Centerra Gold And Two More Undervalued Small Caps In Canada With Insider Action

The Canadian market has shown robust performance, with a 1.2% increase over the last week and an impressive 11% rise over the past year, alongside expectations of a 15% annual earnings growth. In this context, identifying undervalued small-cap stocks like Centerra Gold that show potential for significant value can be particularly compelling for investors looking to capitalize on current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Martinrea International | 5.8x | 0.2x | 47.88% | ★★★★★★ |

Dundee Precious Metals | 8.2x | 2.8x | 46.25% | ★★★★★★ |

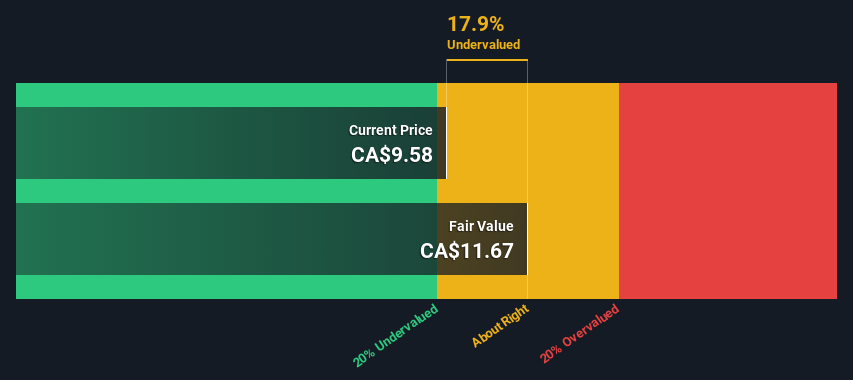

Nexus Industrial REIT | 2.4x | 3.0x | 17.40% | ★★★★★☆ |

Calfrac Well Services | 2.2x | 0.2x | 4.52% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.4x | 3.0x | 35.16% | ★★★★★☆ |

Guardian Capital Group | 10.5x | 4.1x | 32.05% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -96.07% | ★★★★☆☆ |

Trican Well Service | 8.1x | 1.0x | -9.61% | ★★★☆☆☆ |

Westshore Terminals Investment | 14.2x | 3.8x | 0.38% | ★★★☆☆☆ |

Freehold Royalties | 15.4x | 6.6x | 47.17% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Centerra Gold

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Centerra Gold is a gold mining company with operations primarily focused on extracting and processing gold, along with other minerals such as molybdenum, and has a market capitalization of approximately $1.17 billion CAD.

Operations: Molybdenum and Mount Milligan are significant contributors to the revenue, generating $254.54 million and $416.79 million respectively. The company's gross profit margin has fluctuated, observed at 40.22% in the latest quarter of 2024, compared to previous years where it ranged from 14.42% to 58.82%.

PE: 25.7x

Centerra Gold, reflecting insider confidence, recently purchased shares, signaling strong belief in the company's prospects. With a significant turnaround from a net loss to reporting robust first-quarter earnings of US$66.43 million and sales growth to US$305.88 million, their financial health appears revitalized. Additionally, consistent shareholder returns are evidenced by a quarterly dividend of CAD 0.07 per share and strategic share repurchases totaling $12.1 million since January 2024. These actions underscore Centerra’s potential as an appealing investment amidst undervalued entities in the Canadian market.

Delve into the full analysis valuation report here for a deeper understanding of Centerra Gold.

Evaluate Centerra Gold's historical performance by accessing our past performance report.

Chemtrade Logistics Income Fund

Simply Wall St Value Rating: ★★★★★★

Overview: Chemtrade Logistics Income Fund is a provider of industrial chemicals and services, primarily focused on sulphur and water chemicals and electrochemicals, with a market capitalization of approximately CA$0.74 billion.

Operations: EC and SWC segments generate substantial revenue streams, with reported figures of CA$756.10 million and CA$1045.42 million respectively, highlighting the company's significant market presence in these areas. The gross profit margin has shown an upward trend, reaching 0.24% in the latest quarter, indicating improved efficiency in managing production costs relative to sales.

PE: 5.2x

Chemtrade Logistics Income Fund, reflecting a cautious market sentiment, has recently affirmed monthly dividends and announced a significant share repurchase program, signaling potential confidence in its intrinsic value. Despite facing a downturn in quarterly earnings and sales from the previous year, they have declared consistent dividends and are set to buy back nearly 10% of their shares starting June 2024. This move, coupled with insider purchases earlier this year, may suggest an optimistic outlook from those closest to the company.

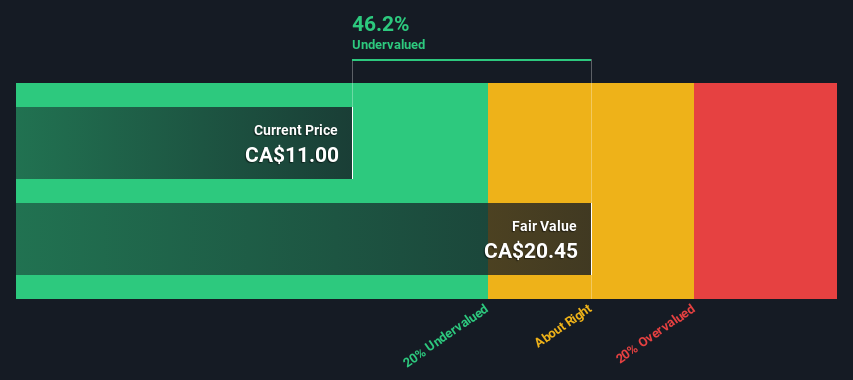

Dundee Precious Metals

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals is a Canadian-based international gold mining company with operations and projects in Bulgaria and other countries, with a market capitalization of approximately CA$1.10 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, with a notable gross profit margin peaking at 55.29% in the latest quarter, reflecting robust operational efficiency in metal extraction and processing activities.

PE: 8.2x

Dundee Precious Metals, reflecting a blend of strategic growth and financial prudence, recently bolstered its executive team with seasoned industry veterans, enhancing its corporate development potential. In the first quarter of 2024, the company maintained stable earnings with a slight dip to US$45.74 million in net income on sales of US$123.79 million. Insider confidence is evident as they have recently purchased shares, signaling belief in the company's value despite market undervaluation. With ongoing projects like Coka Rakita promising high-margin outputs and robust economics, Dundee stands out for leveraging operational expertise and regional synergies in Eastern Europe, projecting an enriched future landscape for growth.

Where To Now?

Unlock our comprehensive list of 35 Undervalued TSX Small Caps With Insider Buying by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CG TSX:CHE.UN and TSX:DPM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance