for investment and other income is pegged at $129 million, suggesting a 69.6% plunge from the prior-year quarter’s reading.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Centene this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that's not the case here as elaborated below.

Earnings ESP: Centene has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: Centene currently carries a Zacks Rank #3. You can see the complete list of today's Zacks #1 Rank stocks here.

Stocks to Consider

While earnings beat looks uncertain for Centene, there are some companies from the Medical space worth considering as our model shows that these have the right combination of elements to beat on earnings beat this time around:

Genmab A/S GMAB has an Earnings ESP of +18.10% and a Zacks Rank of 2 at present. The Zacks Consensus Estimate for GMAB’s third-quarter 2022 earnings stands at 23 cents per share, indicating growth of 9.5% from the prior-year quarter’s actuals.

Genmab’s bottom line beat earnings estimates in each of the last four reported quarters.

Humana Inc. HUM has an Earnings ESP of +1.12% and a Zacks Rank #2. The Zacks Consensus Estimate for HUM’s third-quarter 2022 earnings is pegged at $6.24 per share, suggesting growth of 29.2% from the prior-year quarter's reported figure.

Humana's earnings beat estimates in each of the trailing four quarters.

Haemonetics Corporation HAE has an Earnings ESP of +2.16% and a Zacks Rank of 3. The Zacks Consensus Estimate for HAE’s third-quarter 2022 earnings is pegged at 70 cents per share, indicating an improvement of 16.7% from the year-ago quarter's reported figure.

Haemonetics’ earnings beat estimates in three of the trailing four quarters and missed the mark once.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Genmab AS Sponsored ADR (GMAB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance