Centene (CNC) Wins Contract to Serve Texas' Foster Population

Centene Corporation’s CNC Texas unit Superior HealthPlan recently clinched a six-year contract from the Texas Health and Human Services Commission (HHSC) to continue serving the state’s Medicaid members.

CNC’s purpose to serve the Medicaid community with better health outcomes is fulfilled through the STAR Health managed care program, developed in alliance with Texas Department of Family and Protective Services (DFPS). The program has been helmed by Superior alone in Texas since its launch in 2008.

Shares of Centene lost 2% on Sep 16, replicating a decline in the broader markets.

The contract win will enable the Centene subsidiary to continue addressing the intricate medical and non-medical requirements of children and youth belonging to the foster care system. The recent reward will offer an opportunity for Superior to synergize with the local providers and community partners in Texas for volunteering high-quality and holistic healthcare solutions in aid of the underserved population at risk.

This will surely better equip and empower Superior in setting high healthcare standards all through Texas. While many children continue to survive under the foster care system of the United States, contract wins similar to the latest one lays a perfect ground for CNC’s arm to offer relief to its foster care members and improve their conditions.

Additionally, receipt of the latest contract is expected to solidify the reputation of Superior that has been earned by serving the foster care system for more than a decade. In 2008, Superior emerged as the first U.S. managed care organization to offer Medicaid coverage — thanks to its tie-ups with Texas HHSC and DFPS — to foster children across Texas.

To enhance its services for foster care, Superior frequently resorted to a collaborative healthcare approach and other initiatives. To this end, the Foster Care Center of Excellence program was instituted to provide urgent care and therapy for the foster-care members suffering trauma. The Health Passport tool securely stores vital information of the members in a web application that can be accessed by healthcare providers, Medical Consenters and the STAR Health staff, to name a few.

This deal win is expected to drive the Medicaid business of the parent company Centene. Offering Medicaid plans since 1999 has established a strong foundation for CNC across Texas. With such a solid Medicaid business in place, CNC makes efforts to penetrate newer geographies and grow its customer base. Higher membership bodes well as it piles up premiums (the most significant revenue contributor) of a managed care organization.

Apart from a strong Medicaid business, Centene has robust Medicare and Marketplace plans in place with efforts to upgrade made by its Superior unit. The subsidiary leverages its federal insurance marketplace plan Ambetter to better serve the underinsured and uninsured population. Superior’s Medicare Advantage plan WellCare looks after the Medicare population.

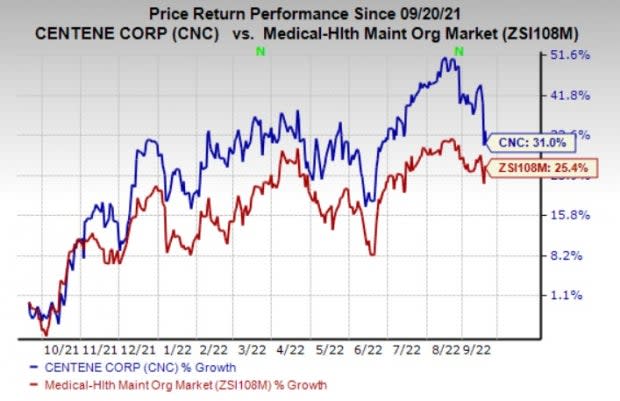

Shares of Centene have gained 31% in a year compared with the industry’s rally of 25.4%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Centene currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the Medical space are Assertio Holdings, Inc. ASRT, Molina Healthcare, Inc. MOH and ShockWave Medical, Inc. SWAV. While ShockWave Medical flaunts a Zacks Rank #1 (Strong Buy), Assertio and Molina Healthcare carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Assertio’s earnings beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 126.39%. The Zacks Consensus Estimate for ASRT’s 2022 earnings is pegged at 51 cents per share. A loss of 3 cents was reported in the prior year. The consensus mark for ASRT’s 2022 earnings has moved 4.1% north in the past 30 days.

The bottom line of Molina Healthcare outpaced earnings in each of the trailing four quarters, the average being 3.22%. The Zacks Consensus Estimate for MOH’s 2022 earnings suggests an improvement of 30.4% from the year-ago reported figure. The same for revenues implies 12.5% growth from the year-ago reported figure. The consensus mark for MOH’s 2022 earnings has moved 0.2% north in the past 30 days.

ShockWave Medical’s earnings beat estimates in each of the trailing four quarters, the average being 180.14%. The Zacks Consensus Estimate for SWAV’s 2022 earnings is pegged at $2.57 per share. A loss of 26 cents was reported in the prior year. The consensus mark for SWAV’s 2022 earnings has moved 27.2% north in the past 30 days.

Shares of Assertio, Molina Healthcare and ShockWave Medical have gained 156.8%, 23% and 34.3%, respectively, in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Assertio Holdings, Inc. (ASRT) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance