Chevron (CVX) to Report Q3 Earnings: What's in the Cards?

Chevron Corporation CVX is scheduled to release third-quarter 2021 results on Friday Oct 29, before the opening bell.

The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is pegged at $2.21 per share while the same for revenues stands at $42.47 billion.

Against this backdrop, let’s consider the factors that are likely to impact the company’s September-quarter results.

Factors at Play

Chevron's cost-reduction efforts continue to aid growth. For the 2021-2025 forecast period, the company reiterated its organic capital and exploratory expenditure guidance in the $14-$16 billion range. It doubled its initial estimate of Noble Energy synergies to $600 million, which in turn, is anticipated to lower operating cost by 10% from the 2019 reported levels.

Chevron’s capital-efficient investment plan and cost-effective measure are expected to double its return-on-capital employed. This, in turn, may lead to free cash flow growth of more than 10% and a capital budget as low as $14 billion per year through 2025. All these strategic moves are expected to have driven its third-quarter earnings and cash flows higher.

According to the U.S. Energy Information Administration, in the months of July, August and September during 2020, the average monthly WTI crude price was $40.71, $42.34 and $39.63 per barrel, respectively. In 2021, average prices were $72.49 in July, $67.73 in August and $71.65 in September, reflecting an increase year over year. This price rise is expected to have bettered Chevron’s upstream earnings in the quarter under review. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings from the upstream segment is pegged at $3.8 billion, indicating growth from the sequential quarter’s reported figure of $3.2 billion.

The third-quarter performance of the company’s downstream business, which manufactures and distributes additives, lubricants and petrochemicals, is expected to have improved sequentially.The Zacks Consensus Estimate for the September-quarter earnings from this segment is pegged at $1.1 billion, suggesting growth from the sequential quarter’s reported figure of $839 million.

On the flip side, Chevron anticipates significant turnarounds to cut upstream production by 150,000 barrels of oil equivalent per day in the third quarter, largely at TCO, thus bringing its planned curtailments down to around 5,000 barrels.

What Does Our Model Say?

The proven Zacks model does not conclusively predict a beat for Chevron this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Chevron has an Earnings ESP of 0.00%.

Zacks Rank: Chevron sports a Zacks Rank of 1, currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Highlights of Q2 Earnings & Surprise History

Chevron reported adjusted second-quarter earnings per share of $1.71, beating the Zacks Consensus Estimate of $1.54. The company reported a loss of $1.56 per share in the year-ago period.

Its turnaround in the bottom line reflects higher oil prices and production plus an increase in refined products sales. This was complemented by the integrated energy major’s successful cost-reduction initiatives, which allowed it to lower operating expenses and capital spending by 14% and 16%, respectively, from the corresponding year-ago levels.

The company, which recently set up a ‘New Energies’ division to look after the alternate fuels business, generated revenues of $37.6 billion. The sales figure beat the Zacks Consensus Estimate of $35.6 billion and skyrocketed 178.6% year over year.

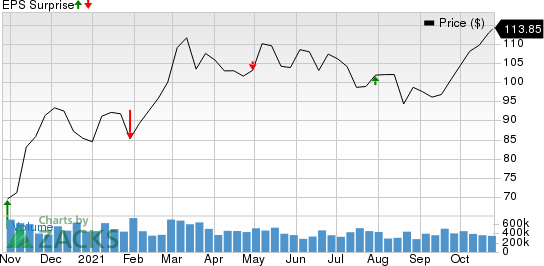

As far as earnings surprises are concerned, this San Ramon, CA-based company’s bottom line surpassed the Zacks Consensus Estimate in two of the trailing four quarters and lagged the same on the remaining two occasions, the average surprise being 8.58%. This is depicted in the graph below:

Chevron Corporation Price and EPS Surprise

Chevron Corporation price-eps-surprise | Chevron Corporation Quote

Stocks to Consider

While an earnings beat looks uncertain for Chevron, here are some firms from the energy space that you may want to consider on the basis of our model:

Oceaneering International, Inc. OII has an Earnings ESP of +100.00% and a Zacks Rank #3, currently. The firm is scheduled to release earnings on Oct 27.

Ovintiv Inc. OVV has an Earnings ESP of +1.96% and is presently Zacks #1 Ranked. The firm is scheduled to release earnings on Nov 2.

Diamondback Energy, Inc. FANG has an Earnings ESP of +2.48% and a Zacks Rank #2 at present. The firm is scheduled to release earnings on Nov 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Ovintiv Inc. (OVV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance