China property crisis deepens as Moody's withdraws credit ratings

China’s property crisis deepened as Moody’s withdrew a flurry of credit ratings from key companies.

The credit ratings agency issued sudden removals for 11 Chinese businesses today in a blow to Beijing’s efforts to revive the fortunes of the world’s second largest economy.

Moody’s withdrew scores from 10 Chinese developers, including Logan Group, Ronshine China and Zhenro Properties Group, saying the decision was down to “business reasons”.

Earlier it had removed its Baa3 score - one step away from junk territory - from one of the country’s major bad-debt managers, China Great Wall Asset Management.

The sudden action comes after Moody’s cut its outlook for Chinese sovereign bonds to negative in December.

China has been grappling a post-pandemic economic downturn that has led to a significant slump in property investment across the country, which has led to a slowdown in growth.

One of the China’s biggest housebuilders, Evergrande, collapsed in 2021, which spooked the whole market. Other developers have also been going bust.

Read the latest updates below.

06:16 PM GMT

Signing off

Thanks for joining us today. US markets are less animated than yesterday, with the S&P 500 up 0.20pc, the Dow Jones Industrial Average of 30 leading American companies up 0.27pc, and the Nasdaq Composite index up 0.05pc.

Mark Hackett, chief of investment research at US insurder Nationwide, said:

Investors are sanguine, with political uncertainty, elevated valuations, and Fed uncertainty not able to dent the momentum in the market.

Chris Price will be back on Monday morning to cover the opening of markets in London, but I’ll leave you with the latest report from Adam Mawardi: Morgan Stanley banker branded Mike Ashley ‘dishonest’ in $1bn trading row.

05:59 PM GMT

Fertility rate slumps to record low in ‘slow-burn’ economic crisis

The fertility rate in England and Wales has dropped to a record low, with British women having fewer children than at any point since at least 1939 in a “slow-burn” economic crisis. Eir Nolsøe reports:

New figures from the Office for National Statistics show that the fertility rate, which measures the average number of children a woman of childbearing age will have, dropped to 1.49 in 2022.

The number, which is the lowest in 83 years, comes amid an increasingly political debate about why women are having fewer children.

Many politicians and economists fear that the economy will struggle to grow and living standards will stagnate or decline as the number of older people increases while fewer children are born.

05:44 PM GMT

Retailers launch last-ditch attempt to get Hunt to scrap tourist tax

Retailers have launched a last-ditch effort to persuade Jeremy Hunt to scrap Britain’s tourist tax in the Budget with the most detailed evidence yet that removing it will spark a £3.8bn tourism boom. Szu Ping Chan and Hannah Boland report:

The Association of International Retail (AIR) and New West End Company, which represents retail businesses in London’s key shopping areas, submitted fresh evidence to Downing Street this week contradicting Treasury assumptions that reinstating VAT-free shopping will cost £2.5bn in foregone tax revenues.

Its evidence, based on detailed spending data collected through its network of retailers, suggests that the amount of lost VAT will be just one fifth of the Treasury’s projection because EU visitors spend less money on shopping than on hotels, leisure and dining out.

The AIR notes that the Treasury’s original forecast was based on the assumption that tax-free shopping has little or no impact on how international travellers behave or where they decide to go on holiday.

Its analysis shows that the cost of foregone VAT is likely to be closer to £525m based on how visitors from inside and outside the EU spend their money.

05:13 PM GMT

Germany businesses downbeat, key survey shows

Germany’s businesses remain mired in pessimism, a key survey showed Friday, as Europe’s largest economy struggles with shortages of skilled labor, slower global trade, high interest rates and political squabbling.

The closely watched Ifo institute survey of business sentiment rose only slightly to 85.5 points in February from 85.2 points in January due to “slightly less pessimistic expectations,” the institute said in an accompanying statement.

“The German economy is stabilising at a low level,” the institute said.

The survey results follow a sharp downgrade of the government’s expectations for growth this year, to only 0.2pc, from 1.3pc in the previous forecast. Germany’s economy shrank 0.3pc in 2023, the worst performance by a major economy and a reversal of years of economic success as an export champion.

Giant chemical company BASF on Friday joined a string of major employers saying they would cut positions, citing a “low-demand environment.” The company said it made money last year “in all significant countries except Germany” and losses at its home base in Ludwigshafen meant it would seek to cut cut costs there by €1.1bn (£940m) a year by the end of 2026.

Other employers recently announcing job reductions include appliance maker Miele, which plans to move 700 jobs to Poland, and Deutsche Bank, which said it will drop 3,500 positions.

05:08 PM GMT

Germany’s businesses remain downbeat according to key survey

Germany’s businesses remain mired in pessimism, a key survey has shown, as Europe’s largest economy struggles with shortages of skilled workers, slower global trade, high interest rates and political squabbling.

The closely watched Ifo institute survey of business sentiment rose only slightly to 85.5 points in February from 85.2 points in January due to “slightly less pessimistic expectations,” the institute said in an accompanying statement.

“The German economy is stabilising at a low level,” the institute said.

The survey results follow a sharp downgrade of the government’s expectations for growth this year, to only 0.2pc, from 1.3pc in the previous forecast. Germany’s economy shrank 0.3pc in 2023, the worst performance by a major economy and a reversal of years of economic success as an export champion.

Giant chemical company BASF on Friday joined a string of major employers saying they would cut positions, citing a “low-demand environment.” The company said it made money last year “in all significant countries except Germany” and losses at its home base in Ludwigshafen meant it would seek to cut cut costs there by €1.1bn (£940m) a year by the end of 2026.

Other employers recently announcing job reductions include appliance maker Miele, which plans to move 700 jobs to Poland, and Deutsche Bank, which said it will drop 3,500 positions.

04:54 PM GMT

FTSE 100 closes up

The FTSE 100 closed up 0.28pc. The biggest riser was Standard Chartered, up 4.85pc, followed by Rightmove, up 1.85pc. The biggest faller was investment firm St James’s Place, down 2.96pc, followed by insurer Admiral, down 1.40pc.

Meanwhile, the FTSE 250 fell 0.44pc. The biggest riser was biotechnology firm PureTech Health, up 11.55pc, followed by Georgia-based TBC Bank, up 3.21pc. The biggest faller was Domino’s Pizza, down 4.25pc, followed by WAG Payment Solutions, down 4.13pc.

04:46 PM GMT

Bosch to cut 3,500 jobs in home appliances unit

Bosch is to axe 3,500 jobs at its home appliances subsidiary by 2027, the latest in a series of job cuts among German manufacturers as they struggle with rising costs and weaker demand. A thousand jobs will go this year, according to a company statement.

The division sells appliances under the Bosch, Siemens and Neff brands, among others.

The company had to “reduce complexity and costs” in order to “safeguard its competitiveness” in a challenging economic environment, it said.

04:36 PM GMT

Analysts expecting bumper profits from British Airways despite slide into recession

The owner of British Airways is expected to report soaring sales last year, shrugging off fears that the UK’s recent recession has dented demand for holidays.

International Airlines Group (IAG), which also owns airlines Iberia, Vueling and Aer Lingus, will publish its financial results for 2023 on Thursday.

The aviation giant is expected to report sales totalling just shy of €30bn euros (£25bn), a record yearly amount for the group and more than a quarter higher than the prior year.

It follows IAG reporting record profits between July and September last year, the critical summer season, as it benefited from a boom in leisure travel.

The company flagged particularly strong demand for flights on its North and South Atlantic routes and top holiday destinations in Europe.

Analysts are expecting an underlying operating profit for the full year of €3.5bn (£3bn), which would top its previous peak achieved in 2018.

A group of analysts at investment platform AJ Bell said the bumper profits could come despite IAG being “dogged by labour unrest and geopolitical uncertainty, while the UK’s gradual slide into recession may not have helped sentiment either, given how sensitive airline travel (passengers and cargo) can be to the economic cycle”.

04:16 PM GMT

Warner Bros falls 11.8pc after bigger-than-expected loss

Film and television group Warner Bros Discovery has fallen in trading this afternoon after posting results which showed a $400m (£316m) loss for the fourth quarter of 2023. Revenue dropped 7pc to $10.3bn, below analyst estimates of $10.5bn.

Warner boss David Zaslav said the company was “now on solid footing with a clear pathway to growth”.

He added: “This business is not without its challenges. Among them, we continue to face the impacts of ongoing disruption, and the pay-TV ecosystem and a dislocated linear advertising ecosystem. We are challenging our leaders to find innovative solutions.”

03:56 PM GMT

Denmark urges Europe to rearm faster

The Danish government has said today that Europe needs to rearm more quickly as it became the latest Nato member to sign a 10-year agreement on security cooperation with Ukraine.

The bilateral agreements, already signed by the UK, Germany and France, follow a pledge by the Group of Seven nations last year to establish bilateral “long term security commitments and arrangements” with Ukraine.

Denmark, a staunch supporter of Ukraine, is among the biggest contributors of military aid relative to the size of its economy. Its new 1.7bn krone (£195m) military aid package was unveiled on Thursday.

Mette Frederiksen, the Danish prime minister, said that Denmark hoped to supply Ukraine with F-16 jets soon.

03:49 PM GMT

America imposes ban on trade with more companies over links to Russia

The Biden administration said on Friday it has imposed new trade restrictions on a range of companies from Russia, China, Turkey, the United Arab Emirates, Kyrgyzstan, India and South Korea which it says are supporting Russia’s war effort in Ukraine.

The action, one day before the second anniversary of Russia’s invasion of Ukraine, essentially bans US shipments to the targeted firms.

“Our hearts are heavy that Russia’s senseless and bloodthirsty war of choice is ongoing and we have to continue to show resolve and support the Ukrainian people,” Alan Estevez, a US Commerce Department under secretary who oversees export policy, said in a statement.

The move, which brings the total number of those entities targeted over Russia’s invasion of Ukraine to 900, is one element of the latest round of sanctions by the United States, partners and allies in response to Russia’s ongoing war in Ukraine, which began on Feb. 24, 2022.

The US also imposed sanctions on over 500 targets over the war and the death of Russian opposition leader Alexei Navalny.

Earlier this week, the European Union approved a 13th package of Ukraine-related sanctions against Russia, banning nearly 200 entities and individuals accused of helping Moscow procure weapons or of involvement in kidnapping Ukrainian children.

Of the 93 entities listed on Friday, some were companies added for diverting controlled microelectronics to Russia’s military and intelligence authorities, the Commerce Department said. Others were targeted for procuring American equipment to help Russia replenish its munitions and other military goods.

03:38 PM GMT

Germany becomes ninth country to legalise weed

Germany today became the ninth country to legalise recreational use of cannabis when the Bundestag passed a law allowing individuals and voluntary associations to grow and hold limited quantities of the drug.

The law passed by Chancellor Olaf Scholz’s ruling coalition legalises cultivating up to three plants for private consumption and owning up to 25 grams of cannabis.

Larger-scale, but still non-commercial, cannabis production will be allowed for members of so-called cannabis clubs with no more than 500 members, all of whom must be adults. Only club members can consume their product.

“We have two goals: to crack down on the black market and improved protection of children and young people,” health minister Karl Lauterbach said at the start of a rowdy debate where the opposition accused him of promoting drug use.

Christian Democrat legislator Tino Sorge said:

You are asserting in all seriousness that by legalising more drugs we will contain drug use among young people.

That is the most stupid thing I’ve ever heard.

But Lauterbach said that this amounted to “sticking our heads in the sand”: not only had cannabis use soared among young people, whose developing brains were particularly endangered, but drugs on the streets were both stronger and more impure nowadays, greatly increasing their harm.

03:34 PM GMT

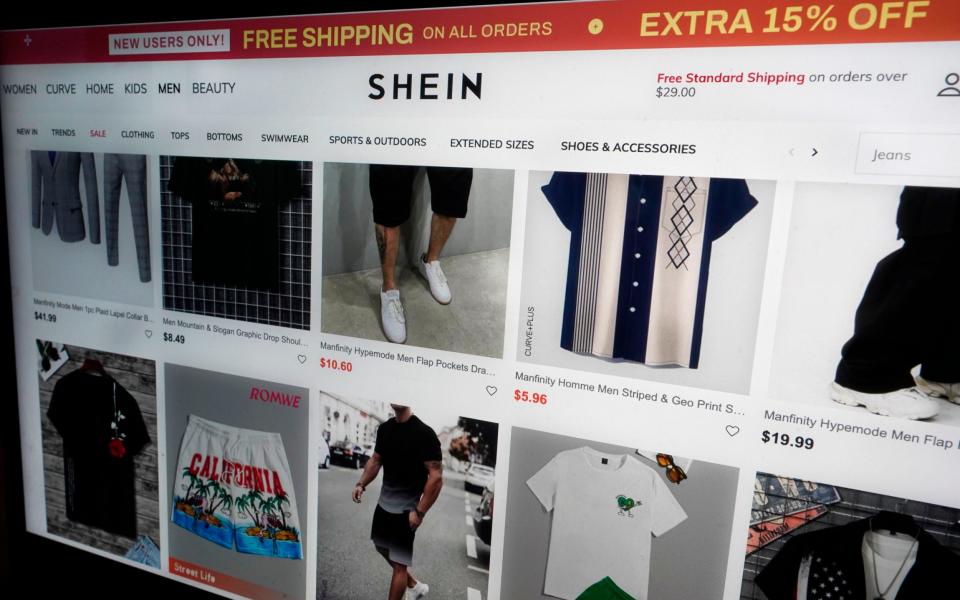

Shein seeks to poach suppliers from Boohoo as fast fashion war heats up

Shein has moved to poach suppliers from rival Boohoo as the battle for market share between the two fast fashion companies heats up. Hannah Boland reports:

The Chinese retail giant has written to Boohoo suppliers to see if they would be interested in striking a deal. In the email, first reported by Drapers, Shein said it was “looking for suitable suppliers around the world and also hope that your company is interested in cooperating with us”.

It went on: “According to preliminary understanding, your company has good experience in fashion, manufacturing and design. We would like to learn more about your company.”

A Shein spokesman declined to comment on the supplier email.

It comes as Shein races to meet demand for its clothes as sales surge. UK sales rose above £1bn in the 16 months to December 2022, helping it make a £12.2m profit.

The retailer’s rapid rise has been driven by Gen Z shoppers on the hunt for cheaper versions of high street clothes. It sells dresses for less than £5 and jeans for under £7.

Shein is expected to hold a larger share of the UK clothing market than Zara within the next few years, with figures from GlobalData suggesting it currently accounts for 2.2pc of all sales. Boohoo’s market share has fallen from 1.13pc in 2020 to 0.86pc in 2022.

03:33 PM GMT

Nvidia hits $2 trillion valuation amid AI stocks boom

Nvidia leapt above $2 trillion in market valuation for the first time amid the AI frenzy that has gripped the market since the chip maker’s blockbuster quarterly report.

The manufacturer joins an elite club of businesses to have surpassed the mark, featuring Google-owner Alphabet and state-backed oil giant Saudi Aramco.

Completing the list are Microsoft and Apple, which are the only companies to surpass $3 trillion valuations.

It is an astonishing rise for Nvidia among the rapid surge in interest in AI. It’s market capitalisation was less than $280bn in October 2022 and only broke the $1 trillion mark for the first time in June last year.

With that, I will wish you a great weekend and take my leave. Alex Singleton will have all the latest market news from here.

03:12 PM GMT

Sunak tells protesting farmers: 'we've got your back'

Rishi Sunak has offered his support to protesting farmers in Wales.

Farmers across Wales have objected to the Welsh Labour government’s proposals to change farming subsidies to require more land to be set aside for environmental schemes.

The sustainable farming scheme (SFS), which is currently under consultation, would require 10pc of a farmer’s land to be covered in trees and the same amount again set aside for wildlife habitat.

The Labour government in the Senedd insists the change is necessary to fight climate change but could be adjusted by the end of the consultation.

Mr Sunak met campaigners outside the Welsh Conservative Conference in Llandudno, where he offered his support for their cause, telling them he was “sorry for what you are going through”.

He said: “We’re going to do everything we can because we’ve got your back.”

British farmers - you are the lifeblood of this nation.

Keir Starmer’s Labour don’t get it.

But I will never stop fighting for you. pic.twitter.com/XuZDTivYfP— Rishi Sunak (@RishiSunak) February 23, 2024

03:00 PM GMT

Former Post Office boss hands back her CBE

Former Post Office boss Paula Vennells has forfeited her CBE for “bringing the honours system into disrepute”, according to a list published on the Cabinet Office website.

Ms Vennells was the Post Office’s chief executive from 2012 to 2019, has come under fire over why hundreds of sub-postmasters were wrongly prosecuted for fraud and false accounting under her watch.

More than 700 subpostmasters were prosecuted between 1999 and 2015 after faulty Horizon accounting software suggested that they had stolen money.

More than 100 sub-postmasters have had their convictions quashed by the Court of Appeal but many more are yet to be cleared.

02:46 PM GMT

Electric cars are being forced down people’s throats, says Sir Jim Ratcliffe

Sir Jim Ratcliffe has accused British and European governments of forcing electric cars “down the consumer’s throat”, as he prepares to sell a new battery-powered 4x4 that will have a backup petrol engine.

Our industry editor Matt Oliver has the latest:

Speaking at an event in London, the billionaire behind Ineos and Manchester United warned electric vehicles (EVs) still have major drawbacks and argued car makers should not be forced to sell them exclusively.

Sir Jim added that current European regulations effectively force companies like his to develop EVs, adding that they “can’t survive” without launching one.

He said it should be up to motorists to decide which technology triumphs, adding that continuing innovation in Formula 1 was proof that the internal combustion engine was “not at the end of the road yet”.

Read Sir Jim’s concerns about EVs.

02:35 PM GMT

S&P 500 breaks 5,100 for first time

The S&P 500 rose past 5,100 for the first time in history as the AI-fuelled clamour for stocks continued on Wall Street.

The benchmark US share index opened higher by 13.89 points, or 0.3pc, at 5,100.92.

The Dow Jones Industrial Average rose 58.86 points, or 0.2pc, at the open to 39,127.97 while the Nasdaq Composite gained 53.18 points, or 0.3pc, to 16,094.80.

02:29 PM GMT

Eiffel Tower to remain closed amid strikes

The Eiffel Tower is expected to remain closed on Saturday morning as staff voted to extend a strike over the monument’s management.

The iconic site has been shut since Monday in protest of what unions say is insufficient investment.

The tower’s operator, SETE, has advised tourists to check its website before showing up, or to postpone their visit.

Ticket holders will be reimbursed, the operator said.

Unions have criticised SETE for basing its business model on what they say is an inflated estimate of future visitor numbers, while underestimating repair and maintenance costs.

The unions also say that city hall is charging the Eiffel Tower’s operator a leasing fee that is too high, sapping funds for necessary maintenance work.

On Thursday, SETE promised new measures to address these concerns, including hiking the price of tickets by 20pc.

A ticket now costs €29.40 for an adult to take the lift to the summit, while those who climb up partway by stairs pay a little less.

02:16 PM GMT

First-time buyers warned as lenders roll out sub-1pc mortgages

High street lenders will begin offering sub-1pc mortgage rates from next week to those buying a new build property.

Our money reporter Ruby Hinchliffe has the details:

The new scheme, which some brokers have dubbed “the biggest innovation in the mortgage market since Help to Buy”, sees developers foot a portion of the interest rate bill in the first two or five years of the loan.

But experts warn that first-time buyers who use the scheme face a steep jump in repayments when the term comes to an end.

Instead of reducing the stamp duty land tax bill or throwing in some extra cash for furniture, major developers have agreed to make a prepayment of interest to lenders to bring buyers’ initial monthly payments down.

Read on for details on the scheme aimed at helping first-time buyers who have struggled to get on the housing ladder.

02:01 PM GMT

Nvidia on track to hit $2 trillion valuation

Nvidia is expected to become the first chip maker to hit a $2 trillion (£1.6trn) valuation when markets open on Wall Street later.

The shares have gained 1.2pc in premarket trading after it achieved the biggest one day increase in value of any company in history on Thursday.

This chart shows how it is leaving the whole world in its wake:

This week’s #chartoftheweek looks at Nvidia’s performance relative to the S&P and the Magnificent 7 this year, after their knockout earnings release this week.

NVDA reported record revenue growth after the bell on Wednesday – with FY24 revenue coming in up 126% Y/Y. The stock… pic.twitter.com/jbHiAbO6ZD— FactSet (@FactSet) February 23, 2024

01:47 PM GMT

Gaza suffers ‘one of the largest economic shocks ever’

The Palestinian territories have suffered one of the largest economic shocks on record, the World Bank has said, with nearly every Gazan resident living in poverty.

Our senior economics reporter Eir Nolsøe has the latest:

Israel’s bombardment of Gaza caused its economy to contract 24pc in 2023 and by more than 80pc in the final three months of the year.

It means Gaza’s economy has plunged from £529m in the three months through September to £71m at the end of the year.

The World Bank warned that every person in the territory faces “acute food insecurity with at least one in four experiencing catastrophic hunger” and “a growing risk of famine”.

This chart shows how Gaza’s economy has collapsed.

01:26 PM GMT

China property crisis deepens as Moody's withdraws credit ratings

China’s property crisis deepened as Moody’s withdrew a flurry of credit ratings from key companies.

The credit ratings agency issued sudden removals for 11 Chinese companies, pushing them into junk territory.

Moody’s withdrew scores from 10 Chinese developers, including including Logan Group, Ronshine China and Zhenro Properties Group, saying the decision was down to “business reasons”.

Earlier it had removed its Baa3 score from one of the country’s major bad-debt managers, China Great Wall Asset Management.

The sudden action comes after Moody’s cut its outlook for Chinese sovereign bonds to negative in December.

01:07 PM GMT

CAB Payments boss steps down after disastrous float

The boss of CAB Payments is to leave the fintech company, months after its disastrous float on the London stock market.

The payment processing enterprise was one of the largest businesses to list on the London Stock Exchange last year, floating at a value of around £800m.

However, it saw this tumble by 80pc over the following three months amid a warning over profits.

Today, the company told shareholders that chief executive Bhairav Trivedi will step down from the role next month.

He will be replaced in the top job by Neeraj Kapur, who joined the business today.

Mr Trivedi will then become a strategic adviser for the company to help his successor’s transition into the new role.

12:44 PM GMT

Serco ordered to stop using facial recognition on staff

The UK privacy and data protection watchdog has ordered Serco to stop using facial recognition technology to monitor the attendance of leisure centre employees.

The Information Commissioner’s Office (ICO) found that Serco Leisure and community leisure trusts were unlawfully processing the biometric data of more than 2,000 employees at 38 leisure facilities across the UK.

It said facial recognition and fingerprint scanning were used to monitor workers’ attendance and then the subsequent payment for their time.

The leisure centre operator failed to show why these methods were needed rather than “less intrusive” means, such as ID cards or fobs for staff, the ICO said.

The ICO also said employees were also not offered a clear alternative to having their faces and fingerprints scanned. A Serco Leisure spokesman said:

Despite being aware of Serco Leisure’s use of this technology for some years, the ICO have only this week issued an enforcement notice and requested that we take action.

We now understand this coincides with the publication of new guidance for organisations on processing of biometric data which we anticipate will provide greater clarity in this area.

We take this matter seriously and confirm we will fully comply with the enforcement notice.

12:33 PM GMT

Mike Ashley steps up stake in model train maker Hornby

Mike Ashley has raised his stake in the model railway maker Hornby, in the latest stock market bet by the Sports Direct billionaire.

Our senior business reporter Daniel Woolfson has the details:

Hornby said on Friday that Mr Ashley’s Frasers Group had raised its stake from 2.4pc to 8.9pc of the company, making him its third-largest shareholder.

The increased stake triggered a surge in Hornby’s share price, rising by as much as 50pc today.

Mr Ashley, the majority shareholder in Frasers, has a long history of taking stakes in retailers and companies he believes are undervalued, and has taken large positions in rivals including Currys, AO World, Boohoo and Asos.

He is now the largest shareholder in both Boohoo and AO World after gradually building his stake, while he is the second-largest shareholder in Asos and the fifth-largest in Currys.

Read how Hornby’s fortunes have changed.

12:01 PM GMT

Ross challenges Scottish Labour and SNP leaders to oil and gas debate

Douglas Ross has challenged Humza Yousaf and Anas Sarwar to debate him on the future of oil and gas.

The Scottish Conservative leader has written to his SNP and Labour counterparts to argue only his party has supported the North Sea industry “every step of the way”.

It follows a heated back-and-forth at First Minister’s Questions on Thursday over Labour’s proposals to extend the windfall tax on oil and gas company profits.

Following the fiery debate, Aberdeen and Grampian Chamber of Commerce tweeted all three leaders to say it is willing to host a debate on the issue, asking: “How does next month sound?”

Mr Ross has now told his opponents he is “fully behind” the idea.

11:48 AM GMT

Passenger duty is 'enormous disadvantage' for UK airports, says Ryanair

Ryanair has said air passenger duty is putting UK airports at an “enormous disadvantage” to European rivals and limiting growth in the number of flights.

The discount airline’s chief commercial officer Jason McGuinness said many airports outside London are being “hamstrung” because the tax limits growth in flight capacity.

Passengers with economy tickets for UK departures are charged APD at a rate of £6.50 for domestic flights and £13 for short-haul trips.

The rate increases for longer flights and passengers travelling in premium cabins.

Mr McGuinness said air passenger duty is doing “untold damage” to regional airports which is “going to get worse over the next number of years, predominantly because European airports are becoming significantly more competitive”.

The Treasury was approached for a comment.

11:34 AM GMT

Mike Ashley arrives for day three of Morgan Stanley trial

Retail tycoon Mike Ashley has arrived for the third day of the trial in which Morgan Stanley is accused of demanding $1bn in collateral from him because of “snobbery”.

The Wall Street bank rejects the claim as contrived and without merit, arguing that the margin call - where parties are asked to deposit extra cash to backstop their investment positions - was to protect it against a potential 400pc rise in Hugo Boss shares.

The High Court is hearing evidence today from the Morgan Stanley banker who claims to have triggered the margin call.

11:16 AM GMT

Vice to shut down website and sack hundreds of staff as free news model collapses

Vice is to lay off hundreds of employees and shut down its website months after being bought out of bankruptcy.

Our reporter James Warrington has the details:

In a memo to staff, chief executive Bruce Dixon said the media business would lay off “several hundred” staff members as it transitions to a “studio model”.

The overhaul means Vice will shut its own website and instead focus on selling articles and videos, including news, to established media brands.

Bosses said the company will also put more emphasis on social media in a bid to “take our content to where it will be viewed most broadly”.

Read Mr Dixon’s plans for the future of the business.

11:02 AM GMT

Wall Street to take a breather after record surge

US stock markets are poised for a more muted open after a stunning rally on Thursday triggered by AI poster child Nvidia.

The S&P 500 and Dow Jones Industrial Average both surged to record closing highs as investors piled into technology stocks as the AI-fueled frenzy on Wall Street gained more steam.

The tech-heavy Nasdaq is about 1pc away from its all-time high touched in November 2021.

Nvidia added $277bn in stock market value on Thursday, Wall Street’s largest one-day gain in history.

Shares of the heavyweight chip designer were up 2.1pc in premarket trading as the company closes in on $2 trillion in market value for the first time.

Ahead of the opening bell, trading of futures in the Dow Jones Industrial Average and S&P 500 were flat, while the Nasdaq 100 was down 0.1pc.

10:42 AM GMT

German and Dutch central banks reveal losses as cheap money era ends

The German and Dutch central banks both posted multi-billion euro losses last year and have predicted more financial pain ahead, suggesting that they are unlikely to pay dividends into state coffers for years to come.

The European Central Bank and some of its largest national affiliates are generating large losses, depleting provisions and much of their equity, as sharply higher interest rates force them to pay out billions in interest to commercial banks.

The Bundesbank said it lost €21.6bn (£18.5bn) last year, wiping out nearly all of its provisions while its Dutch counterpart lost €3.5bn (£3bn), both broadly in line with expectations.

Bundesbank President Joachim Nagel said: “The financial burdens are likely to persist for several years. We ... expect them to be considerable again for the current year.”

Most of the losses are as a result of the ECB’s decade long-stimulus programme from an era of excessively low inflation after the global financial crisis.

The ECB printed trillions of euros worth of cash to stimulate growth and most of that excess liquidity, €3.5trillion, is still sloshing around the financial system.

The European central bank must now pay lenders a 4pc deposit rate when this is deposited back at the ECB, while the assets its bought, mostly government debt, yield much less.

10:14 AM GMT

Pound on track for weekly rise

The pound is on track for its first weekly gain against the dollar in more than a month as consumer confidence slipped back in February.

Sterling was little changed at $1.26 - or 79p - as Ofgem revealed that household energy bills will fall by an average of £238 a year from April, helping to drive down inflation.

Against the euro, the pound was flat at €1.16 - or 85p.

MUFG researcher Derek Halpenny said: “The better UK data and the strong risk appetite should be benefiting the pound more than what we are seeing to date.”

10:00 AM GMT

Oil falls as Fed pushes back on early interest rate cuts

Oil prices were on track to end a two-week winning streak after US Federal Reserve Governor Christopher Waller said interest rate cuts should be delayed at least two more months.

Brent crude, the international benchmark, has fallen 1.3pc today to less than $83 a barrel, while US-produced West Texas Intermediate has dropped 1.5pc towards $77.

The prospect of rate cuts being pushed back underpinned the dollar, which makes it less attractive to buy commodities priced in the currency, although the greenback was on track to record a weekly fall for the first time in 2024.

The dollar was last flat against the pound at $1.26.

In a speech in Minneapolis on Thursday, Mr Waller said:

The strength of the economy and the recent data we have received on inflation mean it is appropriate to be patient, careful, methodical, deliberative – pick your favorite synonym.

Whatever word you pick, they all translate to one idea: What’s the rush?

09:45 AM GMT

Smart meters to be fixed for free after rash of breakdowns

Households are to be offered free replacements for broken smart meters after a rash of failures threatened to leave many consumers with no way of monitoring their energy consumption.

Our energy editor Jonathan Leake has the details:

The new policy, which replaces a previous one-year-only warranty, was announced as energy regulator Ofgem unveiled a sharp cut in the price cap that will bring average bills down by £238 a year.

The wave of smart meter breakdowns is the latest problem to hit the rollout, which has been going for more than a decade and has repeatedly missed its targets.

The meters, which allow households and their energy suppliers to monitor usage in real time, are seen as essential for the switch to net zero and the rise of electric vehicles, whose owners need to know when tariffs are cheapest for charging their cars.

Read how the free repairs is one of several introduced alongside today’s overall cut in prices.

09:23 AM GMT

German business confidence remains low

German business confidence remained depressed as Europe’s largest economy braces itself for a recession.

The Ifo Institute’s Business Climate index rose slightly from 85.2 in January to 85.5 in February, close to its post-pandemic low.

Earlier today, separate figures confirmed Germany’s economy shrank at the end of 2023, putting it on track for a recession.

Meanwhile, data on Thursday showed the country’s private sector output fell to a four-month low.

Franziska Palmas, senior Europe economist at Capital Economics, said: “Overall, the surveys leave us comfortable with our forecast that, following a 0.3pc quarter on quarter drop in Q4, German GDP will edged down further in Q1 and stagnate over the year as a whole.”

Germany Business Confidencehttps://t.co/VNYiJDLvbS pic.twitter.com/KevfuVSgYf

— TRADING ECONOMICS (@tEconomics) February 23, 2024

09:04 AM GMT

Gas prices fall back to pre-energy crisis levels

Wholesale gas prices have fallen back to levels last seen before Vladimir Putin began squeezing gas supplies in a further sign Europe is moving past its energy crisis.

Dutch front-month futures, the benchmark European contract, fell below €23 per megawatt hour to their lowest level since May 2021.

The fall in prices comes after a mild winter across the Continent, which has left storage sites about 65pc full - well ahead of the average for the time of year.

Gas prices are down more than 90pc from their peak in the wake of Russia’s invasion of Ukraine, when prices topped €339 per megawatt hour.

The UK equivalent contract has fallen by a similar percentage from 640p per therm in August 2022 to less than 57p today.

08:37 AM GMT

Standard Chartered helps boost FTSE 100

The FTSE 100 edged higher amid rises in financial stocks following Standard Chartered’s promise to return £4bn to shareholders over the next three years.

The UK’s blue-chip index rose 0.1pc but it remains course for a marginal losses over the course of the week.

Standard Chartered jumped 6.4pc to the top of FTSE 100 after the Asia-focused bank rewarded shareholders with dividends and a fresh $1bn (£800m) buyback as annual profit rose 18pc.

The stock powered a 1pc rise in British banks.

Meanwhile, the mid-cap FTSE 250 has fallen 0.4pc lower, as British consumer sentiment fell for the first time in four months in February, according to a GfK survey.

The UK’s Domino’s Pizza Group fell 4pc as Barclays downgraded the firm to “equal weight” from “overweight”.

08:24 AM GMT

Consumer confidence slips ahead of mobile contract price hikes

Consumer confidence has stalled in Britain after months of positivity as stubborn inflation led households to limit their spending, figures suggest.

GfK’s long-running Consumer Confidence Index fell two points to minus 21 in February, although the forecast for personal finances over the next 12 months remained unchanged and is 18 points higher than this time last year.

The fall comes as households face a new round of rising essential costs, with inflation fuelling mid-contract price hikes for the likes of mobile and broadband and looming re-mortgaging.

Confidence in the general economy over the next 12 months fell by three points to minus 24, although this remains 19 points higher than a year ago.

The major purchase index, an indicator of confidence in buying big ticket items, is down five points to minus 25, 12 points higher than last February.

08:10 AM GMT

Germany on track for recession amid declining investment

Germany is on track for recession as official figures confirmed its economy shrank at the end of last year amid declining investment.

Gross domestic product in Europe’s largest economy fell by 0.3pc in the fourth quarter of 2023 as businesses spent less on equipment.

Investments fell significantly compared to the previous quarter with construction investments down 1.7pc and investments in machines, devices and vehicles down 3.5pc at the end of the year.

Ruth Brand, president of the Federal Statistical Office, said:

This means that the German economy ended 2023 in the red.

In the final quarter, declining investment slowed down the economy, while consumption increased slightly.

08:07 AM GMT

FTSE 100 rises amid global stocks surge

The FTSE 100 rose as trading began following an AI-fuelled rally on Thursday that sent US, European and Asian markets to new record highs.

The UK’s blue chip index was up 0.2pc to 7,701.81 while the midcap FTSE 250 was flat at 19,266.69.

07:45 AM GMT

Standard Chartered announces £4bn bonanza for shareholders

Banking giant Standard Chartered has laid out plans to hand cash back to shareholders as it became the latest lender to reveal higher profits.

The Asia-focused bank launched a $1bn (£800m) share buyback and plans to return around $5bn (£4bn) to shareholders over the next three years.

It came as the company reported a pre-tax profit of $5.7bn (£4.5bn) for 2023, up 22pc against the previous year.

Chief executive Bill Winters said:

We produced strong results in 2023, continuing to demonstrate the value of our franchise and delivering our financial objective of a 10pc RoTE (return on tangible equity) for the year.

We will now build on this success, taking action to deliver sustainably higher returns with a focus on driving income growth and improving operational leverage.

07:42 AM GMT

Ofgem increases bills for direct debit payers to level playing field on standing charges

Ofgem confirmed plans to set a permanent solution to prepayment customers paying higher standing charges, which was removed by the Government’s temporary Energy Price Guarantee.

Ofgem said the solution must be funded by bill-payers rather than taxpayers, to maintain fairness, meaning prepayment customers will save around £49 per year while direct debit customers will pay £10 more each year.

Citizens Advice chief executive Dame Clare Moriarty said:

It’s good news that the cost of energy is falling, but the impact of sky-high prices will be felt for years to come.

We know more than five million people live in households behind on their energy bills and, with the price of energy still far higher than just three years ago, many people will struggle to pay off these debts.

The Government promised a new plan for energy bill support by April 2024, but will miss its own deadline. And the withdrawal of cost-of-living payments this spring will make it so much harder for many of those already finding it difficult to make ends meet. Without action, people will face a cycle of winter crises year after year.

07:31 AM GMT

Energy system is broken, says union

Unite general secretary Sharon Graham accused energy companies of profiteering, even within the price cap system. She said:

Ofgem’s price cap might have fallen slightly but hard-working people are still paying through the nose while the energy profiteers laugh all the way to the bank.

Centrica, which earlier this month reported £2.8bn profits, has even publicly celebrated Ofgem’s complicity. Its chief executive bragged that its huge profits last year were boosted by an additional fee Ofgem added to the price cap.

Everyone except the energy barons can see the system is broken. The need for public ownership has never been more pressing. It is time our politicians made the right choices.

07:19 AM GMT

Energy market still faces 'big issues,' says Ofgem boss

Ofgem chief executive Jonathan Brearley said:

This is good news to see the price cap drop to its lowest level in more than two years – and to see energy bills for the average household drop by £690 since the peak of the crisis – but there are still big issues that we must tackle head-on to ensure we build a system that’s more resilient for the long term and fairer to customers.

That’s why we are levelising standing charges to end the inequity of people with prepayment meters, many of whom are vulnerable and struggling, being charged more up-front for their energy than other customers.

We also need to address the risk posed by stubbornly high levels of debt in the system, so we must introduce a temporary payment to help prevent an unsustainable situation leading to higher bills in the future. We’ll be stepping back to look at issues surrounding debt and affordability across market for struggling consumers, which we’ll be announcing soon.

These steps highlight the limitations of the current system – we can only move costs around – so we welcome news that the Government is opening the conversation on the future of price regulation, seeking views on how standard energy deals can be made more flexible so customers pay less if using electricity when prices are lower.

But longer term we need to think about what more can be done for those who simply cannot afford to pay their energy bills even as prices fall. As we return to something closer to normality we have an opportunity to reset and reframe the energy market to make sure it’s ready to protect customers if prices rise again.

07:17 AM GMT

Energy suppliers allowed to charge extra to support struggling customers

Ofgem has also announced it will allow energy suppliers to temporarily charge an additional £28 per year to make sure they have sufficient funds to support customers who are struggling.

This will be added to the bills of customers who pay by direct debit or standard credit and is partly offset by the termination of an allowance worth £11 per year that covered debt costs related to the Covid pandemic.

Further changes mean direct debit customers will pay about £10 a year more, while those on prepayment meters will save about £49.

Ofgem has levelled all standing charges for customers on prepayment meters, meaning customers are not charged more depending on the payment method they use.

Since October 2022 the so-called “prepayment meter premium” was removed by government support via the Energy Price Guarantee.

However, with that support coming to an end on April 1, Ofgem has taken steps to provide a lasting solution, which must be funded by bill payers rather than tax payers, to maintain fairness in the system.

07:05 AM GMT

Energy bills to fall by £238 a year

Household energy bills will fall by an average of £238 a year from April under the latest limits imposed on suppliers by regulators.

Ofgem has revealed that its price cap will fall from its current rate of £1,928 a year for a typical dual-fuel household to £1,690 from April 1 - a drop of about £20 a month.

The changes will reduce typical energy bills by 12pc to their lowest level in two years - but it is less than analysts’ predictions of a fall to £1,656.

In 2022, the price cap for direct debit payers rose from £1,216 a year in January to £1,877 in April following the energy shock triggered by Russia’s invasion of Ukraine.

In October of that year it rose again to £3,371 and peaked at £4,059 in January 2023, although households were shielded from the full increases by the Government’s subsidies which capped bills at £2,500 a year.

Ofgem chief executive Jonathan Brearley said: “This is good news to see the price cap drop to its lowest level in more than two years – and to see energy bills for the average household drop by £690 since the peak of the crisis – but there are still big issues that we must tackle head-on to ensure we build a system that’s more resilient for the long term and fairer to customers.”

07:02 AM GMT

Good morning

Thanks for joining me. Ofgem has lowered its price cap on energy bills meaning households will save about £238 a year from April.

The energy regulator lowered its limit on what suppliers can charge from an average of £1,928 a year to £1,690.

5 things to start your day

1) Mercedes-Benz chief vows to build petrol cars ‘well into’ 2030s | German car giant waters down its targets for electric vehicle sales as demand slumps

2) Rolls-Royce will build first mini-nuclear reactor in Europe instead of UK, boss warns | Engineering giant’s boss warns of consequences to Britain’s slow decision making

3) How Japan shook off decades of stagnation – and beat stock market records | Benchmark boost fuels hopes of a much-anticipated economic comeback

4) Thames Water crisis prompts warning that fines could trigger collapse | Rising debt levels risk landing taxpayers with multi-billion pound bailout bill

5) Ben Marlow: Amoral Cadbury owner is giving cover to Putin’s war crimes | Mondelez’s flimsy stance on Russia has exposed the whole ESG edifice as an absurd, empty sham

What happened overnight

Asian shares climbed following a day of record highs in Japanese, US and European markets fuelled by Nvidia’s mammoth results.

Shanghai, Sydney, Seoul, Taipei, Wellington and Mumbai, as well as Bangkok, Manila and Kuala Lumpur all rose.

Jakarta and Singapore were down, while Hong Kong was flat. Tokyo is closed for a holiday.

All of Wall Street’s main stock indexes hit record highs following the huge earnings from Nvidia that prompted a fresh round of stock buying over artificial intelligence.

The Dow Jones Industrial Average broke 39,000 for the first time on Thursday, finishing up 1.2pc at a record 39,069.11.

Meanwhile, the S&P 500 jumped 2.1pc to a record 5,087.03, while the tech-rich Nasdaq Composite Index surged 3pc to 16,041.62, leaving it about 15 points short of an all-time high.

Shares of Nvidia surged 16.4pc, lifting its market value to almost $2bn, after reporting that quarterly profits soared to $12.3bn amid record high revenue driven by demand for its technology to power artificial intelligence.

The yield on 10-year US Treasuries was little changed at 4.32pc, from 4.33pc late on Wednesday.

Yahoo Finance

Yahoo Finance