Chemtrade Logistics Income Fund (TSE:CHE.UN) Has Re-Affirmed Its Dividend Of CA$0.05

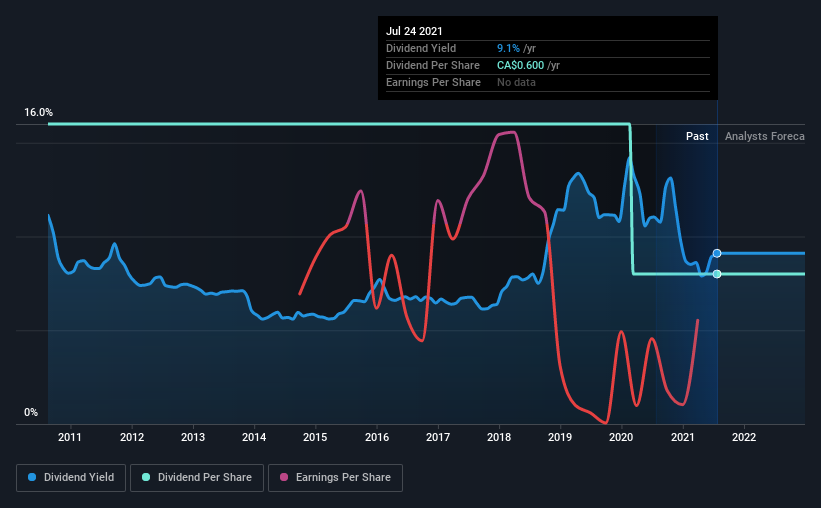

The board of Chemtrade Logistics Income Fund ( TSE:CHE.UN ) has announced that it will pay a dividend on the 26th of August, with investors receiving CA$0.05 per share. This makes the dividend yield 9.1%, which will augment investor returns quite nicely.

See our latest analysis for Chemtrade Logistics Income Fund

Chemtrade Logistics Income Fund's Distributions May Be Difficult To Sustain

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even though Chemtrade Logistics Income Fund isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Analysts are expecting EPS to grow by 70.6% over the next 12 months. It's encouraging to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. However, the positive cash flow ratio gives us some comfort about the sustainability of the dividend.

Chemtrade Logistics Income Fund's Track Record

While the dividend hasn't seen any major cuts in the last 10 years, it was reduced by half last year after the onset of the Covid pandemic, going from CA$1.20 to CA$0.60. A company that decreases its dividend over time generally isn't what we are looking for but 2020 was a unique year where several companies either reduced or suspended their dividends.

Dividend Growth Potential

Chemtrade Logistics Income Fund's EPS has fallen by approximately 36% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

The company has also been raising capital by issuing stock equal to 12% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On Chemtrade Logistics Income Fund's Dividend

Overall, we don't think this company makes a great dividend stock. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 4 warning signs for Chemtrade Logistics Income Fund that investors should know about before committing capital to this stock. We have also put together a list of global stocks with a solid dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance