Centene (CNC) Wins Contract From Arizona's Medicaid Agency

Centene Corporation CNC declared that its Arizona subsidiary, Arizona Complete Health, has been awarded a managed care contract by the single Medicaid agency of the state, Arizona Health Care Cost Containment System (“AHCCCS”). The new contract is likely to be effective from the beginning of October 2024 and will run for three years. It can be extended up to a maximum number of four times for one year each.

The recent move imparts the power to the Centene unit, which is believed to be the largest Medicaid health plan in Arizona, to cater to the needs of members of the Arizona Long Term Care System (“ALTCS”). Being one of the oldest Medicaid-managed long-term services and support programs across the United States, ALTCS is meant to look after the elderly and/or physically disabled population (“E/PD”) of Arizona.

Catering to roughly 26,000 Arizonans, ALTCS provides a comprehensive set of physical, behavioral and long-term healthcare services, and assistance. It provides pharmacy benefits as well. The program promotes the independent living of a member to the greatest extent possible through delivering home and community-based services.

Centene boasts a longstanding history of catering to AHCCCS members for nearly two decades now. The contract win will offer an opportunity for the health insurer to continue its collaborative work with its provider partners in Arizona, which in turn, will enable an in-depth understanding of local communities. This is expected to address diversified needs and bring improved health outcomes for the ALTCS-E/PD members across the state.

A solid Medicaid business, which Centene has built through provider collaborations and significant investments, continues to provide a competitive edge to the health insurer. Contract wins similar to the latest one are expected to further solidify CNC’s footprint in Arizona as well as serve as a means to boost its Medicaid membership growth. Needless to say, membership growth usually drives premiums (the most significant revenue contributor) of a health insurer and Medicaid members make up a significant chunk of CNC’s overall membership.

In addition to a growing Medicaid business, the health insurer serves Arizona through individual, Medicare and dual-eligible programs. Centene provides Medicare Advantage plans through the Wellcare brand and distributes Marketplace plans through the Ambetter Health insurance offering. These subsidiaries play a major role in expanding the reach of Centene’s plans across different U.S. communities as well as integrates lucrative features within them from time to time.

As a recent example, Ambetter Health teamed up with the health benefits platform, Take Command, to develop an Individual Coverage Health Reimbursement Arrangements product for aiding Indiana’s employers in offering diversified healthcare choices to its employee base. The noteworthy features of the product, such as affordability, flexibility and tax credits, can be enjoyed from the very beginning of 2024. The product equips employers to reimburse payments made for health insurance plans by employees, thereby providing better management of healthcare costs and lowering the administrative burden for the statewide businesses.

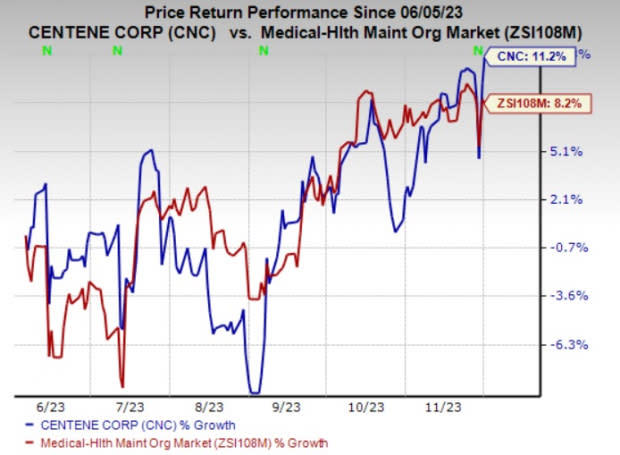

Shares of Centene have risen 11.2% in the past six months compared with the industry’s 8.2% growth. CNC currently carries a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the Medical space are IRadimed Corporation IRMD, Amphastar Pharmaceuticals, Inc. AMPH and Novo Nordisk A/S NVO, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

IRadimed’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average beat being 11.67%. The Zacks Consensus Estimate for IRMD’s 2023 earnings and revenues suggests an improvement of 36.4% and 22.5% from the respective year-ago reported figures.

The consensus estimate for IRadimed’s 2023 earnings has moved 7.9% north in the past 30 days. Shares of IRMD have declined 10.6% in the past six months.

Amphastar Pharmaceuticals’ earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 52.06%. The consensus estimate for AMPH’s 2023 earnings and revenues suggests an improvement of 62.4% and 28.4% from the respective year-ago reported figures.

The consensus estimate for Amphastar Pharmaceuticals’ 2023 earnings has moved 17.6% north in the past 30 days. Shares of AMPH have gained 25.9% in the past six months.

Novo Nordisk’s earnings outpaced the Zacks Consensus Estimate in two of the trailing four quarters, matched the mark once and missed the same in the remaining one occasion, the average surprise being 0.58%. The consensus estimate for NVO’s 2023 earnings and revenues suggests an improvement of 51.5% and 31.5% from the respective year-ago reported figures.

The consensus estimate for Novo Nordisk’s 2023 earnings has moved 1.9% north in the past 30 days. Shares of NVO have gained 27.3% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Amphastar Pharmaceuticals, Inc. (AMPH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

iRadimed Corporation (IRMD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance