China’s Pork Probe Is Yet Another Blow for Struggling EU Farmers

(Bloomberg) -- The threat of China slapping tariffs on the European Union’s pork is the last thing the continent’s beleaguered industry needs.

Most Read from Bloomberg

At Blackstone's $339 Billion Property Arm, the Honeymoon Is Over

CDK Tells Car Dealers Their Systems Will Likely Be Down for Days

Putin’s Hybrid War Opens a Second Front on NATO’s Eastern Border

China, the world’s biggest pork consumer, this week announced a probe on imports from the EU that could result in tariffs as part of a trade tit-for-tat. The bloc’s top exporters of the meat — like Spain and Denmark — warn that any levies will further hit overseas sales that have been falling for several years, hurting the entire supply chain from farmers to processors.

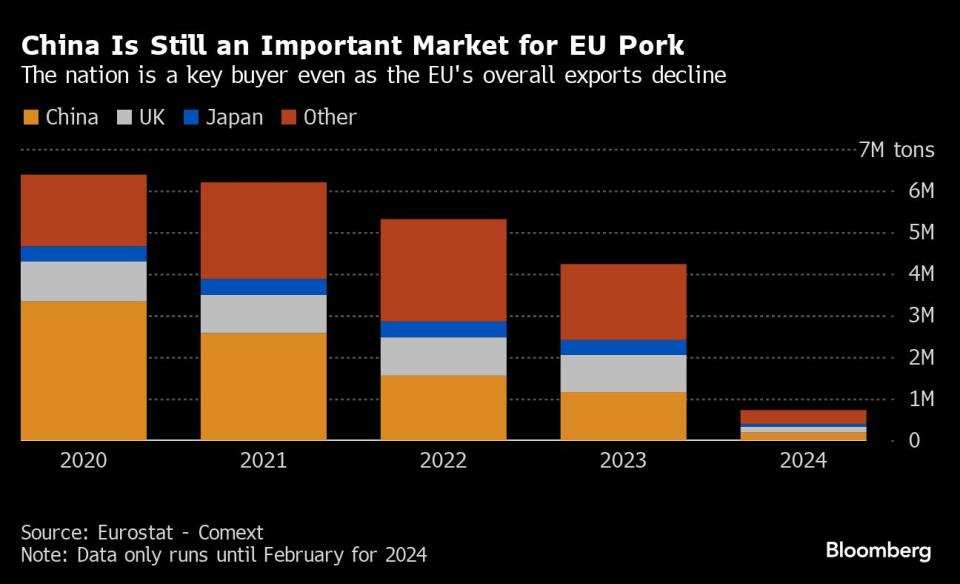

The EU is already losing its crown as the No. 1 pork exporter. After benefiting from demand in China when African swine fever ravaged herds, European shipments have struggled as Chinese output rebounded and the bloc had its own outbreaks of the disease. Farmers’ profits have also been squeezed by higher feed and energy costs and consumers eating less pork, prompting processors to cut jobs, close slaughterhouses and target more local markets.

The pork probe is the latest retaliation in a spat that has also included Chinese electric vehicles and European brandy. If tariffs do come in, EU hog suppliers may also find it hard to find new markets for niche products — such as pig ears — that China buys.

“We are becoming hostages in a trade war we aren’t even really part of,” said Danish pig farmer Torben Farum, who counts China as a buyer of his products. “We actually have enough to contend with and then this just comes on top.”

China imported 930,000 tons of pork and pork offal products — worth $1.86 billion — from around the world in the first five months of year, customs data show. Spain, Denmark and the Netherlands were among the biggest suppliers.

While overall European pork exports have dropped in recent years, China remains a crucial buyer for the EU as its single biggest overseas market for the meat. But China has needed to import less as its herd recovers, with sluggish consumption amid an economic downturn adding to an oversupply there.

For now, pork and offal products from Europe are clearing customs normally, according to industry sources who are closely watching the situation. Even so, some traders in China are now snatching up frozen pork product stocks at ports and in warehouses amid worries that any future trade measures against EU shipments could push up prices of those products, industry sources said.

If the year-long probe does lead to duties, that could benefit rival exporters like the US and Brazil, whose supplies are already competitive in China. Total US shipments in 2024 are forecast to be on par with the EU.

It’s unclear how quickly China’s probe will progress. The investigation means companies have to register with Chinese authorities, and they may be questioned by Beijing before any decision is taken on potential tariffs, said Anne Richard, director at French industry association Inaporc.

“For now, we are in waiting mode,” she said. “It will be complicated to replace China in the short term, as it’s our No. 1 market.”

A Ministry of Commerce spokesman on Thursday said China has the right to launch anti-dumping measures after the release of preliminary results, in accordance to related domestic and World Trade Organization rules.

China has targeted agricultural trade before. It lifted punitive tariffs on Australian wine exports this year, signaling an end to a three-year campaign of trade pressure on Canberra that also included barley. It also imposed lengthy restrictions on US poultry that affected companies such as Tyson Foods Inc. and Pilgrim’s Pride Corp., before lifting a ban on shipments in 2019.

China Is Targeting Europe’s Soft (Pork) Belly: Javier Blas

Finding New Buyers

A key concern for many European suppliers is finding alternative markets to send offcuts of carcasses such as trotters, snouts, ears and head meat, said Miguel Angel Higuera, director of Spanish pig-farmers group Anprogapor.

Last year, China accounted for 65% of the 3.2 billion kroner ($460 million) worth of by-products Denmark exports, according to the Danish Agriculture and Food Council.

“When my pigs go to the slaughterhouse, they are being cut up and then — roughly speaking — the bacon goes to England, the ham goes to Italy, the snouts, ears and tails go to China, and the pork roast we’ll eat here in Denmark,” Farum said.

Selling those niche products to nations like China helps European processors keep costs down by spreading them out across the whole carcass. If those offcuts are instead sold at lower prices in smaller Asian markets or for pet food, then production costs will be passed onto premium cuts sold in Europe, said Rupert Claxton, meat and livestock director at consultancy Gira.

Any drop in demand is expected to drive carcass prices down. Danish farmer Farum isn’t seeing a decline yet, but he’s nervous about what the probe could mean for his industry.

“It sends a signal to the market and it may make some farmers reconsider if they want to continue or not,” he said.

--With assistance from Clara Hernanz Lizarraga, Nayla Razzouk and Chris Miller.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance