Charting 2024's ETF Boom. Ether Entering the Arena?

Quick: Name that last major IPO to capture the intrigue of the investment public. Next: What's the biggest M&A deal you can recall? And when was the last round of stock splits to signal to Wall Street that executives were optimistic about rising stock prices ahead?

Adjusting to the New Normal

If you have to shake a few cobwebs loose to come up with the answers, you're not alone. Wall Street Horizon data show that there has been a relative dearth of activity across a range of corporate actions, recent split announcements from Walmart (WMT), Chipotle (CMG), and NVIDIA (NASDAQ:NVDA) notwithstanding. The reason? While it might require a deep dive, it's hard to ignore the elephant in the room. The Federal Reserve's historic rate-hiking campaign that began shortly after one of the most bubbly periods in US market history has possibly taken its toll on capital-market activity.

2024: An ETF Boom

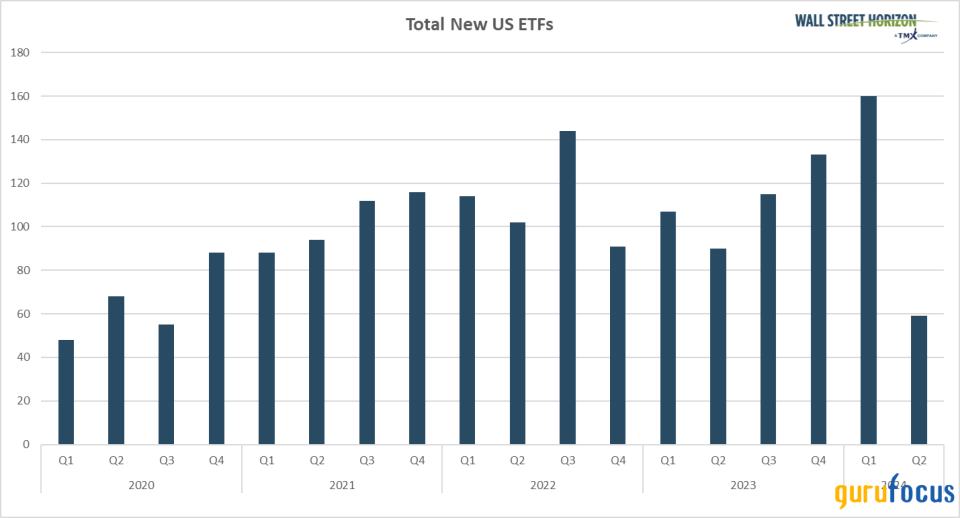

But leave it to Wall Street to produce new tools to draw in investors and traders alike. With almost five months of data now in the books, our team noticed that the count of total new US ETFs is tracking at materially higher levels this year compared to 2023.

A Rise in US ETFs Coming to Market in 2024?

Source: Wall Street Horizon

Investors Have Options' and Are Getting Active

What could be responsible for a bulk of the jump is the meteoric rise in popularity of income-focused funds. ETFs that sell options to generate additional yield are broadly targeted at investors who prefer income rather than growth. It's an interesting bifurcation given the constant attention (ourselves included) at Magnificent Seven or Fab Five stocks.

Investors are also getting active with their bond ETF interests. Data from VettaFi reveal that narrower credit spreads and uncertainty over Fed rate policy have helped draw over $11 billion in net inflows domestically and $27 billion globally into active bond ETFs. Financial advisors are using these funds to manage their clients' fixed-income allocations. What's more, the bond bear market that began some four years ago has resulted in a significant transition from fixed-income mutual funds to ETFs.[1]

"Advisors and investors are increasingly turning to ETFs to gain exposure. While most of the assets are in a low-cost, broad market ETFs, in 2024 asset managers have been turning to offering more targeted strategies that charge higher fees and can benefit from education, explained Todd Rosenbluth, Head of Research at VettaFi.

Leveraged Ways to Play Tech

Last week's earnings report from the AI poster child, NVIDIA (NASDAQ:NVDA), seemed to be the center of the financial media's attention before the long weekend. And with Alphabet (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), and Apple (NASDAQ:AAPL) each holding major product events this month and next, it's easy to look beyond the proliferation of the aforementioned hybrid ETFs.

There's another nascent ETF niche, though. Single-stock funds designed to either provide a yield boost or lever up exposure to an individual mega-cap is another mushrooming corner of the ETF space.

Enter: ETH

But, oh, that's not all. Crypto investors are having their day. Back in January, 11 spot Bitcoin ETFs were approved and began trading.[2] The world's largest cryptocurrency soared initially, but then pulled back and held within a volatile trading range. Bitcoin printed a new all-time high shortly before the end of the first quarter, rewarding early-buyers of the ETFs.

Then just last week, the US Securities and Exchange Commission (SEC) approved eight applications for spot Ether ETF - regulators had requested exchanges get their fund filings together just days before the Thursday night announcement.[3] It could be the next wave of investor interest in ETFs.

The Bottom Line?

While corporate dealmaking remains generally tepid so far in 2024, there has been a notable jump in the number of new US ETFs coming to market. There continues to be an increase in covered-call and other equity-options ETFs, but expect more headlines in the crypto ETF arena as the summer heats up.?

1 Golden Age for Active Bond ETFs?, VettaFi, Kirsten Chang, May 22, 2024, https://www.etftrends.com2 11 newly approved bitcoin ETFs start trading todaybut experts say to approach with caution', CNBC, Mike Winters, January 10, 2024, https://www.cnbc.com3 US SEC approves exchange applications to list spot ether ETFs, Reuters, Hannah Lang, Suzanne McGee, May 23, 2024, https://www.reuters.com

??Copyright 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance